Get the free CVB Hotel/Motel Sales Tax Funding Grant ... - Le Mars, IA

Show details

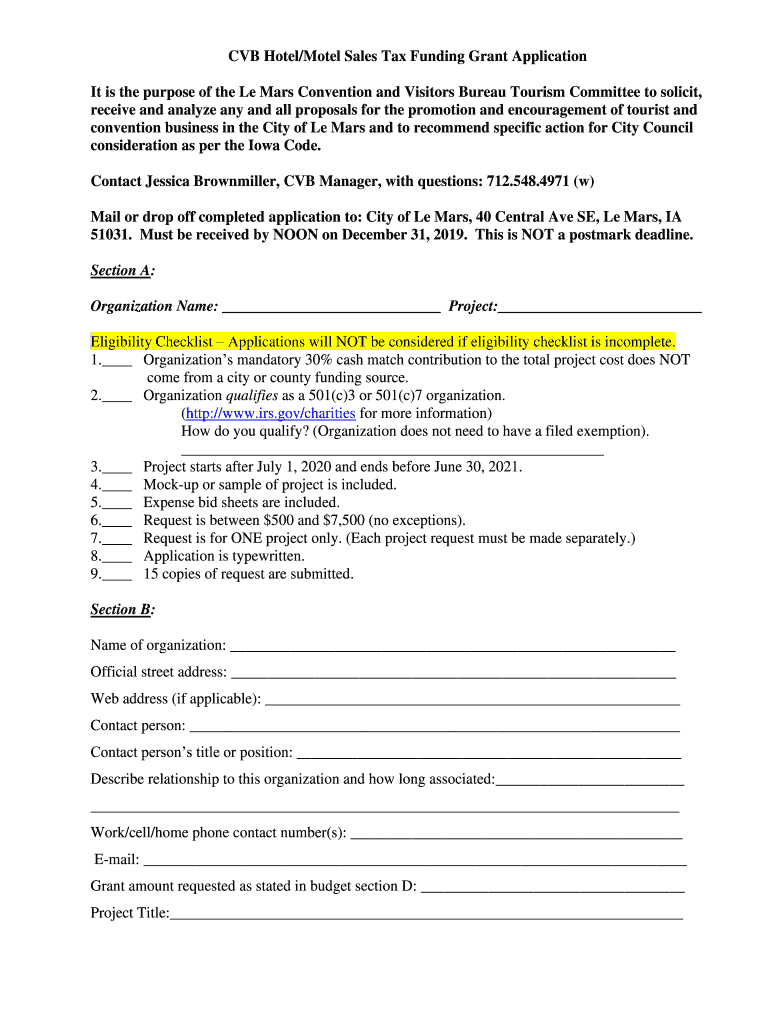

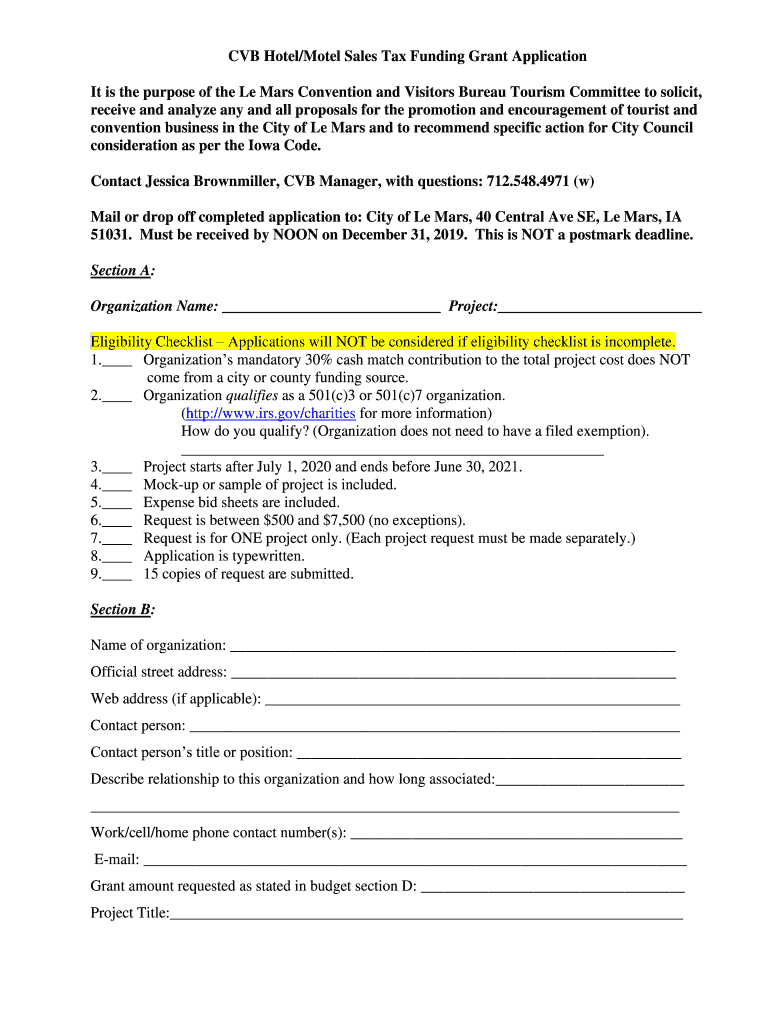

CAB Hotel/Motel Sales Tax Funding Grant Application

It is the purpose of the Le Mars Convention and Visitors Bureau Tourism Committee to solicit,

receive and analyze any and all proposals for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cvb hotelmotel sales tax

Edit your cvb hotelmotel sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cvb hotelmotel sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cvb hotelmotel sales tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cvb hotelmotel sales tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cvb hotelmotel sales tax

How to fill out cvb hotelmotel sales tax

01

Gather all the necessary information and documentation such as the hotel/motel's sales and occupancy records, tax rates, and any relevant forms required by the CVB (Convention and Visitors Bureau).

02

Start by identifying the specific requirements and guidelines set by the CVB for filling out the sales tax forms. These guidelines may include instructions on what information to include, how to calculate the tax amount, and any specific deadlines or reporting periods.

03

Create a spreadsheet or document to organize the data needed for the sales tax form. Include fields for the date of each transaction, the amount of sales made, the tax rate applied, and any exempt sales.

04

Fill in the sales tax form accurately and completely based on the information collected. Double-check all calculations and ensure that all required fields are filled out properly. Be diligent in reporting any exempt sales or other exceptions as instructed by the CVB.

05

Submit the completed sales tax form to the CVB according to their specified method. This may involve mailing it, delivering it in person, or submitting it electronically through an online portal. Be sure to adhere to any deadlines for submission and keep a copy of the form for your records.

06

Keep track of all the sales tax forms submitted and maintain organized records of any supporting documents. This will be helpful for future reference and in case of any audits or inquiries from the CVB or other tax authorities.

07

Stay updated with any changes in CVB regulations or requirements regarding hotel/motel sales tax. It is important to remain compliant and adapt your reporting practices accordingly.

Who needs cvb hotelmotel sales tax?

01

All hotels or motels that provide accommodation services and are located within the jurisdiction of the CVB (Convention and Visitors Bureau) are typically required to pay and report the hotel/motel sales tax.

02

Additionally, any business or individual who is involved in the sales and rental of sleeping accommodations, including owners, managers, and operators of hotels or motels, are subject to this tax. The tax is usually used to support various tourism and promotional activities in the local area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cvb hotelmotel sales tax directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your cvb hotelmotel sales tax along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I sign the cvb hotelmotel sales tax electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your cvb hotelmotel sales tax in seconds.

How do I edit cvb hotelmotel sales tax on an iOS device?

You certainly can. You can quickly edit, distribute, and sign cvb hotelmotel sales tax on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is cvb hotelmotel sales tax?

CVB hotel/motel sales tax is a specific tax levied on the rental charges of hotel and motel accommodations, often used to fund local tourism and convention activities.

Who is required to file cvb hotelmotel sales tax?

Hotels and motels that collect this tax from guests are required to file CVB hotel/motel sales tax returns.

How to fill out cvb hotelmotel sales tax?

To fill out CVB hotel/motel sales tax, businesses typically need to complete the designated tax form, report total sales, the amount of tax collected, and provide any required payment on the form.

What is the purpose of cvb hotelmotel sales tax?

The purpose of CVB hotel/motel sales tax is to generate revenue to promote tourism, support local convention and visitor bureaus, and enhance hospitality infrastructure.

What information must be reported on cvb hotelmotel sales tax?

Information that must be reported typically includes total room revenue, tax collected, business identification, and the filing period.

Fill out your cvb hotelmotel sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cvb Hotelmotel Sales Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.