GA Hotel/Motel Monthly Tax Return - City of Tybee Island 2020 free printable template

Show details

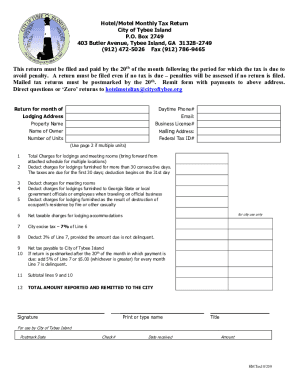

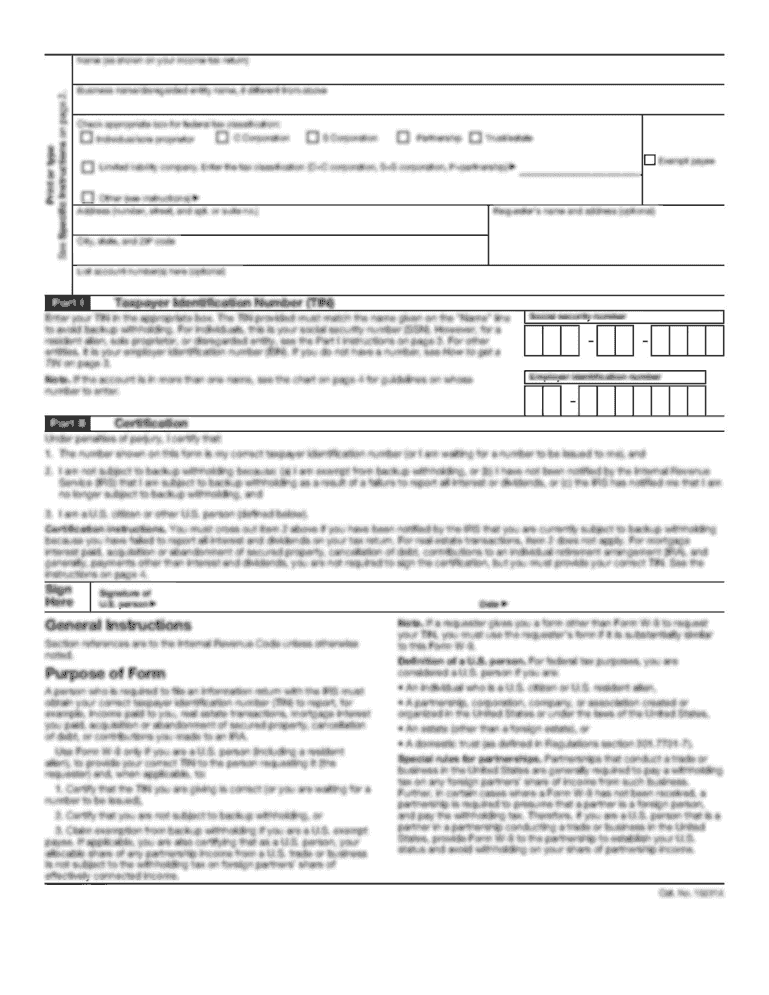

Hotel/Motel Monthly Tax Return City of Tybee Island P. O. Box 2749 403 Butler Avenue Tybee Island GA 31328-2749 912 786-4573 Fax 912 786-5832 This return must be filed and paid by the 20th of the month following the period for which the tax is due to avoid penalty.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA HotelMotel Monthly Tax Return

Edit your GA HotelMotel Monthly Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA HotelMotel Monthly Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA HotelMotel Monthly Tax Return online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit GA HotelMotel Monthly Tax Return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Hotel/Motel Monthly Tax Return - City of Tybee Island Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA HotelMotel Monthly Tax Return

How to fill out GA Hotel/Motel Monthly Tax Return - City

01

Collect all relevant financial records for the month, including total sales and number of guests.

02

Obtain the GA Hotel/Motel Monthly Tax Return form from the appropriate city website or tax office.

03

Enter the total gross revenue earned from hotel/motel services on the designated line of the form.

04

Calculate the amount of hotel/motel tax owed based on the applicable tax rate set by the city.

05

Fill in the number of rooms rented and other relevant statistics required by the form.

06

Review all entries for accuracy before submitting.

07

Submit the completed form along with the payment for the tax owed by the deadline specified by the city.

Who needs GA Hotel/Motel Monthly Tax Return - City?

01

Hotel and motel operators who generate income from room rentals within the city.

02

Any business that provides lodging services, including bed and breakfasts and vacation rentals.

03

Individuals or entities required by local laws to report and pay hotel/motel taxes to the city.

Fill

form

: Try Risk Free

People Also Ask about

What is local lodging tax?

Property owners and managers are required to pay lodging tax for renting out a room or property in certain states or localities. In some regions, lodging tax may also be known by another name such as: stay tax, occupancy tax, room tax, sales tax, tourist tax, or hotel tax.

What is the hotel tax rate in Savannah GA?

ing to a resolution passed by Savannah's city council in February 2021 under an eight percent hotel/motel tax.

What is Tybee hotel-motel tax?

Just down the road, Tybee Island falls in the middle at a 7% hotel/motel tax. In 2021, Thunderbolt also passed a hotel-motel tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find GA HotelMotel Monthly Tax Return?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific GA HotelMotel Monthly Tax Return and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in GA HotelMotel Monthly Tax Return?

With pdfFiller, the editing process is straightforward. Open your GA HotelMotel Monthly Tax Return in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit GA HotelMotel Monthly Tax Return in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing GA HotelMotel Monthly Tax Return and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is GA Hotel/Motel Monthly Tax Return - City?

The GA Hotel/Motel Monthly Tax Return - City is a tax form used by hotel and motel operators to report and remit the hotel/motel tax collected from guests to the city government. This form is submitted on a monthly basis.

Who is required to file GA Hotel/Motel Monthly Tax Return - City?

All hotel and motel operators in the city that collect hotel/motel taxes from their guests are required to file the GA Hotel/Motel Monthly Tax Return - City.

How to fill out GA Hotel/Motel Monthly Tax Return - City?

To fill out the GA Hotel/Motel Monthly Tax Return - City, operators must provide their business information, report the total gross receipts from room rentals, calculate the tax due based on the applicable tax rate, and submit the form along with payment to the city.

What is the purpose of GA Hotel/Motel Monthly Tax Return - City?

The purpose of the GA Hotel/Motel Monthly Tax Return - City is to ensure compliance with local tax laws by accurately reporting and remitting the hotel/motel taxes collected from guests to the city government.

What information must be reported on GA Hotel/Motel Monthly Tax Return - City?

The information that must be reported on the GA Hotel/Motel Monthly Tax Return - City includes the total gross receipts from room rentals, the total hotel/motel tax collected, any applicable deductions, and the total tax due for the reporting period.

Fill out your GA HotelMotel Monthly Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA HotelMotel Monthly Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.