Get the free sba form 1368 monthly sales figures

Show details

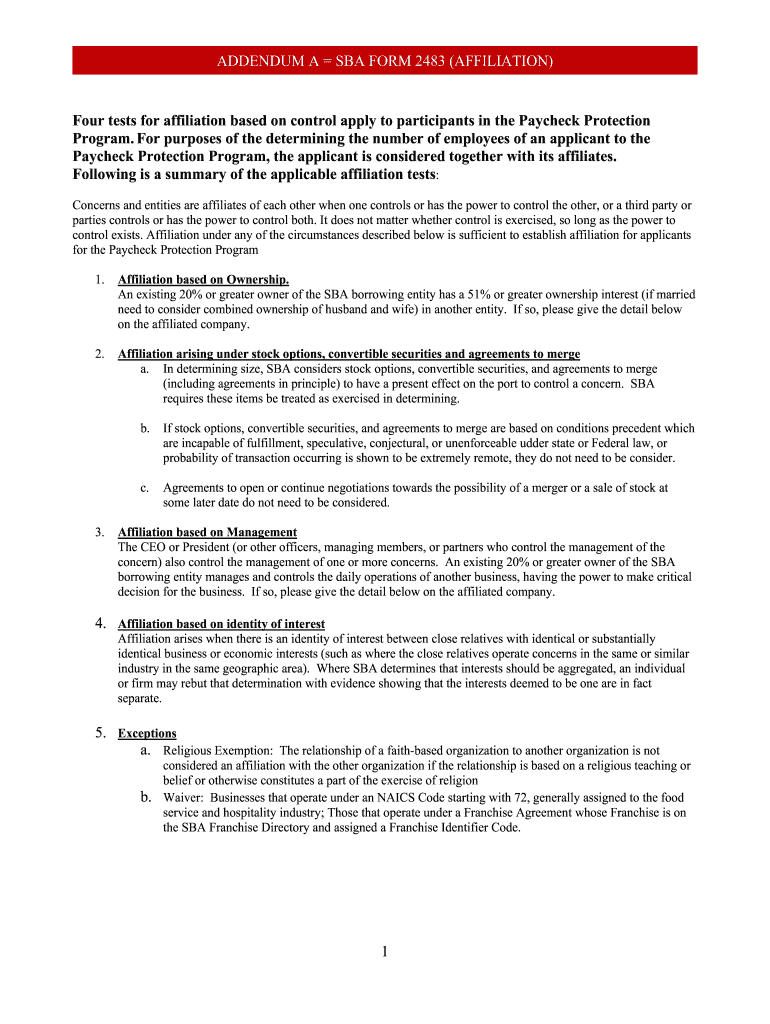

ADDENDUM A SBA FORM 2483 (AFFILIATION)Four tests for affiliation based on control apply to participants in the Paycheck Protection Program. For purposes of the determining the number of employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba form 1368 monthly

Edit your sba form 1368 monthly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 1368 monthly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba form 1368 monthly online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sba form 1368 monthly. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

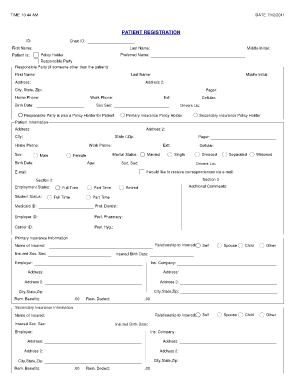

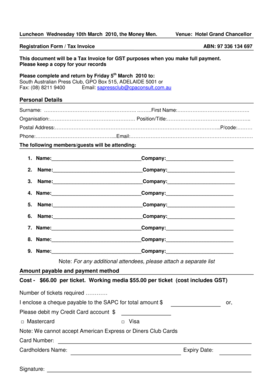

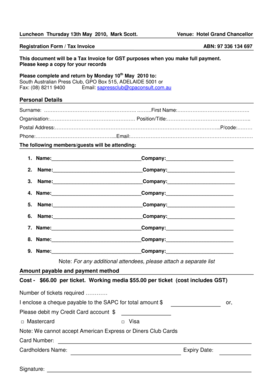

How to fill out sba form 1368 monthly

How to fill out SBA form 1368 monthly:

01

Begin by entering the date at the top of the form.

02

Fill in your business name, address, and contact information in the designated sections.

03

Provide your SBA loan number and the purpose of the loan.

04

Enter the date your business was established and the type of business it is.

05

Indicate the average number of employees per month for the reporting period.

06

Specify the gross receipts for each month in the reporting period.

07

Include any other sources of income, such as rental or investment income.

08

Calculate the total receipts and other income for each month and enter in the appropriate section.

09

Report the total income for each month in the designated area.

10

Deduct the cost of goods sold and the total expenses for each month to arrive at the net income.

11

Finally, calculate the total net income for the reporting period and enter in the appropriate field.

Who needs SBA form 1368 monthly:

01

Small business owners who have received an SBA loan and need to report their monthly financial information.

02

Individuals or businesses who are required to provide monthly financial statements as part of their loan agreement with the SBA.

03

Companies that are on an SBA loan payment plan and need to track their monthly income and expenses for reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

How does SBA determine EIDL loan amount?

The loan amount will be based on your actual economic injury and your company's financial needs, regardless of whether the business suffered any property damage. *A business may qualify for, both, an EIDL and a physical disaster loan. The maximum combined loan amount is $2 million.

How is SBA loan amount determined?

SBA Uses Cash Flow Analysis to Determine Your Repayment Ability. In addition to the total eligible loan calculation, SBA loan officers use a cash flow analysis to determine the EIDL amount you qualify for, specifically if you will be able to repay the EIDL amount you are requesting.

How does the SBA calculate the EIDL amount?

The loan amount cannot exceed $500,000. Gross Profit ÷ 2 = maximum loan amount You Gross Profit is Annual Revenues less Cost of Goods Sold.

What is SBA form 1368 monthly sales?

SBA Form 1368 allows small business owners the opportunity to provide details about the economic impact of a disaster on their business. It also requires you to disclose monthly sales figures, an economic forecast, and any additional information not captured in the forecast.

How much money was allocated to EIDL?

Since its inception, the COVID EIDL program, a federal disaster relief loan, has allocated more than $351 billion in relief aid to 3.9 million borrowers, including to the smallest of small businesses from historically underserved, disadvantaged communities.

What is Form 1368?

* The Form 1368 is required for an economic injury loan increase request when supporting documentation is not available. PROVIDE THE FOLLOWING INFORMATION IN ADDITION TO THE REQUIREMENTS ON THE. “DISASTER BUSINESS LOAN APPLICATION,” SBA FORM 5. Monthly Sales Figures.

How is EIDL grant amount calculated?

The standard calculation is “Gross Receipts” of 2019 minus cost of goods sold (COGS) times 2. For example, if your total gross revenue was $50,000 and your COGS was $10,000, you should be eligible for up to an $80,000 loan. The loan may change based on answering the optional questions in the application.

What is the maximum eligible loan amount for EIDL?

Program updates As of September 8, 2021, new COVID-19 EIDL policy changes took effect as follows: Maximum loan cap increased from $500,000 to $2 million. Use of funds was expanded to include payment and pre-payment of business non-federal debt incurred at any time (past or future) and payment of federal debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sba form 1368 monthly without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including sba form 1368 monthly, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit sba form 1368 monthly straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sba form 1368 monthly.

Can I edit sba form 1368 monthly on an iOS device?

You certainly can. You can quickly edit, distribute, and sign sba form 1368 monthly on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is sba form 1368 monthly?

SBA Form 1368, also known as the 'Monthly Sales Report,' is a form used by small businesses to report monthly sales information to the Small Business Administration (SBA) in relation to their loan responsibilities.

Who is required to file sba form 1368 monthly?

Businesses that have received funding through SBA loans or certain disaster loans are typically required to file SBA Form 1368 monthly to report their sales and ensure compliance with loan terms.

How to fill out sba form 1368 monthly?

To fill out SBA Form 1368, individuals need to provide details such as their business's name, loan number, and monthly sales figures, along with any additional requested financial data. It's crucial to ensure accuracy and completeness in the reporting.

What is the purpose of sba form 1368 monthly?

The purpose of SBA Form 1368 is to keep the SBA informed about the financial performance of borrowers, ensuring they are on track with their sales and capable of repaying their loans.

What information must be reported on sba form 1368 monthly?

SBA Form 1368 requires the reporting of monthly sales figures, year-to-date sales totals, and any significant changes in sales patterns or business operations that may affect loan repayment.

Fill out your sba form 1368 monthly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Form 1368 Monthly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.