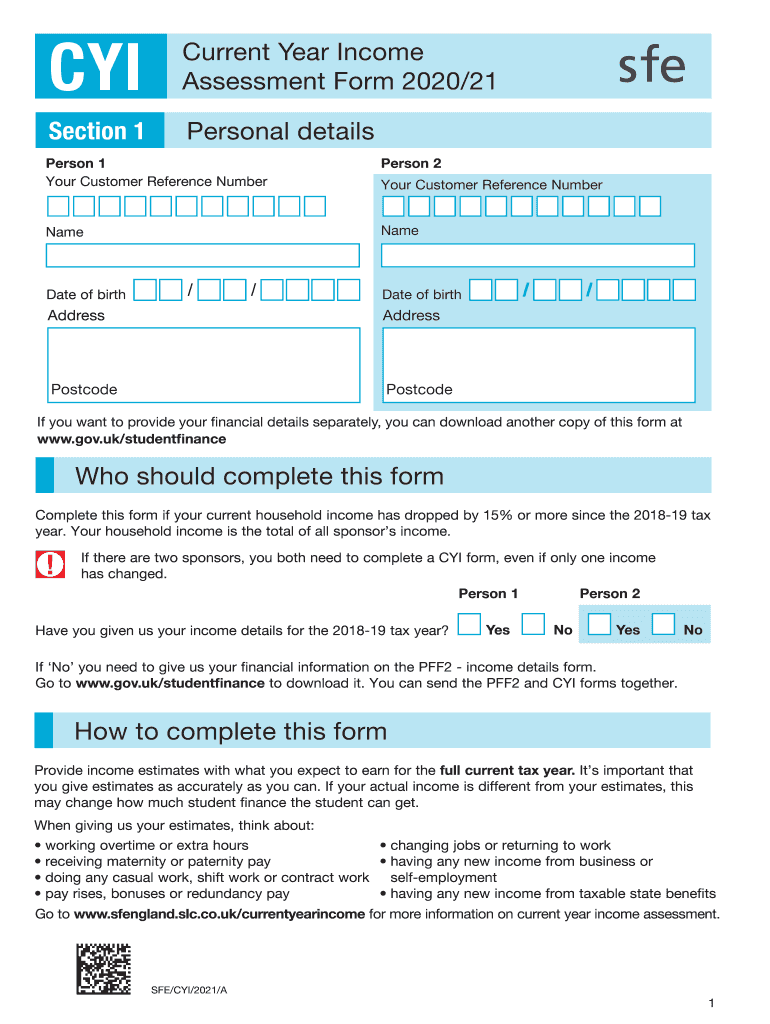

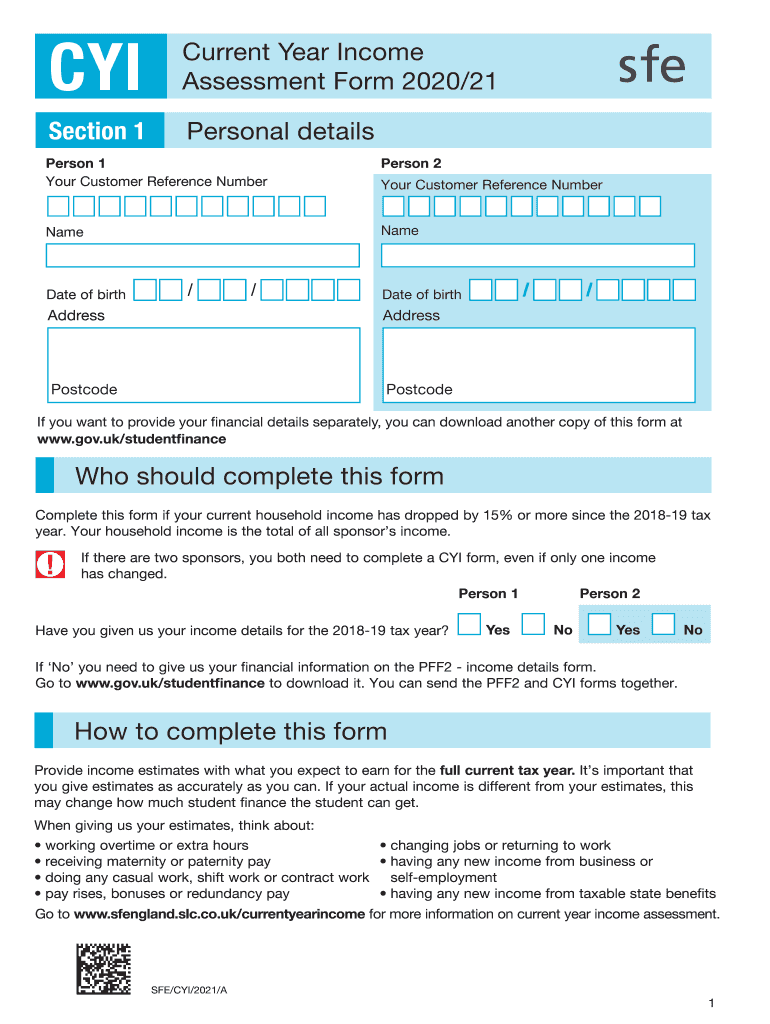

UK Form CYI 2020 free printable template

Show details

Concurrent Year Income

Assessment Form 2020/21Section 1Personal detailsPerson 1

Your Customer Reference NumberPerson 2NameNameDate of birthDate of birthAddressAddressPostcodePostcodeYour Customer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK Form CYI

Edit your UK Form CYI form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Form CYI form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK Form CYI online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK Form CYI. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Form CYI Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Form CYI

How to fill out UK Form CYI

01

Obtain the UK Form CYI from the official government website or relevant authority.

02

Read the instructions carefully to understand the requirements for filling the form.

03

Fill out your personal details, including name, address, and contact information.

04

Provide any necessary identification numbers, such as National Insurance or passport numbers.

05

Indicate the purpose of your application in the designated section.

06

Include any additional information or documentation requested in the form.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where required.

09

Submit the form as instructed, either online or by post.

Who needs UK Form CYI?

01

Individuals applying for specific UK services or benefits that require Form CYI.

02

Residents needing to update or provide information to the UK government.

03

People engaged in processes that necessitate evidence of their eligibility or identity.

Fill

form

: Try Risk Free

People Also Ask about

How to fill in self assessment form UK?

What information will I need to fill in a Self Assessment tax return? your ten-digit Unique Taxpayer Reference (UTR) your National Insurance number. details of your untaxed income from the tax year, including income from self-employment, dividends and interest on shares. records of any expenses relating to self-employment.

Do I need to register for self assessment UK?

You must register for Self Assessment if you have to send a tax return. You'll need to register again if you did not send a tax return last year, even if you've sent one in the past.

Who has to fill in a self assessment tax return UK?

You must send a tax return if, in the last tax year (6 April to 5 April), any of the following applied: you were self-employed as a 'sole trader' and earned more than £1,000 (before taking off anything you can claim tax relief on) you were a partner in a business partnership.

What is the meaning of self assessment tax?

Self Assessment Tax means the amount that an assessee pays on the requisite income after deducting Advance Tax and TDS for the given financial year. Individuals who are required to file their income tax returns are liable to pay their SAT beforehand.

Are UK tax forms available online?

You can file your Self Assessment tax return online. If you need a paper form, call HMRC and request form SA100.

What is UK tax self assessment?

Self Assessment is a system HM Revenue and Customs ( HMRC ) uses to collect Income Tax. Tax is usually deducted automatically from wages and pensions. People and businesses with other income (including COVID-19 grants and support payments) must report it in a tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit UK Form CYI in Chrome?

UK Form CYI can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the UK Form CYI in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your UK Form CYI and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the UK Form CYI form on my smartphone?

Use the pdfFiller mobile app to fill out and sign UK Form CYI on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is UK Form CYI?

UK Form CYI is a tax form used for reporting certain income and gains by individuals who are subject to UK tax laws.

Who is required to file UK Form CYI?

Individuals who have specified types of income or gains falling under the scope of UK tax legislation are required to file UK Form CYI.

How to fill out UK Form CYI?

To fill out UK Form CYI, individuals must gather their financial information, complete the form with accurate details about their income and gains, and submit it to HM Revenue and Customs by the specified deadline.

What is the purpose of UK Form CYI?

The purpose of UK Form CYI is to ensure that the HM Revenue and Customs can accurately assess and collect taxes from individuals based on their reported income and gains.

What information must be reported on UK Form CYI?

UK Form CYI must report information such as sources of income, amounts earned, gains on disposals, and any deductions or reliefs applicable to the taxpayer's situation.

Fill out your UK Form CYI online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Form CYI is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.