American Bank Borrowers Certification & Authorization 2014-2025 free printable template

Show details

Borrower's Certification & Authorization Certification The undersigned certify the following: 1. I/We have applied for a mortgage loan from AMERICAN BANK (lender). In applying for the loan, I/we completed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign borrower39s certification authorization

Edit your borrower39s certification authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your borrower39s certification authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

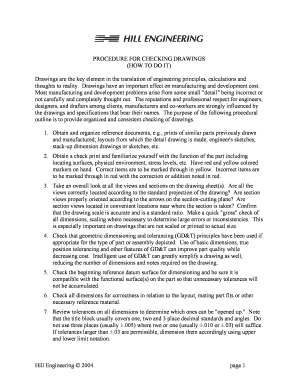

How to edit borrower39s certification authorization online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit borrower39s certification authorization. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out borrower39s certification authorization

How to fill out American Bank Borrowers Certification & Authorization

01

Obtain the American Bank Borrowers Certification & Authorization form from your lender or their website.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Provide information about the loan for which you are applying, including the amount and purpose of the loan.

04

Complete the financial disclosure section, listing your assets, liabilities, income, and any other required financial details.

05

Review and sign the certification section, confirming that all information is accurate and complete.

06

If applicable, attach any necessary documentation as indicated in the form instructions.

07

Submit the completed form to your lender by the specified method (in-person, email, or mail).

Who needs American Bank Borrowers Certification & Authorization?

01

Individuals applying for a loan from American Bank.

02

Borrowers seeking to confirm their financial status and authorize the bank to obtain necessary information.

03

Co-signers who need to certify their financial information for the loan application.

Fill

form

: Try Risk Free

People Also Ask about

Who is the borrower in real estate?

In a real estate agreement, the mortgagor is the borrower of a mortgage loan, and the mortgagee is the lender. The mortgagor makes regular payments on the loan and agrees to a lien on the mortgaged property as collateral for the mortgagee.

Who are called borrowers?

A borrower is a person or business that receives money from a lender with the agreement to pay it back within a specified period of time.

What does borrower mean?

Definitions of borrower. someone who receives something on the promise to return it or its equivalent. Antonyms: lender, loaner. someone who lends money or gives credit in business matters. types: freeloader.

Who is a borrower and lender?

The lender This is the person or entity that lends a certain amount of money on credit to an applicant, who is the borrower, who must repay the amount borrowed, plus the interest agreed upon in the contract, within a predetermined time frame.

What does borrower mean in mortgage?

A mortgage borrower is someone who takes out a home loan to purchase a property. When that person borrows the money, they are making a commitment to pay back that amount in full, on time, and with interest.

How to fill out the borrower's defense application?

You need the following information or documents: Verified account username and password (FSA ID) School name(s) and program of study. Your enrollment dates. Documentation to support why you believe you qualify for borrower defense and to demonstrate financial harm to you, if applicable.

Who is the borrower on a student loan?

Student Borrower means the individual person who is enrolled at an Eligible Institution at the time of Application, executes a Credit Agreement for the purpose of obtaining a Loan from SunTrust under the Program, and who has proceeds disbursed under the Credit Agreement.

Who is the primary borrower on a student loan?

Keep in mind though that both you (as the co-signer) and your child (the primary borrower) are legally responsible for the loan even if you initially agree with each other that only one party will be making payments.

What do you write in a borrower defense?

SECTION IV: BASIS FOR BORROWER DEFENSE This is your opportunity to share the ways in which the school misled you. You want to include as much detail possible in your answers, including as much information as you can remember about who made promises to you and where and when they made those promises.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my borrower39s certification authorization in Gmail?

borrower39s certification authorization and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send borrower39s certification authorization for eSignature?

When you're ready to share your borrower39s certification authorization, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the borrower39s certification authorization in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your borrower39s certification authorization directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is American Bank Borrowers Certification & Authorization?

The American Bank Borrowers Certification & Authorization is a document that certifies the borrower's information, declaring its accuracy, and authorizes the bank to access the necessary credit and financial information for the purpose of processing a loan application.

Who is required to file American Bank Borrowers Certification & Authorization?

Individuals and businesses applying for a loan from American Bank are required to file the American Bank Borrowers Certification & Authorization to provide necessary verification of their financial status.

How to fill out American Bank Borrowers Certification & Authorization?

To fill out the American Bank Borrowers Certification & Authorization, applicants must complete all sections of the form, providing accurate personal and financial information, then sign and date the document to certify its authenticity.

What is the purpose of American Bank Borrowers Certification & Authorization?

The purpose of the American Bank Borrowers Certification & Authorization is to ensure that the bank has accurate and verified information from borrowers in order to assess their creditworthiness and facilitate the loan application process.

What information must be reported on American Bank Borrowers Certification & Authorization?

The information that must be reported includes the borrower's personal identification details, income sources, outstanding debts, credit history, and any other relevant financial information necessary for evaluating the loan application.

Fill out your borrower39s certification authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

borrower39s Certification Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.