Get the free TO FORECLOSE TAX LIENS BY JUNEAU COUNTY

Show details

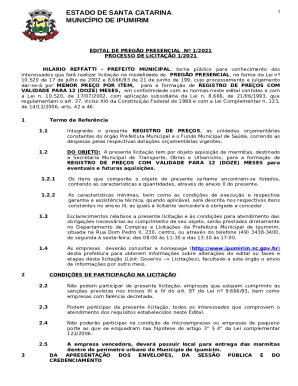

NOTICE OF COMMENCEMENT OF PROCEEDING IN REM TO FORECLOSE TAX LIENS BY JUNEAU COUNTY STATE OF WISCONSIN CIRCUIT COURT JUNEAU COUNTY IN THE MATTER OF THE FORECLOSURE) PETITION AND NOTICE OF TAX LIENS,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign to foreclose tax liens

Edit your to foreclose tax liens form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your to foreclose tax liens form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit to foreclose tax liens online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit to foreclose tax liens. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out to foreclose tax liens

How to fill out to foreclose tax liens

01

Start by researching the specific laws and regulations regarding tax lien foreclosure in your state or jurisdiction.

02

Obtain a list of tax liens that are available for foreclosure.

03

Review the details of each tax lien, including the amount owed, the property's location, and any potential risks or restrictions.

04

Assess the potential profitability of each tax lien by considering factors such as the property's value, the likelihood of redemption by the property owner, and any outstanding mortgages or liens.

05

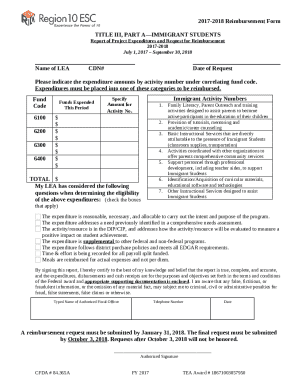

Prepare the necessary foreclosure documents, which may include a notice of intent to foreclose, a petition or complaint, and other relevant legal forms.

06

File the foreclosure documents with the appropriate court or government agency, paying any required fees.

07

Serve the property owner with a copy of the foreclosure documents according to the legal requirements of your jurisdiction.

08

Wait for the specified redemption period to elapse, during which the property owner may pay off the tax lien and prevent foreclosure.

09

If the property owner does not redeem the tax lien, proceed with the foreclosure process.

10

Attend any required court hearings and follow the legal procedures outlined by your jurisdiction.

11

If the court approves the foreclosure, obtain a certified copy of the foreclosure judgment or order.

12

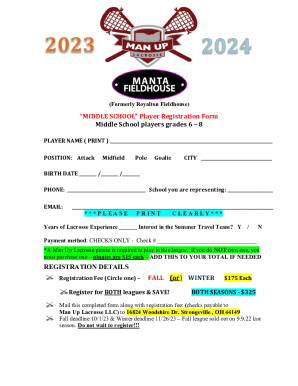

Advertise and conduct a foreclosure sale, either through a public auction or private sale, as specified by your jurisdiction.

13

Transfer the property title to the highest bidder or foreclosure purchaser after receiving the full payment.

14

Record the foreclosure deed or transfer documents with the appropriate government office to formalize the change of ownership.

15

Comply with any additional post-foreclosure requirements, such as eviction of occupants or settlement of any remaining debts or liens on the property.

Who needs to foreclose tax liens?

01

Tax lien investors: Individuals or companies who purchase tax liens as an investment opportunity may need to foreclose tax liens in order to acquire the underlying properties and potentially profit from their resale.

02

Municipalities or government agencies: Local governments or tax authorities that hold tax liens may need to foreclose in order to recoup the unpaid taxes and transfer the properties to new owners.

03

Property owners or lienholders: In some cases, property owners or lienholders who are at risk of losing their rights or interests in a property due to tax liens may choose to foreclose to protect their investments.

04

Attorneys or legal professionals: Lawyers or legal professionals who specialize in real estate or tax law may assist clients in the process of foreclosing tax liens.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my to foreclose tax liens in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your to foreclose tax liens and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit to foreclose tax liens on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share to foreclose tax liens on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out to foreclose tax liens on an Android device?

On an Android device, use the pdfFiller mobile app to finish your to foreclose tax liens. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is to foreclose tax liens?

To foreclose tax liens means to legally terminate the owner's rights to a property due to unpaid property taxes, allowing the government or lienholder to sell the property to recover the owed taxes.

Who is required to file to foreclose tax liens?

Typically, the local tax authority or government agency responsible for tax collection is required to file to foreclose tax liens.

How to fill out to foreclose tax liens?

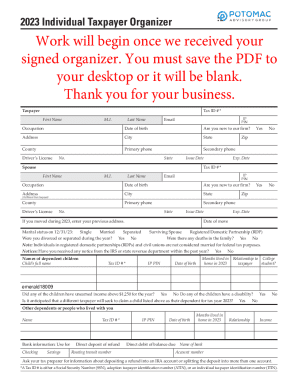

To fill out to foreclose tax liens, one must complete the designated legal forms provided by the local tax authority, include necessary details about the property and the tax obligations, and submit them according to the jurisdiction's guidelines.

What is the purpose of to foreclose tax liens?

The purpose of foreclosing tax liens is to enable the government to recover unpaid property taxes, maintain public revenue, and ensure property is returned to productive use.

What information must be reported on to foreclose tax liens?

Information that must be reported includes the property owner's name, property description, amount of taxes owed, any penalties or interest, and the status of previous notices sent.

Fill out your to foreclose tax liens online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

To Foreclose Tax Liens is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.