HI DoT A-6 2010 free printable template

Show details

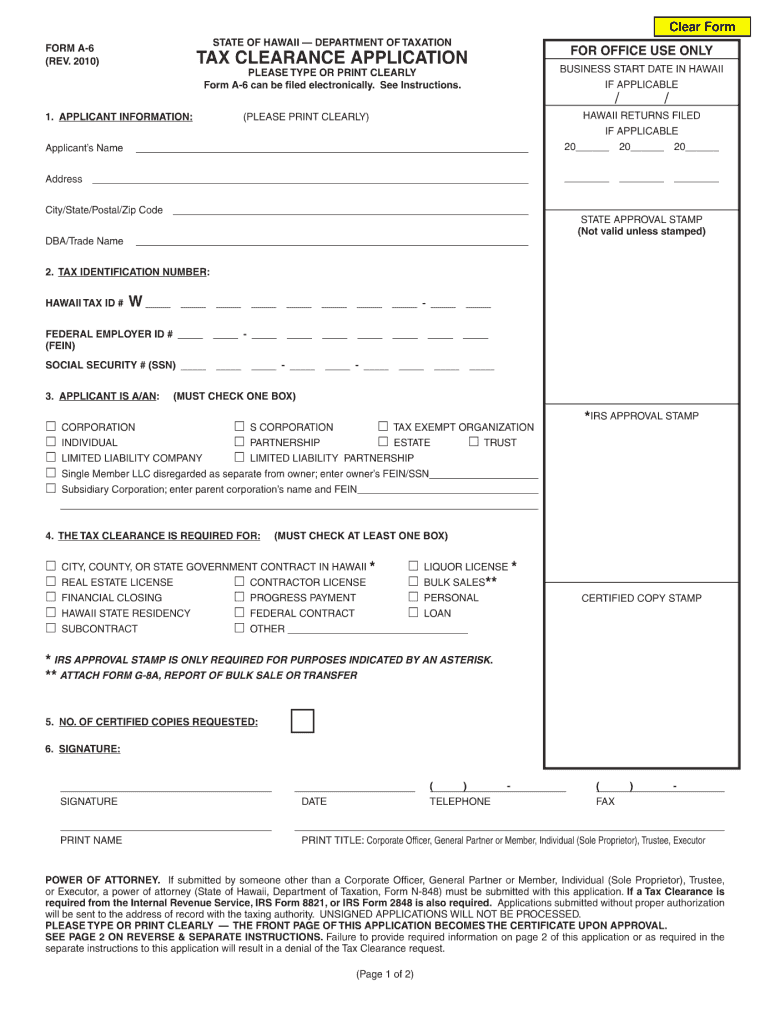

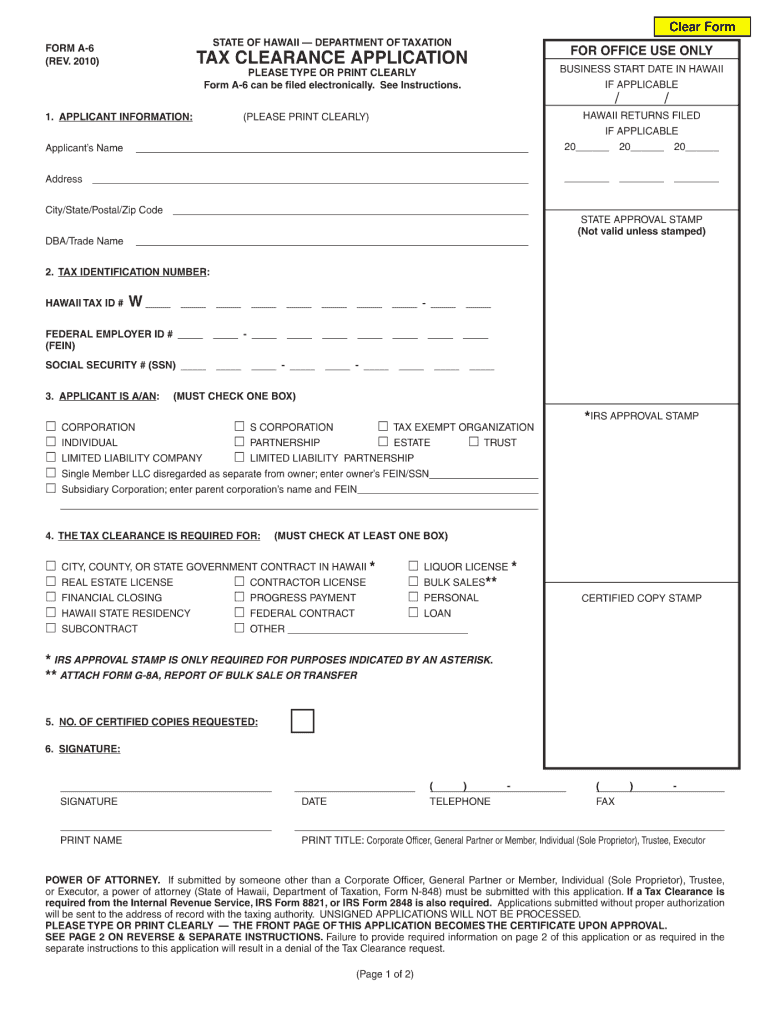

Clear Form A-6 (REV. 2010) TAX CLEARANCE APPLICATION PLEASE TYPE OR PRINT CLEARLY Form A-6 can be filed electronically. See Instructions. (PLEASE PRINT CLEARLY) STATE OF HAWAII -- DEPARTMENT OF TAXATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT A-6

Edit your HI DoT A-6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT A-6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI DoT A-6 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI DoT A-6. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT A-6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT A-6

How to fill out HI DoT A-6

01

Obtain the HI DoT A-6 form from the official website or your local Department of Transportation office.

02

Begin filling out the applicant’s information at the top of the form, including name, address, and contact details.

03

Provide details regarding the vehicle involved, including the make, model, year, and vehicle identification number (VIN).

04

Describe the purpose for which the form is being submitted, such as application for a title or registration.

05

Include any relevant information regarding previous registrations or titles for the vehicle if applicable.

06

Sign and date the form at the bottom, certifying that the information provided is accurate to the best of your knowledge.

07

Submit the completed form to the appropriate office, along with any required fees and additional documentation.

Who needs HI DoT A-6?

01

Individuals applying for a vehicle title or registration in Hawaii.

02

People transferring ownership of a vehicle in Hawaii.

03

Anyone needing to report a change in vehicle information or status.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

How do I get a Hawaii tax clearance certificate?

How do I apply for a tax clearance certificate? After signing in to your Hawaii Tax Online account, navigate to “I Want To” then to “Request a Tax Clearance Certificate” under “Tax Clearance.” You can also download and print the tax clearance application, Form A-6, and submit in person, by fax, or by mail.

Who is required to file a Hawaii tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

What is Hawaii a6 form?

Hawaii Tax Online (HTO) account holders are able to view, download, and print their Tax Clearance certificate (A-6). They may also view their real-time clearance status and request a new certificate via HTO.

Who qualifies for the Hawaii food excise credit?

You must have a federal Adjusted Gross Income (AGI) below $50,000 ($30,000 if Single) to claim the Refundable Food/Excise Credit. It's worth from $35 to $110 per person depending on your AGI.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find HI DoT A-6?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the HI DoT A-6 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete HI DoT A-6 online?

Completing and signing HI DoT A-6 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the HI DoT A-6 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign HI DoT A-6 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is HI DoT A-6?

HI DoT A-6 is a specific form used by the Hawaii Department of Transportation for reporting certain types of transportation-related data.

Who is required to file HI DoT A-6?

Individuals or entities involved in transportation activities that meet specific criteria established by the Hawaii Department of Transportation are required to file HI DoT A-6.

How to fill out HI DoT A-6?

To fill out HI DoT A-6, one must follow the instructions provided by the Hawaii Department of Transportation, ensuring all required fields are completed accurately and any supporting documentation is attached.

What is the purpose of HI DoT A-6?

The purpose of HI DoT A-6 is to collect essential data related to transportation activities in Hawaii for purposes of regulation, planning, and analysis.

What information must be reported on HI DoT A-6?

Information that must be reported on HI DoT A-6 typically includes details about transportation activities, including dates, locations, types of transportation used, and relevant operational data.

Fill out your HI DoT A-6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT A-6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.