Get the free Low Income Housing Tax Credit Project History Form - phfa

Show details

Este formulario debe ser completado y enviado a PHFA cuando sus edificios se hayan puesto en servicio. Este formulario solo necesita completarse una vez, a menos que sea necesaria una revisión. Debe

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low income housing tax

Edit your low income housing tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low income housing tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low income housing tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit low income housing tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

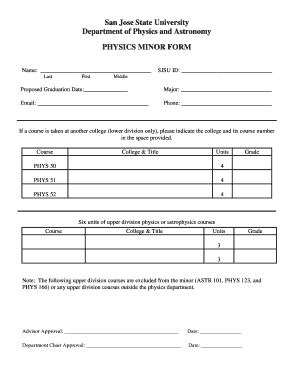

How to fill out low income housing tax

How to fill out Low Income Housing Tax Credit Project History Form

01

Start by gathering all necessary documentation related to the project, including financial statements and project development history.

02

Fill in the project name and address in the designated fields.

03

Provide details about the developers, including their contact information and history of previous projects.

04

List the funding sources used for the project, indicating whether they are public or private.

05

Complete the section regarding compliance with Low Income Housing Tax Credit (LIHTC) program requirements.

06

Include a timeline of the project, highlighting key milestones such as acquisition, construction start, and completion dates.

07

Make sure to provide information on the project's target population and the number of units designated for low-income residents.

08

Review the completed form for accuracy and completeness before submission.

Who needs Low Income Housing Tax Credit Project History Form?

01

Developers of low-income housing projects seeking tax credits.

02

Investors interested in financing low-income housing developments.

03

Housing authorities and agencies that manage or allocate LIHTC funds.

04

Non-profit organizations involved in affordable housing initiatives.

Fill

form

: Try Risk Free

People Also Ask about

What is the history of the low-income housing tax credit?

The low-income housing tax credit (LIHTC) program, created in 1986 and made permanent in 1993, is an indirect federal subsidy used to finance the construction and rehabilitation of low-income affordable rental housing.

What is a form 8609?

Purpose of Form Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. A separate Form 8609 must be issued for each building in a multiple building project. Form 8609 is also used to certify certain information.

What is the meaning of recapture of low-income housing credit?

The LIHTC gives investors a dollar-for-dollar reduction in their federal tax liability in exchange for providing financing to develop affordable rental housing. Investors' equity contribution subsidizes low-income housing development, thus allowing some units to rent at below-market rates.

What is the maximum income for low-income housing?

Eligible basis is a component of the qualified basis of an LIHC project. It is generally equal to the adjusted basis of the building, excluding land but including amenities and common areas. An existing building is a building that has been previously placed in service.

Who does the low-income housing tax credit give federal income taxes to?

The Low-Income Housing Tax Credit provides a tax incentive to construct or rehabilitate affordable rental housing for low-income households. The Low-Income Housing Tax Credit (LIHTC) subsidizes the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants.

What is the eligible basis for the low income housing tax credit?

Conditions for recapture of the credit And, the building must continue to meet certification requirements. If not, the owner may have to recapture a portion of the credit allocation using Form 8611, Recapture of Low-Income Housing Credit. Recapture refers to adding back income that a credit previously reduced.

What is the form 8586 for low-income housing credit?

Use Form 8586 to claim the low-income housing credit. This general business credit is allowed for each new qualified low-income building placed in service after 1986. Generally, it is taken over a 10-year credit period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Low Income Housing Tax Credit Project History Form?

The Low Income Housing Tax Credit Project History Form is a document used to track and report the history and status of projects that receive funding through the Low Income Housing Tax Credit (LIHTC) program.

Who is required to file Low Income Housing Tax Credit Project History Form?

Developers, owners, and operators of projects that have received LIHTC allocations are required to file the Low Income Housing Tax Credit Project History Form.

How to fill out Low Income Housing Tax Credit Project History Form?

To fill out the form, individuals must provide detailed information about the project including its history, ownership, financing, and compliance with LIHTC regulations. Each section of the form must be completed accurately and submitted according to state guidelines.

What is the purpose of Low Income Housing Tax Credit Project History Form?

The purpose of the form is to ensure accountability and transparency in the utilization of tax credits for low-income housing, making it easier for regulatory agencies to monitor compliance and assess the impact of the LIHTC program.

What information must be reported on Low Income Housing Tax Credit Project History Form?

Information that must be reported includes project identification, history of ownership, changes in financing, occupancy rates, compliance with LIHTC requirements, and any significant developments related to the project.

Fill out your low income housing tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Income Housing Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.