Get the free Opening Deposit Accounts

Show details

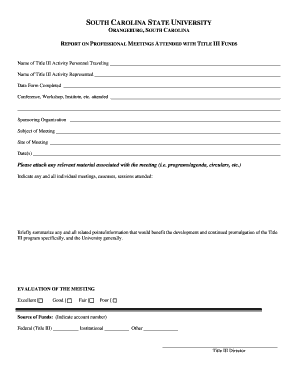

Opening Deposit Accounts January 9, January16 & January 23, 2014 2:30 4:30 ET Webinar Code: SW2-1099 Personal Accounts 1/9/14 Account opening takes well-trained personnel whose efficiency requires

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opening deposit accounts

Edit your opening deposit accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opening deposit accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing opening deposit accounts online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit opening deposit accounts. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out opening deposit accounts

How to fill out opening deposit accounts:

01

Research the various banks or financial institutions that offer opening deposit accounts. Compare their interest rates, fees, and account features to find one that suits your needs.

02

Visit the bank or financial institution in person or go to their website to start the account opening process.

03

Prepare the required documents such as identification proof, proof of address, and any additional documents requested by the bank.

04

Complete the account opening application form, providing accurate and up-to-date information.

05

If necessary, make an initial deposit into the account as specified by the bank.

06

Review the terms and conditions of the opening deposit account and seek clarification from the bank if needed.

07

Sign the necessary agreements or contracts related to the account, ensuring you understand your rights and responsibilities as an account holder.

08

Keep copies of all documents submitted and received during the account opening process for your records.

09

Once the account is successfully opened, you may receive account details, such as an account number and login credentials, allowing you to access your account online or through mobile banking apps.

Who needs opening deposit accounts:

01

Individuals looking to manage their money and earn interest on their savings can benefit from opening deposit accounts. It provides a safe and secure way to store and grow their funds.

02

Businesses, both small and large, often open deposit accounts to separate their operational funds from personal finances and to manage receivables and payables.

03

Parents may open deposit accounts for their children to teach them about saving and responsible financial management.

04

Students may open deposit accounts to receive scholarships or financial aid disbursements, as well as to manage their personal finances while studying.

05

Organizations, such as non-profits or charities, may open deposit accounts to handle donations, manage funds, and facilitate financial transactions.

Opening deposit accounts can be beneficial for a wide range of individuals and entities. Whether it's for personal savings, business transactions, or educational purposes, opening a deposit account provides a convenient and secure way to manage finances and work towards financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify opening deposit accounts without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your opening deposit accounts into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send opening deposit accounts to be eSigned by others?

Once your opening deposit accounts is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find opening deposit accounts?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific opening deposit accounts and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

What is opening deposit accounts?

Opening deposit accounts refers to the process of creating a new account with a financial institution where money can be deposited and withdrawn.

Who is required to file opening deposit accounts?

Individuals or businesses who open a new deposit account are required to file opening deposit accounts.

How to fill out opening deposit accounts?

Opening deposit accounts can typically be filled out online, in person at a bank branch, or through a mobile app.

What is the purpose of opening deposit accounts?

The purpose of opening deposit accounts is to provide individuals and businesses with a secure place to store and manage their money.

What information must be reported on opening deposit accounts?

Information such as the account holder's name, address, social security number, date of birth, and initial deposit amount must be reported on opening deposit accounts.

Fill out your opening deposit accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opening Deposit Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.