Get the free Upstream Petroleum Fiscal and Valuation Modeling in Excel ...

Show details

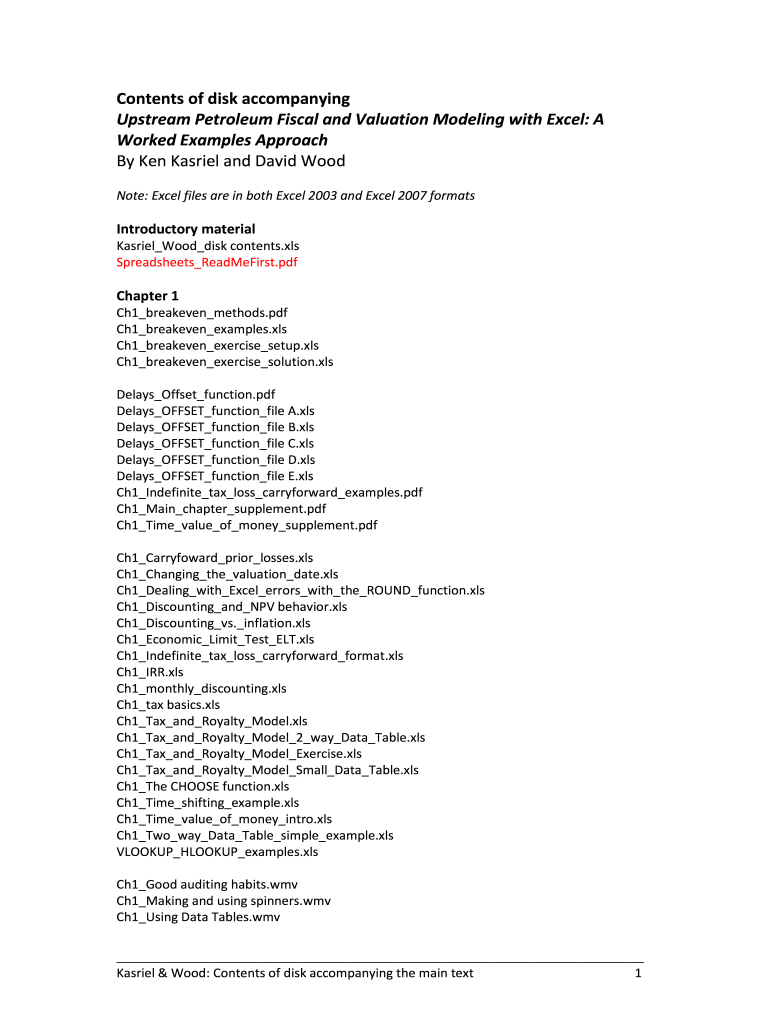

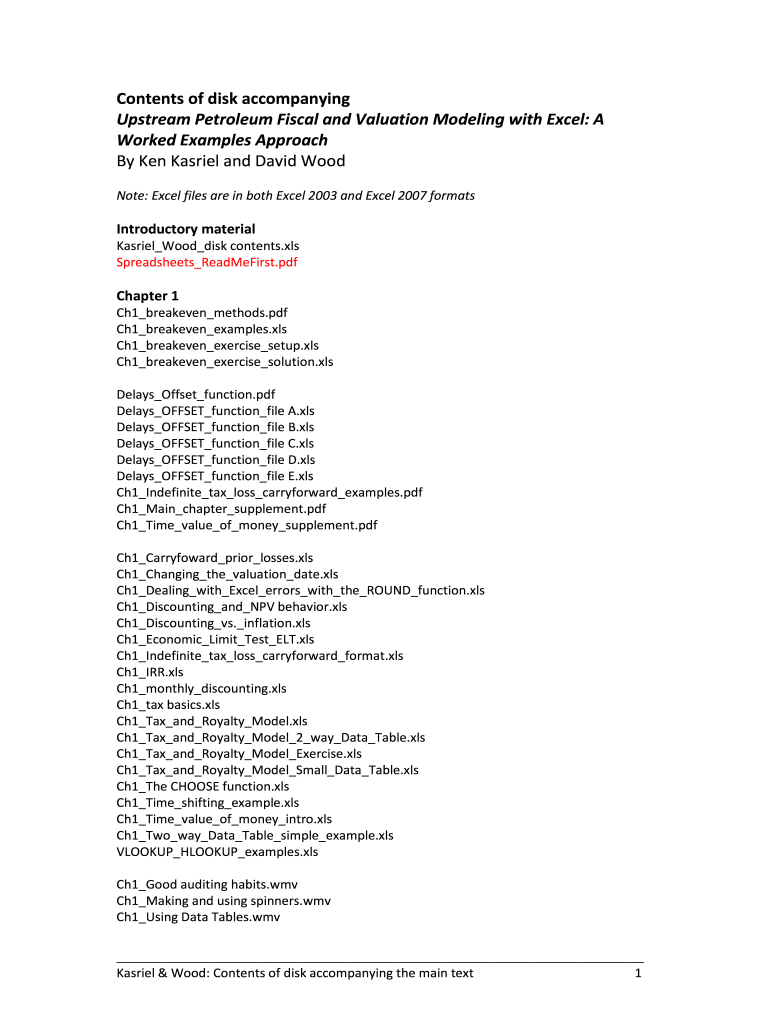

Contents of disk accompanying

Upstream Petroleum Fiscal and Valuation Modeling with Excel: A

Worked Examples Approach

By Ken Gabriel and David Wood

Note: Excel files are in both Excel 2003 and Excel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign upstream petroleum fiscal and

Edit your upstream petroleum fiscal and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your upstream petroleum fiscal and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing upstream petroleum fiscal and online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit upstream petroleum fiscal and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out upstream petroleum fiscal and

How to fill out upstream petroleum fiscal and

01

To fill out upstream petroleum fiscal, follow these steps:

02

Gather all the necessary financial and operational data related to upstream petroleum activities.

03

Identify the appropriate fiscal regime or contract model that applies to the specific upstream project.

04

Understand the specific requirements and guidelines provided by the government or regulatory authorities regarding the fiscal reporting for upstream petroleum activities.

05

Determine the relevant fiscal periods for which the report needs to be prepared.

06

Calculate and compile the revenue generated from upstream petroleum activities, including sales, royalties, bonuses, and other income sources.

07

Deduct the allowable costs and expenses associated with the exploration, development, and production of petroleum reserves.

08

Apply the applicable tax rates or fiscal terms to determine the tax liability or government take.

09

Prepare supporting schedules or documentation as required by the fiscal reporting guidelines.

10

Review and verify the accuracy and completeness of the fiscal report.

11

Submit the filled-out upstream petroleum fiscal report to the relevant government or regulatory authorities within the stipulated deadline.

Who needs upstream petroleum fiscal and?

01

Upstream petroleum fiscal is needed by various stakeholders involved in the petroleum industry, including:

02

- National governments or regulatory authorities to monitor and enforce fiscal policies and regulations.

03

- Oil and gas companies to comply with fiscal reporting requirements and determine their tax liabilities.

04

- Financial institutions and investors to evaluate the financial performance and risk of investments in upstream petroleum projects.

05

- Analysts and researchers to assess the overall economic impact of the petroleum industry and make informed decisions.

06

- Consultants and advisors involved in petroleum fiscal and regulatory matters to provide guidance and support to industry players.

07

- Academic institutions and students studying petroleum economics and fiscal regimes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send upstream petroleum fiscal and to be eSigned by others?

When your upstream petroleum fiscal and is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit upstream petroleum fiscal and online?

The editing procedure is simple with pdfFiller. Open your upstream petroleum fiscal and in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the upstream petroleum fiscal and in Gmail?

Create your eSignature using pdfFiller and then eSign your upstream petroleum fiscal and immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is upstream petroleum fiscal and?

Upstream petroleum fiscal refers to the financial and regulatory framework governing the exploration and production of oil and gas, including tax obligations, royalties, and revenue sharing between companies and governments.

Who is required to file upstream petroleum fiscal and?

Entities involved in the exploration and production of petroleum resources, including operators and contractors in the upstream sector, are required to file upstream petroleum fiscal reports.

How to fill out upstream petroleum fiscal and?

To fill out upstream petroleum fiscal, companies must gather financial data related to production volumes, expenses, and revenues, then complete the designated forms provided by the regulatory authority, ensuring all calculations and information are accurate.

What is the purpose of upstream petroleum fiscal and?

The purpose of upstream petroleum fiscal is to ensure compliance with tax regulations, monitor the financial performance of the sector, and facilitate the fair distribution of revenues from natural resource extraction between governments and companies.

What information must be reported on upstream petroleum fiscal and?

Companies must report information on production volumes, revenue generated, operating expenses, tax liabilities, and any applicable royalties on their upstream petroleum fiscal statements.

Fill out your upstream petroleum fiscal and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Upstream Petroleum Fiscal And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.