Get the free Manufacturing Equipment Use Tax Rebate Application

Show details

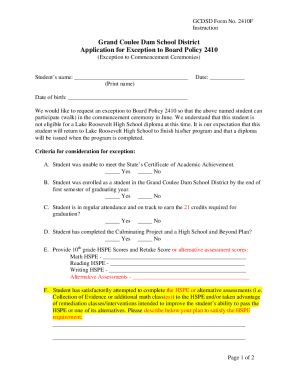

This application is for companies in Fort Collins to request a rebate on the use tax paid for manufacturing equipment purchased in 2010. The application includes sections for company information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manufacturing equipment use tax

Edit your manufacturing equipment use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manufacturing equipment use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit manufacturing equipment use tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit manufacturing equipment use tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manufacturing equipment use tax

How to fill out Manufacturing Equipment Use Tax Rebate Application

01

Obtain the Manufacturing Equipment Use Tax Rebate Application form from the relevant government website or office.

02

Fill in your business information, including name, address, and contact details.

03

Provide details about the manufacturing equipment purchased, including make, model, and purchase date.

04

Include the sales tax exemption certificate if applicable.

05

Attach any required supporting documents, such as receipts or invoices.

06

Review the application for accuracy and completeness.

07

Sign and date the application form.

08

Submit the application to the designated government office by the specified deadline.

Who needs Manufacturing Equipment Use Tax Rebate Application?

01

Manufacturers who have purchased equipment specifically for manufacturing purposes may need to apply for the Manufacturing Equipment Use Tax Rebate Application to reclaim paid taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the Manufacturing use tax exemption in California?

A qualified person pays only 3.3125 percent sales or use tax plus any applicable district-imposed taxes until June 30, 2030, on qualifying purchases and leases. Qualifying purchases are limited to $200 million in a calendar year. The partial exemption is available to anyone who meets the qualifications.

Is business equipment tax exempt?

Consumables, raw materials, machinery, and equipment are generally exempt, but not all states have equivalent laws on the books. Using a quality service provider like TaxConnex can help your company ensure that you do your sales tax returns correctly and properly handle your exemptions.

What is a use tax exemption certificate?

An exemption certificate is a form presented by a business or organization that is exempt from paying sales tax on certain purchases. Each type of sales tax exemption requires different documentation.

What makes my business tax-exempt?

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Can an LLC be exempt from paying sales tax?

Most states provide helpful resale certificate information on their Department of Revenue websites. Does an LLC have to pay sales tax? Yes. An LLC isn't exempt from collecting sales tax on products or other tangible personal properties sold in the various jurisdictions where their businesses currently operate.

Is equipment for my business tax deductible?

Companies can claim a maximum deduction up to $1,220,000 in 2024 taxes for eligible equipment cost up to $3,050,000. Equipment purchase between $1,220,000–$3,050,000: The deduction limit is $1,220,000. The maximum deduction begins to decline once the equipment purchase exceeds $3,050,000.

What is exempt from sales tax in Pennsylvania?

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood.

Do I have to pay sales tax on equipment for my business?

Consumables, raw materials, machinery, and equipment are generally exempt, but not all states have equivalent laws on the books. Using a quality service provider like TaxConnex can help your company ensure that you do your sales tax returns correctly and properly handle your exemptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Manufacturing Equipment Use Tax Rebate Application?

The Manufacturing Equipment Use Tax Rebate Application is a form used to request a rebate on the use tax paid for manufacturing equipment purchased by eligible businesses.

Who is required to file Manufacturing Equipment Use Tax Rebate Application?

Manufacturers who purchase qualifying equipment and have paid use tax on that equipment are required to file the application to obtain a rebate.

How to fill out Manufacturing Equipment Use Tax Rebate Application?

To fill out the application, you must provide your business information, details about the equipment purchased, the amount of use tax paid, and any supporting documentation required by the rebate program.

What is the purpose of Manufacturing Equipment Use Tax Rebate Application?

The purpose of the application is to facilitate the reimbursement of use tax to manufacturers, promoting economic growth by reducing the tax burden associated with purchasing manufacturing equipment.

What information must be reported on Manufacturing Equipment Use Tax Rebate Application?

The application must report the business name, address, description of the equipment, total cost of the equipment, amount of use tax paid, and any additional documentation as required by the rebate process.

Fill out your manufacturing equipment use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manufacturing Equipment Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.