IRS 5498-ESA 2020 free printable template

Show details

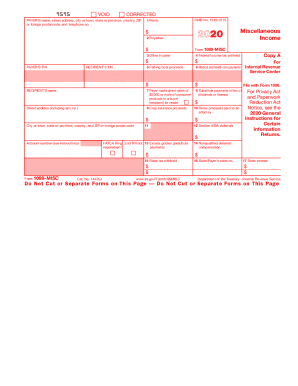

Copy C For Trustee and Paperwork Reduction Act Certain To complete Form 5498-ESA use Returns and the 2018 Instructions for Form 5498-ESA. Form 5498-ESA reports 2018. For more information about Coverdell ESAs see Pub. 970. Beneficiary s taxpayer identification number TIN. Future developments. For the latest information about developments related to Form 5498-ESA and its instructions such as legislation enacted after they were published go to www.irs.gov/Form5498ESA. VOID CORRECTED TRUSTEE S...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5498-ESA

Edit your IRS 5498-ESA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5498-ESA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 5498-ESA online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 5498-ESA. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5498-ESA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5498-ESA

How to fill out IRS 5498-ESA

01

Obtain a copy of IRS Form 5498-ESA from the IRS website or your tax preparer.

02

Identify the account holder's information, including name, address, and Taxpayer Identification Number (TIN).

03

Record the beneficiary's name, address, and TIN, if applicable.

04

Fill in the information regarding the Education Savings Account (ESA) including the account number.

05

Report contributions made to the ESA for the tax year in the appropriate box.

06

Indicate any rollovers or conversions, if applicable.

07

Declare any fair market value of the ESA at the end of the year.

08

Review for accuracy and completeness before submission.

Who needs IRS 5498-ESA?

01

Any individual or entity that has established an Education Savings Account (ESA) and made contributions during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to report form 5498 on my tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Do you report a 5498 on your taxes?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Does every IRA get a 5498?

Retirement contributions If you have an IRA but made no contributions for the year, the custodian generally won't send you a Form 5498 unless you have a required minimum distribution from the account.

Who files the form 5498 ESA?

File this form for each person for whom you maintained any Coverdell education savings account (ESA).

What do I do if I received a form 5498?

Your IRA trustee or custodian is the one responsible for mailing Form 5498 to the IRS, along with a copy to you. You don't have to do anything with the form itself. Just keep it with your tax records.

What is a 5498 ESA?

What is a 5498-ESA (Education Savings Account)? Form 5498-ESA reports the education savings account contributions or rollovers that were made throughout the year. You do not need to enter this form in your tax return.

Does form 5498 need to be reported on taxes?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Where do I report form 5498 ESA?

The 5498 ESA tax Form must be filed by the custodian or trustee of the account. This is the entity that issued the account and oversees the account over the years. This form has two copies, Copy A must be sent to the IRS and Copy B must be distributed to the beneficiary.

Do you have to put form 5498 on tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Does form 5498 need to be reported?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Where does form 5498 IRA go on tax return?

Form 5498 IRA Contribution Information is information for your personal records and is not required to prepare your tax return. Taxpayers should retain this information for their personal records, but there are no tax consequences to the taxpayer until the funds are distributed from the account.

Do I need to report 5498 to IRS?

Form 5498 is for informational purposes only. You are not required to file it with your tax return. This form is not posted until May because you can contribute to an IRA for the previous year through mid-April. This means you will have finished your taxes before you receive this form.

What is form 5498 or 5498 ESA?

Form 5498-ESA is used to report contributions and rollovers made to a Coverdell Education Savings Account for a given tax year. Find more information about Coverdell Education Savings Accounts.

What is a form 5498 used for?

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any catch-up contributions, required minimum distributions (RMDs), and the fair market value (FMV) of the account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 5498-ESA for eSignature?

When you're ready to share your IRS 5498-ESA, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete IRS 5498-ESA online?

Easy online IRS 5498-ESA completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit IRS 5498-ESA on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign IRS 5498-ESA on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IRS 5498-ESA?

IRS 5498-ESA is a tax form used to report contributions to Education Savings Accounts (ESAs). It provides information to the IRS about the amount contributed to a child's ESA during the tax year.

Who is required to file IRS 5498-ESA?

The trustee or issuer of the Education Savings Account is required to file IRS 5498-ESA. This includes banks, custodians, or other financial institutions managing the ESA.

How to fill out IRS 5498-ESA?

To fill out IRS 5498-ESA, the filer must enter information about the account owner, the beneficiary, and the total contributions made during the tax year, including rollovers and any fair market value of the account.

What is the purpose of IRS 5498-ESA?

The purpose of IRS 5498-ESA is to inform the IRS about the amounts contributed to an ESA, ensuring that taxpayers comply with contribution limits and rules associated with these accounts.

What information must be reported on IRS 5498-ESA?

IRS 5498-ESA must report the account owner's name, Social Security number, the beneficiary's name and Social Security number, total contributions made during the year, and the fair market value of the account as of December 31.

Fill out your IRS 5498-ESA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5498-ESA is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.