Get the free To employers:

Show details

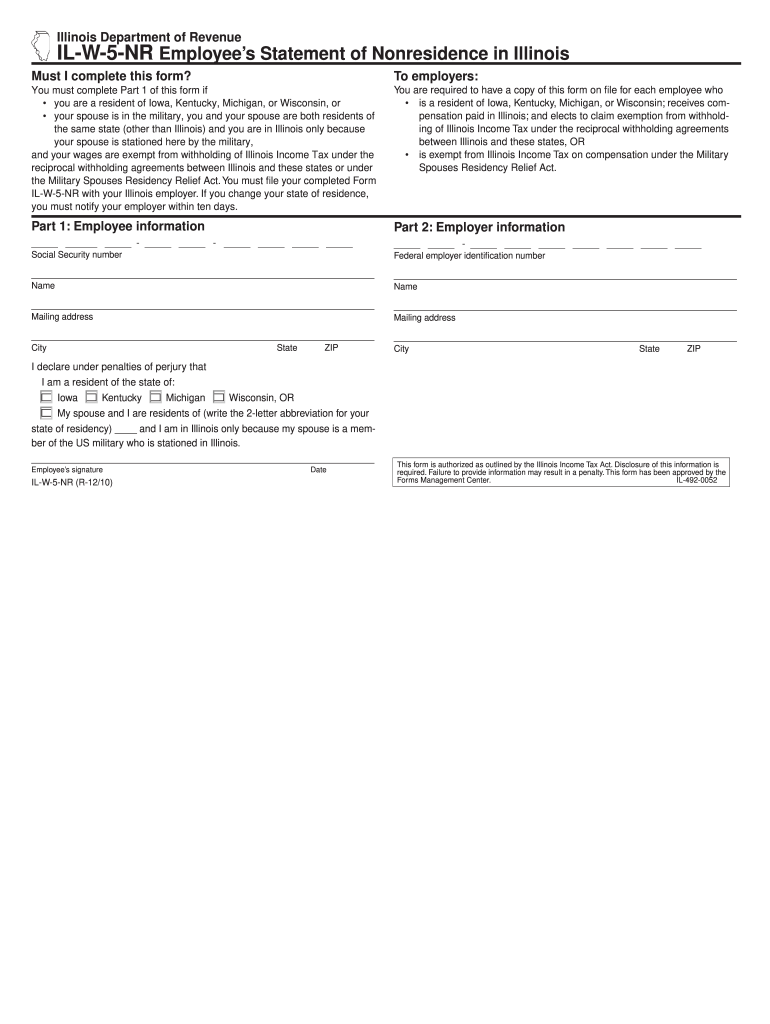

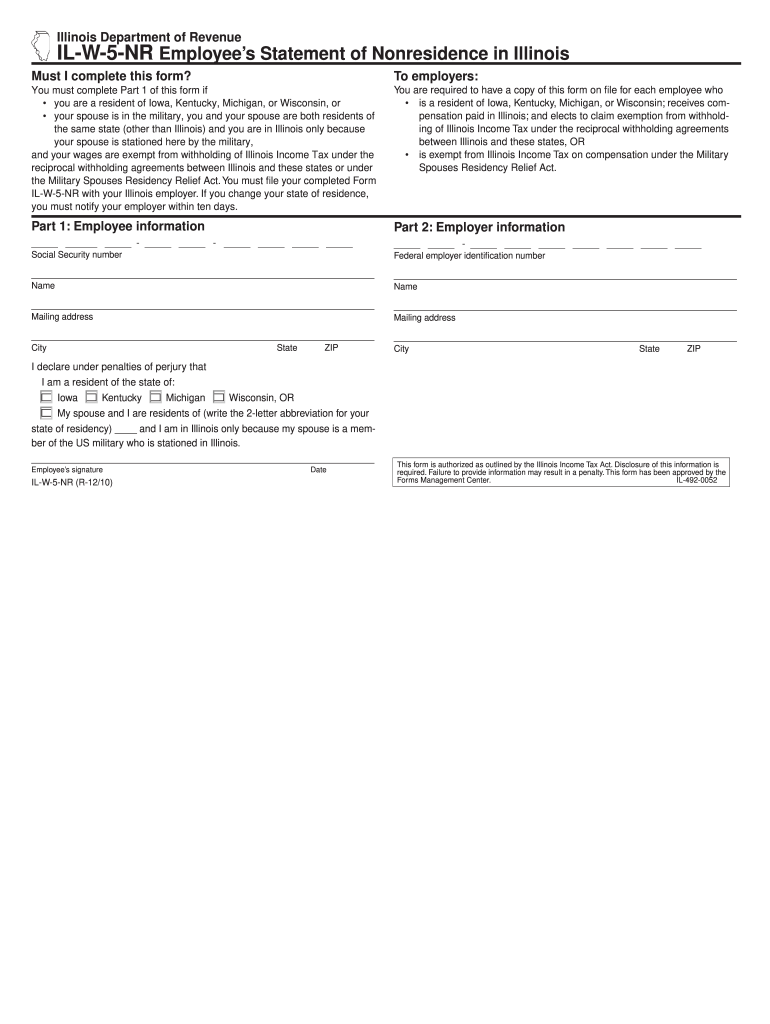

Illinois Department of RevenueILW5NR Employees Statement of Nonresidence in Illinois Must I complete this form? To employers:You must complete Part 1 of this form if you are a resident of Iowa, Kentucky,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to employers

Edit your to employers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to employers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing to employers online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to employers. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to employers

How to fill out to employers

01

Start by gathering all the necessary information such as your personal details, education qualifications, work experience, and references.

02

Format your resume to make it visually appealing and easy to read. Use clear headings and bullet points to highlight key information.

03

Begin by stating your objective or summary, followed by your work experience in reverse chronological order. Include your job titles, company names, dates of employment, and a brief description of your responsibilities and achievements.

04

Include your education qualifications, starting with your highest degree or diploma. Mention the name of the institution, degree obtained, and dates of attendance.

05

Add any relevant certifications, skills, or additional qualifications that can enhance your profile.

06

Include contact information such as your full name, phone number, email address, and LinkedIn profile (if applicable).

07

Proofread your resume for any grammatical or spelling errors. Ensure that the information provided is accurate and up to date.

08

Save your resume in a compatible format (such as PDF or Word) and submit it according to the employer's instructions.

Who needs to employers?

01

Employers are individuals or organizations who are looking to hire employees for job vacancies.

02

They can be businesses of all sizes, ranging from small startups to large corporations.

03

Employers may also include government agencies, non-profit organizations, educational institutions, and healthcare facilities.

04

Anyone who is responsible for the recruitment and selection process within an organization is considered an employer.

05

Employers play a crucial role in identifying suitable candidates, conducting interviews, and making hiring decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify to employers without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your to employers into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in to employers?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your to employers to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit to employers on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share to employers on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is to employers?

It refers to the forms and reports that employers must submit to tax authorities detailing employee wages, taxes withheld, and other relevant information.

Who is required to file to employers?

Employers, including businesses and organizations that pay employees or contractors, are required to file these forms.

How to fill out to employers?

Employers must accurately complete forms by entering employee information, wages paid, and taxes withheld, following guidelines provided by tax authorities.

What is the purpose of to employers?

The purpose is to ensure compliance with tax laws, report employee earnings, and calculate tax obligations.

What information must be reported on to employers?

Employers must report employee names, Social Security numbers, wages, tips, and any taxes withheld.

Fill out your to employers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Employers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.