Get the free CAC Form 100 - citrusadministrativecommittee

Show details

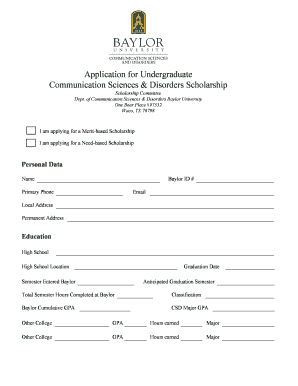

CAC Form 100 2008-09 SEASON OMB No. 0581-0189 Citrus Administrative Committee P.O. Box 24508, Lakeland, FL 33802-4508 Phone 863-682-3103 Fax 863-683-9563 Info citrusadministrativecommittee.org Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cac form 100

Edit your cac form 100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cac form 100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cac form 100 online

Follow the steps below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cac form 100. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cac form 100

How to fill out CAC Form 100:

01

Start by carefully reading the instructions provided with the form. Familiarize yourself with the purpose of the form and the information that needs to be provided.

02

Fill out the personal information section accurately. This includes your name, address, contact details, and any other required details. Double-check for any errors or missing information.

03

Keep in mind the specific details that are required for the form. For example, CAC Form 100 may require information about your business entity, such as the registered business name, your company's tax identification number, and the type of business structure.

04

Complete the financial information section of the form. This could include your business revenue, expenses, assets, and liabilities. Again, make sure to provide accurate and up-to-date information.

05

Pay close attention to any supporting documents that may need to be attached to the form. This could include financial statements, invoices, or proof of business ownership. Ensure that all documents are properly organized and attached securely.

06

Once you have completed all the necessary sections and attached any required documents, review the form thoroughly. Check for any errors, missing information, or inconsistencies. Make any necessary corrections.

07

Sign the form and date it according to the instructions provided. Ensure that the signature is legible and matches the name provided on the form.

08

Depending on the requirements, submit the form electronically or by mail to the appropriate authority or organization. Follow the designated submission process and keep copies of the form for your records.

Who needs CAC Form 100?

01

Business owners: CAC Form 100 is typically required by individuals who own or operate a business entity. This includes sole proprietors, partnerships, corporations, and other registered business structures.

02

Regulatory authorities: CAC Form 100 may be needed by government agencies or regulatory bodies responsible for overseeing business operations. It helps them gather essential information about businesses for various purposes, such as taxation, compliance, or statistical analysis.

03

Financial institutions: Banks or other lending institutions may request CAC Form 100 as part of their due diligence process when evaluating a business's eligibility for loans or other financial services. The form provides valuable insights into a company's financial standing and helps assess its creditworthiness.

04

Investors or potential partners: When seeking funding or entering into partnerships, businesses may be required to provide CAC Form 100 to demonstrate their financial health and viability. Investors and partners often rely on this information to make informed decisions about their involvement with a particular business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cac form 100?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific cac form 100 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in cac form 100 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing cac form 100 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the cac form 100 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your cac form 100 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is cac form 100?

CAC Form 100 is a form used by corporations in Nigeria to declare their income to the Corporate Affairs Commission.

Who is required to file cac form 100?

All corporations registered in Nigeria are required to file CAC Form 100.

How to fill out cac form 100?

CAC Form 100 can be filled out online or manually and must include information on the corporation's income, expenses, and taxes paid.

What is the purpose of cac form 100?

The purpose of CAC Form 100 is to assess the financial status of corporations and ensure compliance with tax laws in Nigeria.

What information must be reported on cac form 100?

Information such as income, expenses, taxes paid, and other financial details must be reported on CAC Form 100.

Fill out your cac form 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cac Form 100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.