IRS Publication 783 2010 free printable template

Show details

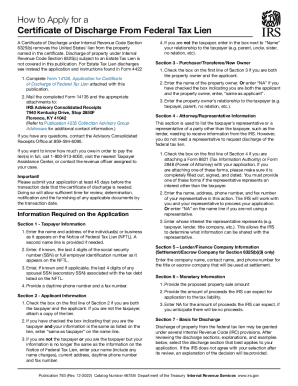

1. Complete Form 14135 Application for Certificate of Dis- Publication 783 Rev. 6-2010 plication to the tax liability. 3. Enter NA for the amount of proceeds the IRS can expect if you anticipate there will be no proceeds. Instructions on how to apply for Certificate of Discharge From Federal Tax Lien named in the certificate. Discharge of property under Internal Revenue Code Section 6325 c subject to an Estate Tax Lien is not covered in this publication* For Estate Tax Lien discharges see...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs 783 2010 form

Edit your irs 783 2010 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

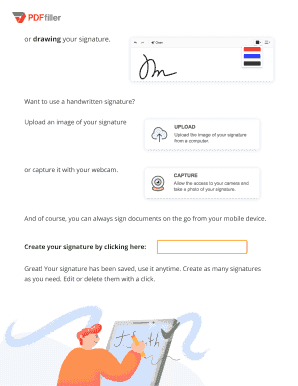

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 783 2010 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs 783 2010 form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs 783 2010 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 783 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs 783 2010 form

Who needs irs publication 783?

01

Taxpayers who are reporting income from sources other than wages, salaries, or tips.

02

Taxpayers who are self-employed or have income from freelance work.

03

Taxpayers who have income from rental properties or investments.

04

Taxpayers who have income from partnerships, S corporations, estates, trusts, or real estate mortgage investment conduits (REMICs).

05

Taxpayers who are claiming certain deductions or credits, such as the foreign tax credit or the credit for child and dependent care expenses.

How to fill out irs publication 783:

01

Begin by gathering all necessary documents and forms, such as Form 1040 or Form 1040NR.

02

Read the instructions provided in irs publication 783 carefully to understand the specific requirements and guidelines for reporting income from various sources.

03

Fill out the relevant sections of your tax return form, ensuring that you accurately report your income from different sources according to the instructions in irs publication 783.

04

Attach any additional forms or schedules as required by the instructions in irs publication 783.

05

Double-check all the information provided to ensure its accuracy and completeness.

06

Sign and date your tax return form before submitting it to the IRS.

Remember, it is always recommended to consult with a tax professional or use tax preparation software to ensure that you accurately fill out irs publication 783 and comply with all applicable tax laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get proof of IRS lien release?

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.

What is the IRS form for lien release?

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.

Can the IRS put a lien on inherited property?

If there's a Form 706 or Form 706-NA, United States Estate Tax Return, filing requirement, a federal estate tax lien attaches to all of the deceased person's gross estate.

How long does it take for the IRS to remove a lien?

The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

How do I remove an IRS lien after statute limitations?

ing to the IRS, if you pay your tax debt in full, it will release your lien within 30 days. You might also work with the IRS to: Settle the debt by paying part of what you owe. Have the IRS withdraw the lien with the understanding that you still owe the debt and will arrange to pay it.

Does the IRS release lien after 10 years?

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (CSED). IRC § 6322. Generally, after assessment, the Service has ten years to collect the tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in irs 783 2010 form?

With pdfFiller, the editing process is straightforward. Open your irs 783 2010 form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit irs 783 2010 form in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your irs 783 2010 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit irs 783 2010 form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing irs 783 2010 form, you can start right away.

What is IRS Form 783?

IRS Form 783 is a form used by individuals and businesses to request an irrevocable consent to extend the Time to Assess Tax, specifically for cases involving collaborative taxation matters.

Who is required to file IRS Form 783?

Any taxpayer who is involved in a situation that requires an extension of the time to assess tax, typically involving tax assessments disputed by the taxpayer, is required to file IRS Form 783.

How to fill out IRS Form 783?

To fill out IRS Form 783, the taxpayer must provide their identifying information, the specific tax period for which the extension is requested, and any additional details required regarding the assessment or dispute.

What is the purpose of IRS Form 783?

The purpose of IRS Form 783 is to legally allow an extension of time for the IRS to assess tax liabilities related to specific cases, ensuring both parties can reach a resolution before a final tax assessment is made.

What information must be reported on IRS Form 783?

Information that must be reported on IRS Form 783 includes the taxpayer's name, address, identification number, details about the tax period, and reasons for requesting the extension of time to assess tax.

Fill out your irs 783 2010 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 783 2010 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.