Get the free BUSINESS LOAN APPLICATION - LGE Community Credit Union - lgeccu

Show details

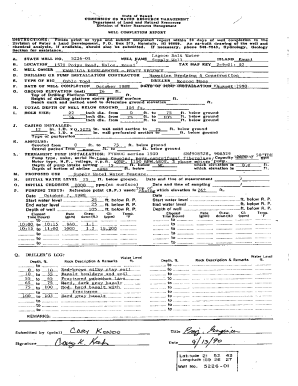

For Credit Union Use Only BUSINESS LOAN APPLICATION Business Account # Employee I. GENERAL BUSINESS INFORMATION Borrower Name: DBA Name: Date of Organization: Federal Tax ID# (EIN): Business Physical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application

Edit your business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business loan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan application

How to fill out a business loan application:

01

Gather all necessary documents and information: Before starting the application process, make sure you have all the required documents and information handy. This may include your business plan, financial statements, tax returns, identification documents, proof of collateral, and any other supporting documents requested by the lender.

02

Research different loan options: Before applying for a business loan, it's important to research and understand the different loan options available to you. This will help you choose the most suitable loan type for your business needs. Some common types of business loans include term loans, SBA loans, equipment financing, and lines of credit.

03

Complete the application form: Once you have gathered all the necessary documents and selected the appropriate loan type, it's time to start filling out the application form. Carefully read and follow the instructions provided by the lender. Be sure to provide accurate and detailed information to increase your chances of approval.

04

Provide business and personal information: The application form will require you to provide both business and personal information. Be prepared to provide details such as your business name, address, contact information, years in business, legal structure, ownership details, and your personal background.

05

Provide financial information: Lenders will want to assess the financial health of your business before approving a loan. Therefore, you'll need to provide financial information such as your business bank statements, income statements, balance sheets, cash flow projections, and tax returns. It's essential to provide accurate and up-to-date financial information to demonstrate your business's ability to repay the loan.

06

Describe the purpose of the loan: In the application, you will have to clearly state the purpose of the loan. Whether it's for business expansion, equipment purchase, working capital, or any other specific need, explain how the loan will be utilized to benefit your business.

07

Timeline and repayment terms: The application form will also require you to provide details about the desired loan amount, repayment terms, and the timeline in which you expect to use the funds. Be realistic while setting these terms as lenders will assess whether your repayment plan aligns with your business's cash flow and financial projections.

Who needs a business loan application:

01

Entrepreneurs and small business owners: If you are launching a new business or looking to grow an existing one, you may need a business loan. A business loan application is essential for those who require financial assistance to fund their business operations, purchase equipment, hire employees, expand their premises, or invest in new projects.

02

Startups: Startups often rely on business loans to finance their initial setup costs and cover operational expenses until they generate significant revenue. A loan application is necessary for startups to secure funding and establish a strong financial foundation.

03

Established businesses: Even well-established businesses may require a business loan application when they need to invest in new equipment, expand their market reach, or fund a major project. Business loans can provide the necessary capital to fuel growth opportunities and maintain a competitive edge in the market.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business loan application online?

With pdfFiller, the editing process is straightforward. Open your business loan application in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the business loan application form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign business loan application and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit business loan application on an iOS device?

Create, modify, and share business loan application using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is business loan application?

Business loan application is a form or document that is filled out by a business owner or representative to apply for a loan for their business.

Who is required to file business loan application?

Any business owner or representative seeking a loan for their business is required to file a business loan application.

How to fill out business loan application?

To fill out a business loan application, you need to provide information about your business, including financial statements, business plan, and any other required documents.

What is the purpose of business loan application?

The purpose of a business loan application is to provide information to the lender about the business seeking a loan, including its financial health, plans for growth, and ability to repay the loan.

What information must be reported on business loan application?

Information such as income statements, balance sheets, cash flow projections, business plan, personal and business credit history, and collateral may need to be reported on a business loan application.

Fill out your business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.