Get the free REGISTRATION FOR LITC TAX LAW TRAINING - mvlslaw

Show details

REGISTRATION FOR ITC TAX LAW TRAINING When: Thursday, October 11, 2012, 9:30 AM to 2:30 PM Where: Rosenberg Martin Greenberg LLP, 25 South Charles Street, Suite 2115 Baltimore, Md. 21201 Speakers:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registration for litc tax

Edit your registration for litc tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registration for litc tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registration for litc tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit registration for litc tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

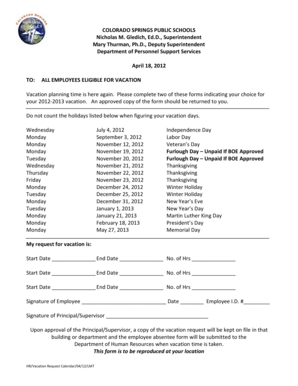

How to fill out registration for litc tax

01

To fill out the registration for litc tax, you will first need to gather all the necessary information and documents. This includes your personal information, such as your name, address, social security number, and contact information.

02

Next, you will need to determine if you are eligible for the Low Income Taxpayer Clinic (LITC) tax assistance. LITCs are organizations that provide free or low-cost legal representation and tax assistance to low-income taxpayers. They can help with a variety of tax issues, including audits, appeals, and collection matters. If you meet the income and other requirements set by the IRS for LITC services, you will be eligible for registration.

03

Once you have determined your eligibility, you can proceed to complete the registration form. This form can typically be found on the LITC's website or obtained directly from the organization. Fill in all the required fields accurately and completely, ensuring that there are no errors or omissions.

04

In addition to the registration form, you may be required to provide supporting documentation. This could include proof of income, such as pay stubs or tax returns, as well as any relevant tax notices, letters, or correspondence from the IRS or state tax authorities.

05

After completing the registration form and gathering all necessary documents, double-check your information for accuracy. Any mistakes could delay the processing of your application or potentially lead to complications down the line. Make sure to review the form thoroughly before submitting it.

06

Finally, follow the instructions provided by the LITC for submitting your registration. This may involve mailing the form and supporting documentation to a specified address or submitting it online through a secure portal. Be sure to adhere to any deadlines or submission requirements outlined by the LITC.

Overall, anyone who meets the income and eligibility requirements set by the IRS and is seeking assistance with their tax issues can benefit from registering for the LITC tax program. Whether you are facing an audit, need assistance with a tax appeal, or are dealing with collection matters, registering for the LITC tax program can provide you with valuable support and legal representation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is registration for litc tax?

Registration for the Low Income Tax Credit (LITC) is a process in which individuals or organizations apply to become certified to provide free or low-cost tax assistance to low income taxpayers.

Who is required to file registration for litc tax?

Any individual or organization that wishes to provide free or low-cost tax assistance to low income taxpayers must file registration for LITC tax.

How to fill out registration for litc tax?

To fill out registration for LITC tax, individuals or organizations must provide information about their tax preparation experience, potential client base, and their commitment to serving low income taxpayers.

What is the purpose of registration for litc tax?

The purpose of registration for LITC tax is to ensure that individuals or organizations meet the qualifications to provide free or low-cost tax assistance to low income taxpayers.

What information must be reported on registration for litc tax?

Information that must be reported on registration for LITC tax includes tax preparation experience, potential client base, and commitment to serving low income taxpayers.

How do I complete registration for litc tax online?

Filling out and eSigning registration for litc tax is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in registration for litc tax without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing registration for litc tax and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the registration for litc tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your registration for litc tax right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your registration for litc tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registration For Litc Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.