Get the free Credit Supply Shocks, Network E ects, and the Real Economy

Show details

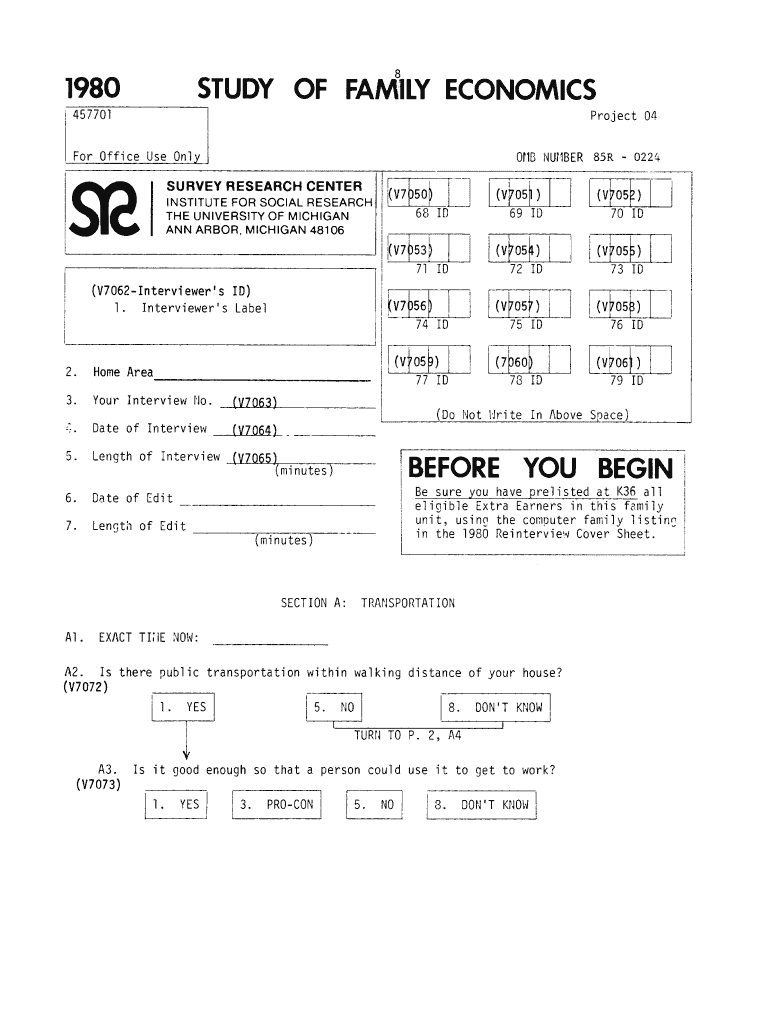

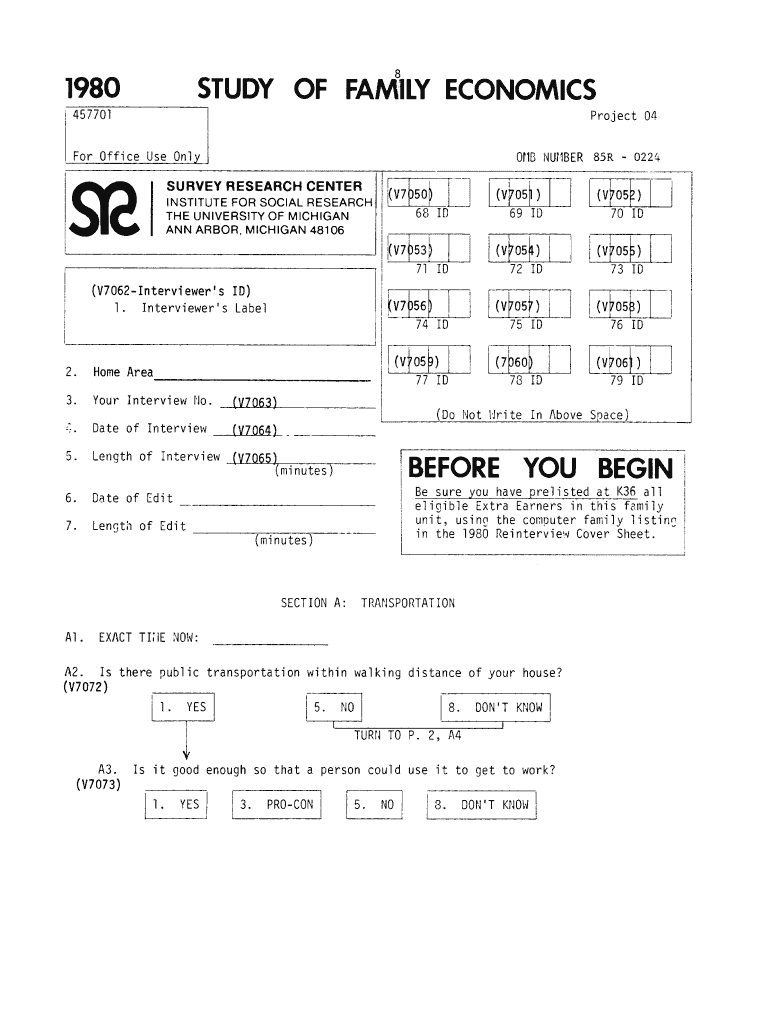

STUDY OF Family ECONOMICS 457701 For Officers Only sv2SURVEYRESEARCHProjectOllB NUf1BER 85R 0224FkjrlCENTERINSTITUTE FOR SOCIAL RESEARCH THE UNIVERSITY OF MICHIGAN ANN ARBOR, MICHIGAN 48106/ I(V7062Interviewers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit supply shocks network

Edit your credit supply shocks network form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit supply shocks network form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit supply shocks network online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit supply shocks network. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit supply shocks network

How to fill out credit supply shocks network

01

To fill out credit supply shocks network, follow these steps:

02

Gather the necessary data related to credit supply shocks, such as the change in lending standards, interest rates, or credit availability.

03

Identify the key players in the network, such as banks, financial institutions, and borrowers.

04

Determine the relationships and connections between these players based on the impact of credit supply shocks.

05

Use a visual representation or a diagram to map out the network, indicating the flow of credit and the interdependencies between the players.

06

Analyze the network to understand the transmission of credit supply shocks and their potential consequences on the overall economy.

07

Regularly update and adjust the network as new data or information becomes available.

08

Use the filled-out credit supply shocks network to inform decision-making, risk assessment, and policy interventions related to credit and financial stability.

Who needs credit supply shocks network?

01

Credit supply shocks network is useful for various stakeholders, including:

02

- Central banks and monetary authorities: They can utilize this network to monitor and assess the impact of credit supply shocks on the financial system and implement appropriate policy measures.

03

- Financial institutions: They can analyze the network to understand the ripple effects of credit supply shocks and manage their lending practices and risk exposure accordingly.

04

- Policymakers and regulators: They can use the network to identify systemic risks, formulate targeted policies, and enhance financial stability.

05

- Researchers and economists: They can study the network to investigate the transmission mechanisms of credit supply shocks and their implications for economic performance.

06

- Investors and market participants: They can gain insights from the network to make informed decisions about credit investments and risk management strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit supply shocks network directly from Gmail?

credit supply shocks network and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for the credit supply shocks network in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your credit supply shocks network in seconds.

How can I edit credit supply shocks network on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing credit supply shocks network right away.

What is credit supply shocks network?

The credit supply shocks network refers to a system that tracks and analyzes disruptions in the availability of credit within the financial system, assessing their impact on the economy.

Who is required to file credit supply shocks network?

Financial institutions, lenders, and organizations that provide credit are typically required to file the credit supply shocks network.

How to fill out credit supply shocks network?

To fill out the credit supply shocks network, organizations must gather and report relevant data on their credit offerings, including levels of lending, types of credit impacted by shocks, and any changes in credit supply.

What is the purpose of credit supply shocks network?

The purpose of the credit supply shocks network is to monitor and mitigate the impact of credit disruptions, ensuring stability in the financial system and guiding policy responses.

What information must be reported on credit supply shocks network?

Institutions must report details regarding credit volume, changes in credit availability, borrower defaults, and other metrics that indicate credit market conditions.

Fill out your credit supply shocks network online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Supply Shocks Network is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.