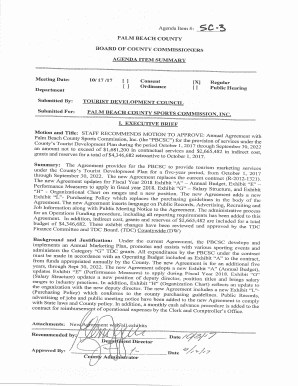

Get the free Personal Auto Rate and Rule Revision - insurance arkansas

Show details

Este documento presenta una presentación para revisión y cambio en las tarifas y reglas de los seguros de automóvil personal de la Garrison Property and Casualty Insurance y otros asociados, incluyendo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal auto rate and

Edit your personal auto rate and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal auto rate and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal auto rate and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit personal auto rate and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal auto rate and

How to fill out Personal Auto Rate and Rule Revision

01

Gather necessary documents related to your personal auto insurance policies.

02

Review the current rates and rules to understand any changes or updates.

03

Access the form or online portal for the Personal Auto Rate and Rule Revision.

04

Fill out the required fields, including policy number, vehicle details, and coverage preferences.

05

Provide any required supporting documents, such as proof of vehicle value or driving history.

06

Double-check all entered information for accuracy.

07

Submit the completed revision form through the designated submission method (online or paper).

08

Keep a copy of the submitted form for your records.

09

Follow up if you do not receive confirmation of your submission or further instructions.

Who needs Personal Auto Rate and Rule Revision?

01

Individuals seeking to adjust their auto insurance premiums.

02

Policyholders wanting to align their coverage with state regulations.

03

Customers needing to update their personal information or vehicle details.

04

Anyone looking to add or remove coverage options from their personal auto insurance policy.

Fill

form

: Try Risk Free

People Also Ask about

What does rate change mean in insurance?

Rate change is a key indicator of how an insurer's loss ratios are likely to change. In practice, insurance companies use a variety of methods to calculate rate change based on the availability of data, system constraints, resource constraints and individual preferences and opinions.

Why is my car insurance going up when I have no claims?

Quick Answer. Even if your driving record is accident-free, your car insurance rates can go up. Rate hikes may result from things you can control, like a moving violation or policy change, or from things beyond your control, such as inflation or more claims in your area.

What is a rate revision in insurance?

A personal auto policy is insurance on your personal vehicle. It may include liability, medical payment coverage, comprehensive, or collision coverage, depending on your policy. By Hearst Autos Research. FG Trade|Getty Images. A personal auto policy is insurance on your personal vehicle.

What does rate revision mean?

Rate Revision means a rate increase or decrease in consequence of a review or audit conducted by the Department or the regional center; Sample 1Sample 2Sample 3 Generate with AI. Rate Revision means a change in premium rates that applies to existing policies.

Can I ask my insurance company to lower my rate?

Rates have also been influenced by several macroeconomic factors, including inflation, rising repair costs, higher prices for parts and labor, supply chain delays, and the increased severity of accidents.

Can I ask my insurance company to lower my rate?

Much like a utility service such as electricity or gas, you cannot negotiate a lower monthly car insurance payment. What you can do, however, is compare rates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Auto Rate and Rule Revision?

Personal Auto Rate and Rule Revision refers to the updates or changes made to the pricing structure and rules governing personal auto insurance policies. These revisions can affect how premiums are calculated based on various factors such as risk assessment, loss experience, and regulatory requirements.

Who is required to file Personal Auto Rate and Rule Revision?

Insurance companies that offer personal auto insurance policies are required to file Personal Auto Rate and Rule Revision with the relevant regulatory authorities in order to ensure compliance with state regulations and provide transparency in pricing.

How to fill out Personal Auto Rate and Rule Revision?

To fill out a Personal Auto Rate and Rule Revision, insurers must provide detailed information regarding the proposed changes, including the rationale for the revisions, data supporting rate adjustments, and how the changes will affect existing policyholders. Specific forms and guidelines provided by the regulatory authority must also be followed.

What is the purpose of Personal Auto Rate and Rule Revision?

The purpose of Personal Auto Rate and Rule Revision is to ensure that insurance premiums are fair and based on accurate risk assessments. It aims to protect consumers by promoting transparency and competition within the insurance marketplace while ensuring that insurers remain financially viable.

What information must be reported on Personal Auto Rate and Rule Revision?

The information that must be reported includes the proposed rates, methodologies used to determine rates, loss data, expenses, historical premium levels, underwriting guidelines, and any other relevant data that justifies the need for rate changes.

Fill out your personal auto rate and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Auto Rate And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.