Get the free DEFERRED COMPENSATION PLAN - LOAN REQUEST FORM

Show details

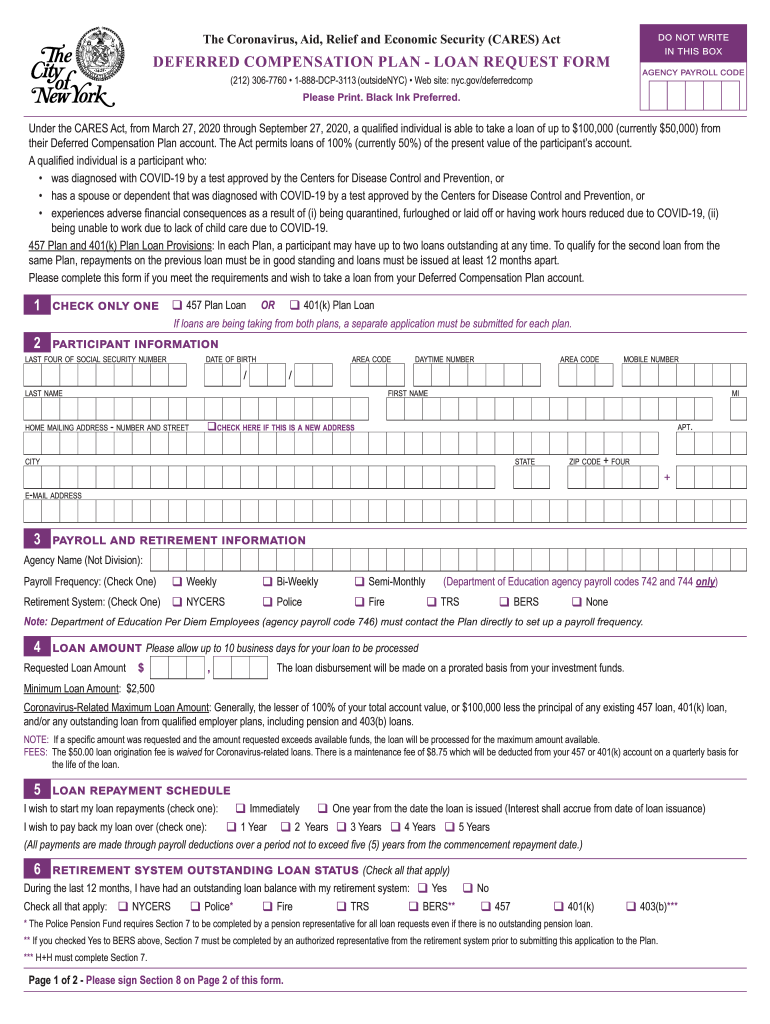

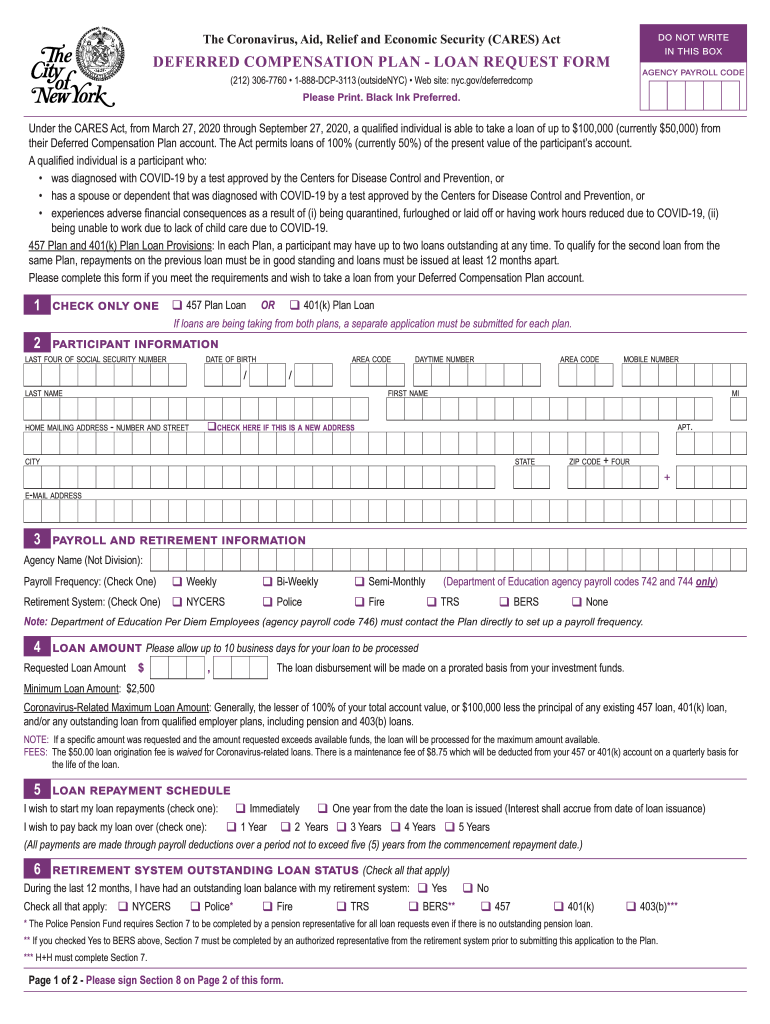

Do not write in this both Coronavirus, Aid, Relief and Economic Security (CARES) Deferred COMPENSATION PLAN LOAN REQUEST FORM agency payroll code(212) 3067760 1888DCP3113 (outside NYC) Website: nyc.gov/deferredcomp

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred compensation plan

Edit your deferred compensation plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred compensation plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred compensation plan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deferred compensation plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred compensation plan

How to fill out deferred compensation plan

01

Step 1: Review the terms and conditions of your deferred compensation plan carefully to understand the rules and regulations.

02

Step 2: Determine the percentage or amount of your salary that you wish to defer into the plan.

03

Step 3: Choose the investment options available within the plan based on your risk tolerance and long-term financial goals.

04

Step 4: Complete the necessary paperwork provided by your employer to enroll in the deferred compensation plan.

05

Step 5: Select the contribution frequency and method, such as payroll deductions, that suits your financial situation.

06

Step 6: Monitor the performance of your deferred compensation plan regularly and make adjustments as needed.

07

Step 7: Consult with a financial advisor or tax professional to understand the tax implications and any potential penalties associated with your deferred compensation plan.

08

Step 8: Take advantage of any employer matching contributions or other benefits offered as part of the plan.

09

Step 9: Review and update your deferred compensation plan periodically to align with changes in your financial circumstances or goals.

10

Step 10: Utilize the funds from your deferred compensation plan according to the regulations set forth by your employer and applicable laws.

11

Note: The exact steps may vary depending on the specific details of your deferred compensation plan and employer's policies.

Who needs deferred compensation plan?

01

High-earning individuals: Deferred compensation plans are particularly beneficial for high-earning individuals who can afford to defer a portion of their income and delay receiving it until retirement.

02

Executives and key employees: These individuals often have access to deferred compensation plans as part of their compensation packages.

03

Individuals nearing retirement: Deferred compensation plans can provide an additional source of income during retirement years, offering financial stability and flexibility.

04

Professionals with seasonal income: Those who earn income in a specific season or have irregular earning patterns can utilize deferred compensation plans to manage cash flow effectively.

05

Employees looking for tax advantages: Deferred compensation plans can offer tax advantages by deferring income to a later date when tax rates may be lower.

06

Individuals with long-term financial goals: The ability to defer income and potentially earn investment returns within a deferred compensation plan can help individuals achieve their long-term financial goals.

07

Note: It is important to consult with a financial advisor or tax professional to determine if a deferred compensation plan is suitable for your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the deferred compensation plan form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign deferred compensation plan and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out deferred compensation plan on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your deferred compensation plan from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit deferred compensation plan on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute deferred compensation plan from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is deferred compensation plan?

A deferred compensation plan is a savings and investment tool that allows employees to set aside a portion of their income for retirement or other financial goals, with the funds being distributed at a later date.

Who is required to file deferred compensation plan?

Employers are typically responsible for setting up and administering deferred compensation plans for their employees.

How to fill out deferred compensation plan?

Employees can typically enroll in a deferred compensation plan through their employer's HR department or benefits portal.

What is the purpose of deferred compensation plan?

The purpose of a deferred compensation plan is to help employees save for retirement and other financial goals in a tax-advantaged way.

What information must be reported on deferred compensation plan?

Deferred compensation plans typically require information such as the employee's contribution amount, investment selections, and distribution options.

Fill out your deferred compensation plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Compensation Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.