Get the free Managing Commercial Credit Risk One-Day Workshop - New York ...

Show details

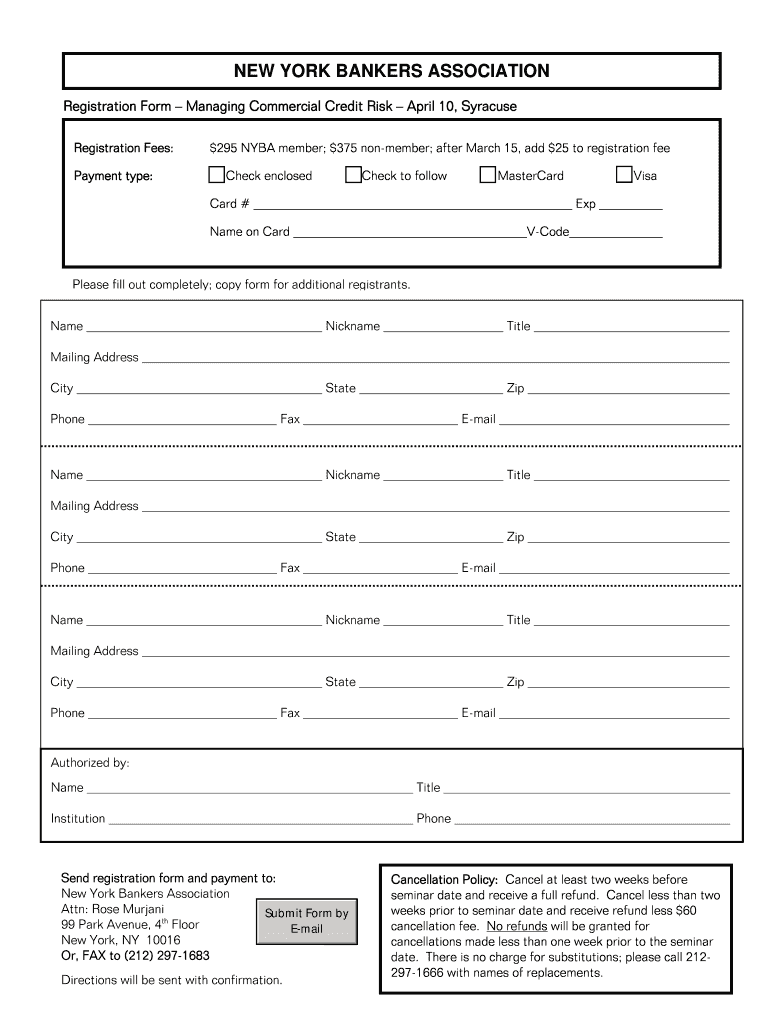

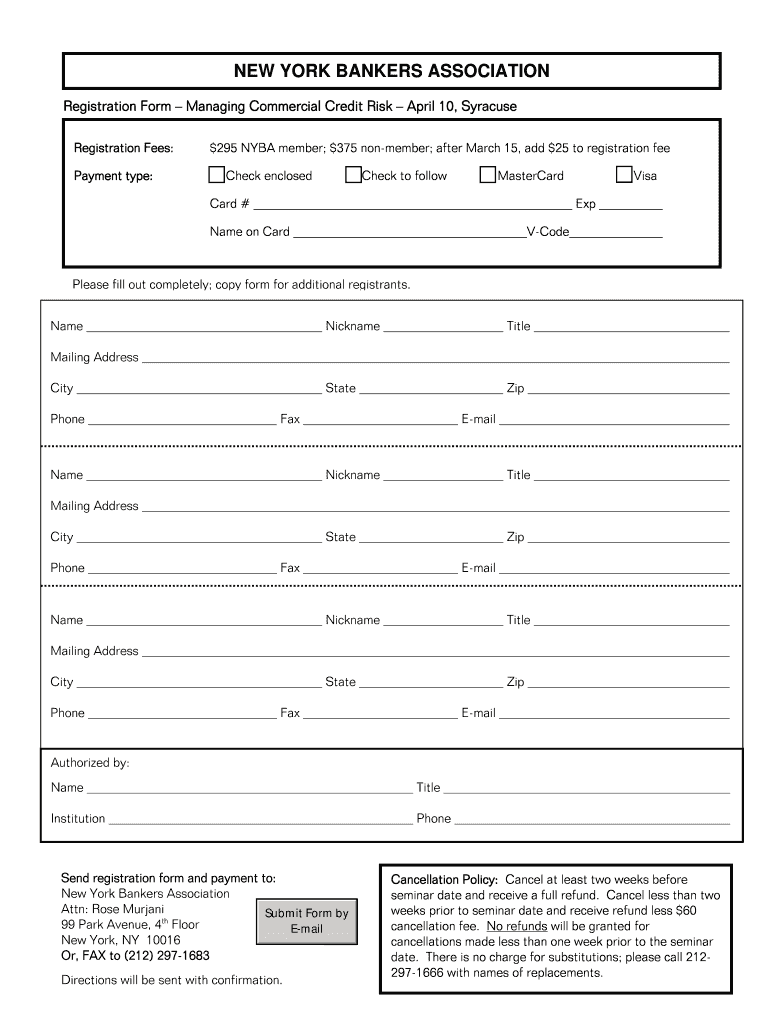

Managing Commercial Credit Risk One-Day Workshop www.nyba.com Presented by Jeff Judy for the New York Bankers Association An investment in knowledge always pays the best interest. Benjamin Franklin

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign managing commercial credit risk

Edit your managing commercial credit risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your managing commercial credit risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit managing commercial credit risk online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit managing commercial credit risk. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out managing commercial credit risk

How to fill out managing commercial credit risk:

01

Identify and assess credit risk: Begin by evaluating the creditworthiness of potential borrowers and existing clients. This involves analyzing financial statements, credit scores, payment histories, and other relevant factors. Assessing credit risk helps in determining the probability of default and potential losses.

02

Set credit limits and terms: Establish credit limits for each customer based on their creditworthiness. This ensures that you are extending credit within acceptable risk levels. Additionally, define the terms of credit, such as repayment terms, interest rates, and late payment penalties. Clear credit terms promote transparency and reduce the likelihood of disputes.

03

Implement credit monitoring and control systems: Regularly monitor the creditworthiness of existing customers to identify any changes in their financial situations. This can be done through financial statement analysis, credit reports, and ongoing communication with customers. Implement robust control systems to track outstanding balances, collections, and delinquencies. Utilize technology, like credit management software, to automate and streamline these processes.

04

Diversify your customer base: Reduce credit risk by diversifying your customer portfolio. Depending on the industry and target market, avoid concentration of credit exposure by managing customer concentration. By expanding your customer base and avoiding overreliance on a small number of clients, you can minimize potential losses if any one customer defaults.

05

Create and enforce effective credit policies: Develop comprehensive credit policies and procedures that clearly outline the terms, conditions, and guidelines for extending credit. Ensure that these policies are consistently enforced throughout the organization. Train employees on credit risk management protocols to maintain consistent practices across the board.

06

Regularly review and update credit risk management strategies: The credit landscape is constantly changing. Regularly review and update your credit risk management strategies to adapt to evolving market conditions and new industry trends. Stay informed about changes in regulations and credit market dynamics to effectively mitigate credit risk.

Who needs managing commercial credit risk?

01

Businesses: Businesses of all sizes, from small startups to large multinational corporations, require effective credit risk management to protect their financial stability. By managing commercial credit risk, businesses can reduce the likelihood of bad debts, enhance cash flow, and maintain healthy relationships with customers.

02

Lenders and Financial Institutions: Lenders and financial institutions, such as banks and credit unions, play a crucial role in managing commercial credit risk. These entities evaluate the creditworthiness of borrowers before extending loans or lines of credit. Effective credit risk management helps lenders minimize potential losses and maintain the overall health of their loan portfolios.

03

Credit Risk Managers: Credit risk managers are professionals responsible for assessing, monitoring, and mitigating credit risk within an organization. They analyze financial data, evaluate creditworthiness, set credit policies, and regularly review credit risk management strategies. These professionals ensure that the organization's credit risk exposure is within acceptable limits and aligned with business objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send managing commercial credit risk to be eSigned by others?

Once your managing commercial credit risk is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find managing commercial credit risk?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific managing commercial credit risk and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit managing commercial credit risk on an iOS device?

Use the pdfFiller mobile app to create, edit, and share managing commercial credit risk from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is managing commercial credit risk?

Managing commercial credit risk involves assessing and mitigating the risk of financial loss from customers who fail to pay for goods or services.

Who is required to file managing commercial credit risk?

Businesses that extend credit to customers or clients are required to file managing commercial credit risk.

How to fill out managing commercial credit risk?

To fill out managing commercial credit risk, businesses need to analyze customer creditworthiness, set credit limits, monitor payment behaviors, and implement risk mitigation strategies.

What is the purpose of managing commercial credit risk?

The purpose of managing commercial credit risk is to protect businesses from financial losses due to non-payment by customers.

What information must be reported on managing commercial credit risk?

Information such as customer credit history, payment trends, outstanding balances, and credit limit utilization must be reported on managing commercial credit risk.

Fill out your managing commercial credit risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Managing Commercial Credit Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.