Get the free For distributions to IRA Beneficiaries or Estate Executors ONLY

Show details

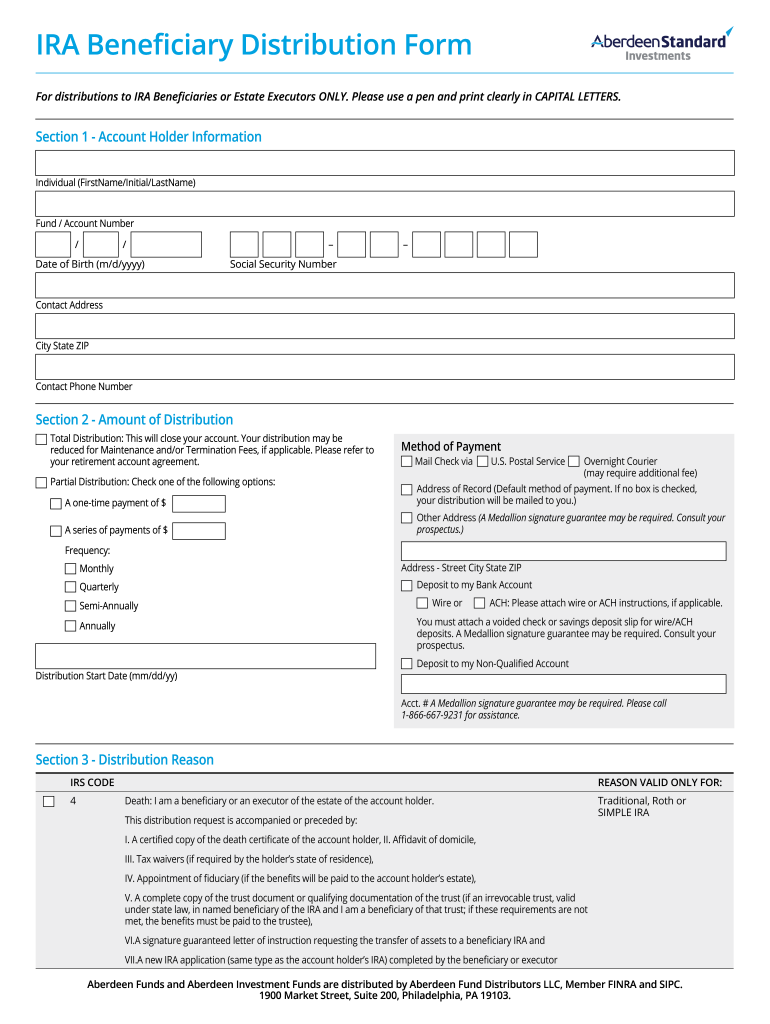

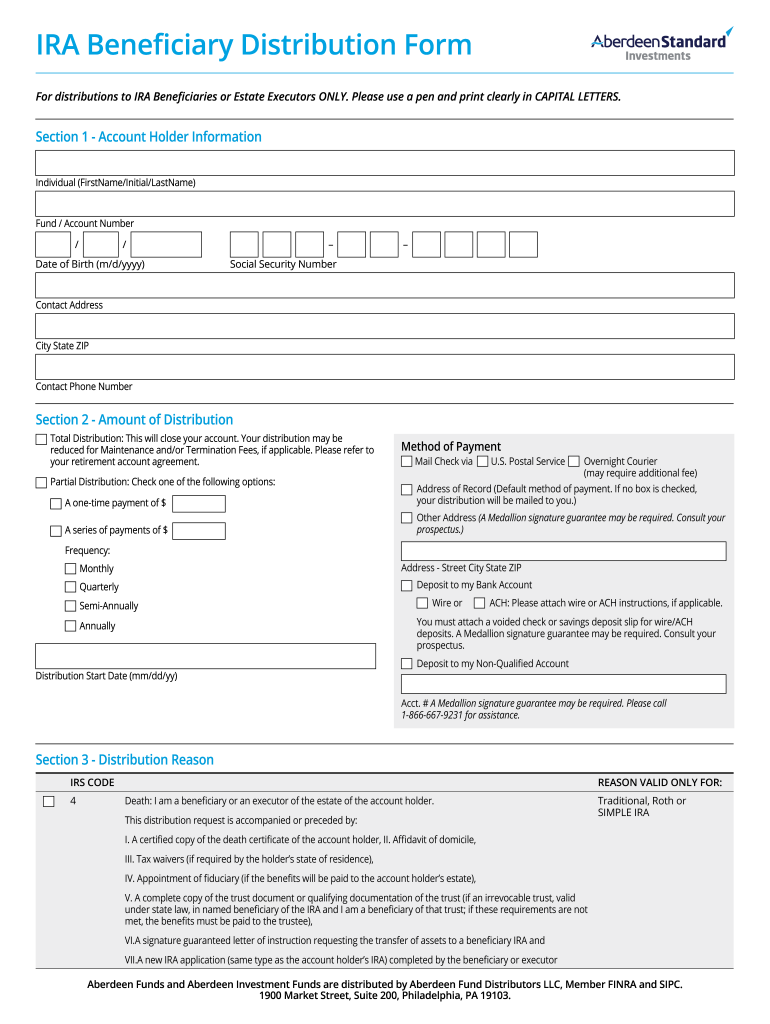

IRA Beneficiary Distribution Form For distributions to IRA Beneficiaries or Estate Executors ONLY. Please use a pen and print clearly in CAPITAL LETTERS. Section 1 Account Holder Information Individual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for distributions to ira

Edit your for distributions to ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for distributions to ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for distributions to ira online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit for distributions to ira. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for distributions to ira

How to fill out for distributions to ira

01

To fill out a form for distributions to an IRA, follow these steps:

02

Obtain the necessary form from your IRA custodian or the financial institution that holds your IRA account.

03

Provide your personal information, including your name, address, date of birth, and Social Security number. This information is needed for identification purposes.

04

Indicate the type of distribution you are requesting, such as a regular withdrawal, a rollover to another IRA, or a transfer to a different account.

05

Specify the amount or percentage of the distribution you wish to withdraw or transfer.

06

Provide the details of the receiving account if you are requesting a rollover or transfer.

07

Sign and date the form to confirm your request.

08

Submit the completed form to your IRA custodian or financial institution according to their instructions.

09

Note: It is advisable to consult with a financial advisor or tax professional before making any distributions from your IRA to ensure you are aware of any tax implications or potential penalties.

10

Please note that these steps are general guidelines and may vary depending on your specific IRA custodian or financial institution. It is always recommended to refer to their instructions and contact their customer support if you have any doubts or need assistance.

Who needs for distributions to ira?

01

Individuals who have an Individual Retirement Account (IRA) may need to take distributions from their IRA under certain circumstances.

02

Retirees: Many individuals use their IRAs as a source of income during retirement. They need to take regular distributions to cover their living expenses.

03

Early retirees: If someone retires before the age of 59½, they may need to take distributions from their IRA to bridge the gap until they become eligible for other retirement income sources, such as Social Security.

04

Beneficiaries: In case of the account holder's death, beneficiaries typically need to take distributions from the inherited IRA.

05

Individuals facing financial hardship: IRA owners may need to take distributions in cases of financial hardship, such as facing unexpected medical expenses or major financial emergencies.

06

It is important to note that the specific rules and requirements for taking distributions from an IRA may vary depending on factors such as the type of IRA (Traditional IRA, Roth IRA, etc.) and the account holder's age. It is advisable to consult with a financial advisor or tax professional for guidance specific to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send for distributions to ira for eSignature?

When you're ready to share your for distributions to ira, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get for distributions to ira?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific for distributions to ira and other forms. Find the template you need and change it using powerful tools.

How do I fill out for distributions to ira using my mobile device?

Use the pdfFiller mobile app to complete and sign for distributions to ira on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is for distributions to IRA?

Distributions to IRA refer to the withdrawal of funds from an Individual Retirement Account.

Who is required to file for distributions to IRA?

Individuals who have an IRA and are taking distributions from it are required to file for distributions to IRA.

How to fill out for distributions to IRA?

To fill out for distributions to IRA, individuals usually need to report the amount withdrawn, the reason for the distribution, and any applicable taxes.

What is the purpose of for distributions to IRA?

The purpose of filing for distributions to IRA is to report the withdrawals made from the account to the relevant tax authorities.

What information must be reported on for distributions to IRA?

Information such as the amount withdrawn, any taxes withheld, and the reason for the distribution must be reported on for distributions to IRA.

Fill out your for distributions to ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Distributions To Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.