Get the free Under section S01(c), 527, or 49471aK11 of the Internal Revenue Code (except private...

Show details

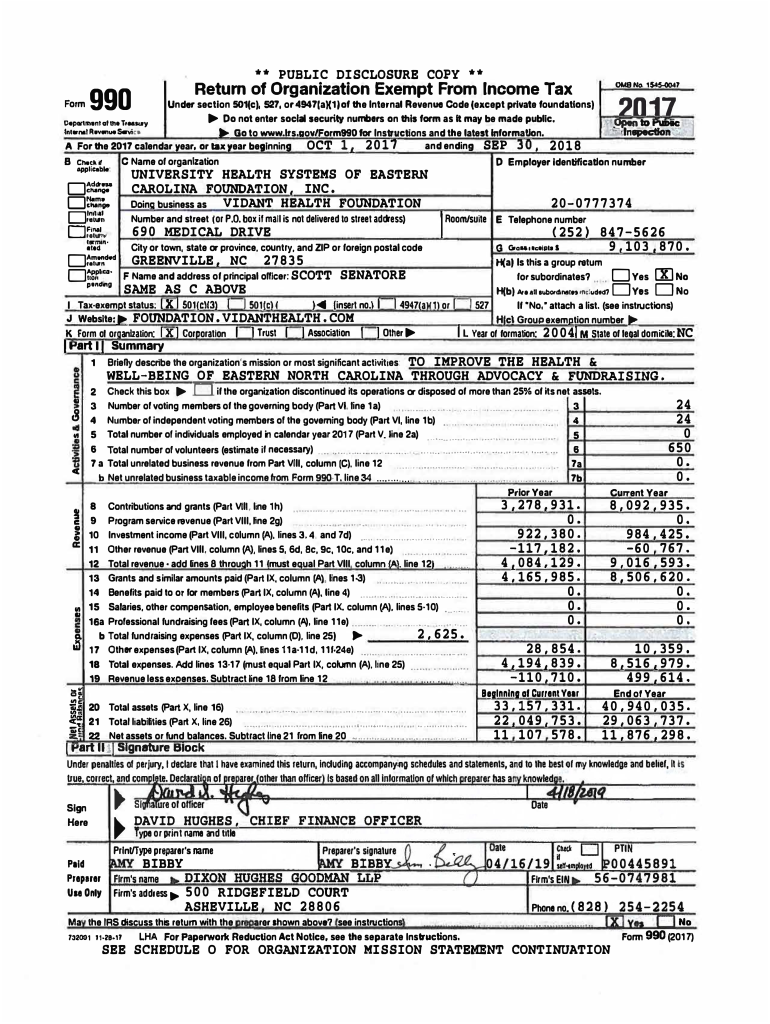

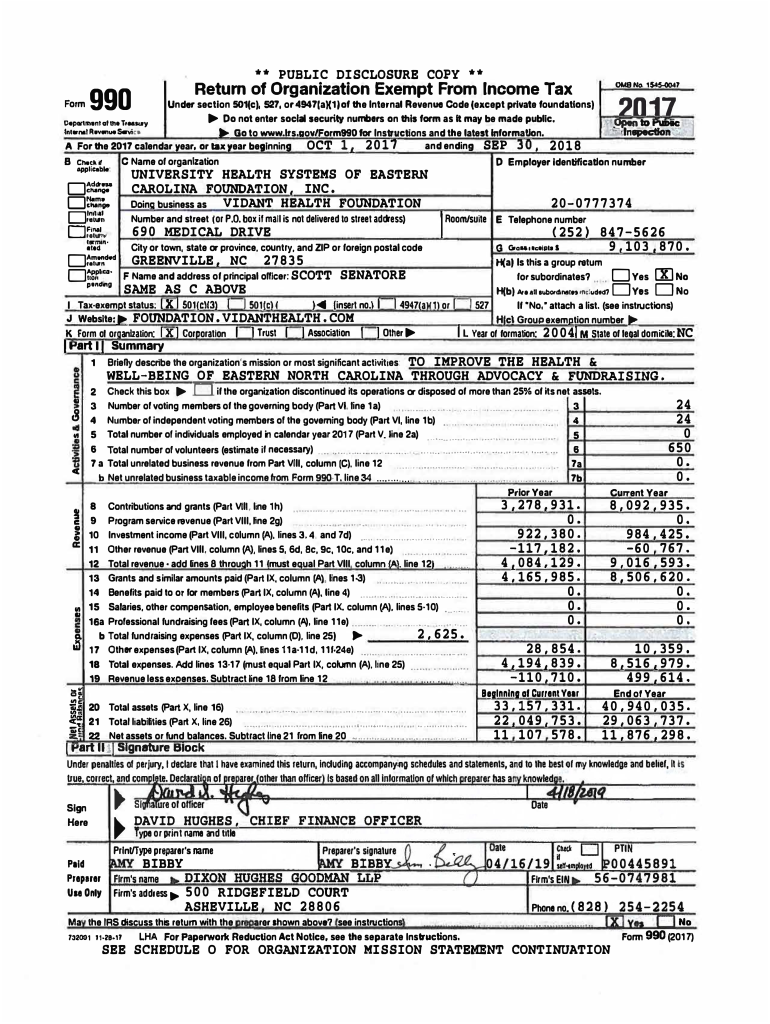

** PUBLIC DISCLOSURE COPY **990FormReturn of Organization Exempt From Income Tax0MB No. 15450047?017Under section S01(c), 527, or 49471aK11 of the Internal Revenue Code (except private foundations)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign under section s01c 527

Edit your under section s01c 527 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your under section s01c 527 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit under section s01c 527 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit under section s01c 527. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out under section s01c 527

How to fill out under section s01c 527

01

To fill out under section s01c 527, follow these steps:

02

Begin by reading the instructions provided for filling out section s01c 527. These instructions should be included with the form.

03

Gather all the necessary information and documents that will be required to complete the section. This may include identification details, financial information, and any supporting documentation.

04

Carefully review each question or prompt within section s01c 527 and provide accurate and complete responses. Ensure that the information provided is legible and easy to understand.

05

If any sections or questions are not applicable to your situation, indicate so clearly on the form. It is important to only provide information that is relevant and applicable.

06

Double-check all the information entered in section s01c 527 to ensure accuracy. Review for any errors or missing details. It may be helpful to have someone else review the form as well for an additional perspective.

07

Once you are confident that the section has been filled out accurately, sign and date the form as required. Follow any additional submission instructions provided.

08

Make a copy of the completed form and any supporting documentation for your records before submitting it.

09

Submit the completed section s01c 527 in accordance with the specified submission method. This may include mailing it to a designated address or submitting it electronically through an online portal.

10

If you have any doubts or questions while filling out the form, seek assistance from a professional, such as a tax advisor or legal expert, who can provide guidance based on your specific situation.

Who needs under section s01c 527?

01

Under section s01c 527 of the relevant law or regulation, those who may need to fill it out include:

02

- Individuals or entities seeking to declare certain tax-exempt status or eligibility for tax benefits.

03

- Organizations or associations engaged in specified activities or operations that fall under the purview of section s01c 527.

04

- Individuals or entities required to provide specific information or disclosures related to their financial or operational activities.

05

It is important to consult the applicable law or regulation and any accompanying guidance or instructions to determine if section s01c 527 applies to your particular situation. If in doubt, seeking advice from a tax professional or legal counsel is recommended.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my under section s01c 527 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your under section s01c 527 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for signing my under section s01c 527 in Gmail?

Create your eSignature using pdfFiller and then eSign your under section s01c 527 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the under section s01c 527 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign under section s01c 527 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is under section s01c 527?

Under section 527, organizations known as 527 groups are tax-exempt organizations that are involved in influencing the selection, nomination, election, appointment, or defeat of candidates for public office.

Who is required to file under section s01c 527?

Organizations that meet the criteria set forth in section 527 of the Internal Revenue Code are required to file under this section.

How to fill out under section s01c 527?

To fill out under section 527, organizations must report their financial activities including contributions, expenditures, and other relevant information using Form 8871 and Form 8872.

What is the purpose of under section s01c 527?

The purpose of section 527 is to provide transparency and regulation for organizations that engage in political activities and attempt to influence the outcome of elections.

What information must be reported on under section s01c 527?

Information such as the organization's name and contact information, details of contributions received, expenditures made, and other relevant financial transactions must be reported under section 527.

Fill out your under section s01c 527 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Under Section s01c 527 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.