CA POA-1 - San Francisco free printable template

Show details

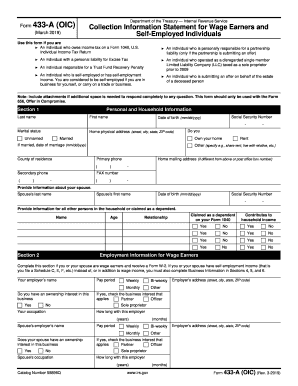

CITY AND COUNTY OF SAN FRANCISCO Office of the Treasurer and Tax Collector Power of Attorney Declaration Form POA-1 See Instructions to complete this form. Part 1 Taxpayer Information Name of Taxpayer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sf poa1

Edit your sf poa1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sf poa1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sf poa1 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sf poa1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sf poa1

How to fill out CA POA-1 - San Francisco

01

Obtain the CA POA-1 form from the California Secretary of State's website or local office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Provide the principal's full name and address in the designated section.

04

Enter the agent's full name and address, ensuring they are qualified to act on your behalf.

05

Specify the powers granted to the agent, whether general or limited.

06

Include the effective date of the power of attorney and any expiration date if applicable.

07

Sign and date the form in the presence of a notary public.

08

Give a copy of the completed form to your agent and keep one for your own records.

09

File the original document with the appropriate county office, if necessary.

Who needs CA POA-1 - San Francisco?

01

Individuals who wish to designate another person to manage their financial or legal affairs in San Francisco.

02

People who may be unable to handle their own decision-making due to health issues, travel, or other circumstances.

03

Anyone looking for a trusted individual to act on their behalf under specific conditions outlined in the CA POA-1.

Fill

form

: Try Risk Free

People Also Ask about

Does a power of attorney need to be recorded in NY?

You are not required to file your power of attorney unless you are using it for a real estate transaction. Real Property Law §421. You can also file a copy with the County Clerk's Office if you would like to be sure you can obtain copies if needed. Remember, your power of attorney cannot help you if it cannot be found.

What is San Francisco gross receipts tax?

Use your San Francisco Business Activity and SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation. Business ActivityRetail Trade; and Certain Services0-$1m0.053%$1-$2.5m0.070%$2.5-$25m0.095%$25m +0.224%15 more columns

What is the POA law in NY?

In New York, you can use a statutory POA to give your agent authority to handle your financial and business matters. For example, you can give your agent the power to pay your bills, file your taxes, sell your real estate property, and more. This type of POA is often called a financial power of attorney.

Where do I file my NY POA?

The taxpayer must file a new POA to appoint the individuals they want to continue to represent them.Representative withdrawal. Fax to:518-435-8406Mail to:NYS TAX DEPARTMENT POA CENTRAL UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0864 Mar 27, 2023

What is the business tax exemption in San Francisco?

The Gross Receipts Tax small business exemption threshold is $2,000,000 of combined gross receipts within the City. The Homelessness Gross Receipts Tax is applied to combined San Francisco taxable gross receipts above $50,000,000.

What is a POA in NYS tax?

The New York tax power of attorney (Form POA-1) is a form that allows a taxpayer to grant a representative permission to handle tax matters on their behalf. A firm itself may not act as a representative, however, a firm's employee may be selected. The representative must be an individual such as a CPA or attorney.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sf poa1 to be eSigned by others?

When you're ready to share your sf poa1, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit sf poa1 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sf poa1.

How do I edit sf poa1 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute sf poa1 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is CA POA-1 - San Francisco?

CA POA-1 is a Power of Attorney form used in San Francisco, California, allowing an individual to designate another person to act on their behalf in legal and financial matters.

Who is required to file CA POA-1 - San Francisco?

Any person in San Francisco who wishes to authorize another individual to manage their legal or financial affairs may need to file CA POA-1.

How to fill out CA POA-1 - San Francisco?

To fill out CA POA-1, individuals should provide their personal information, the details of the person authorized to act on their behalf, and clearly specify the powers being granted.

What is the purpose of CA POA-1 - San Francisco?

The purpose of CA POA-1 is to designate someone to make decisions on behalf of another person, particularly when that individual is unable to manage their own affairs due to absence or incapacity.

What information must be reported on CA POA-1 - San Francisco?

CA POA-1 must include the principal's name and address, the agent's name and address, the specific powers granted, and any limitations on those powers if applicable.

Fill out your sf poa1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sf poa1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.