Get the free Cross border tax, back year filing, FBAR reporting, gillian ...

Show details

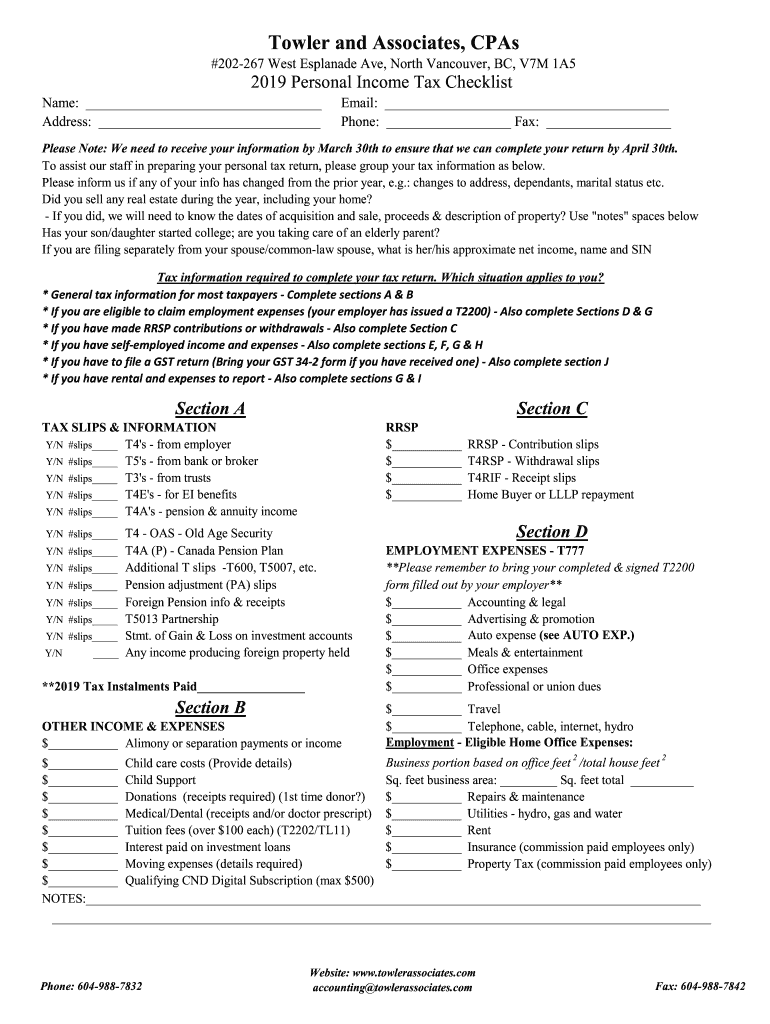

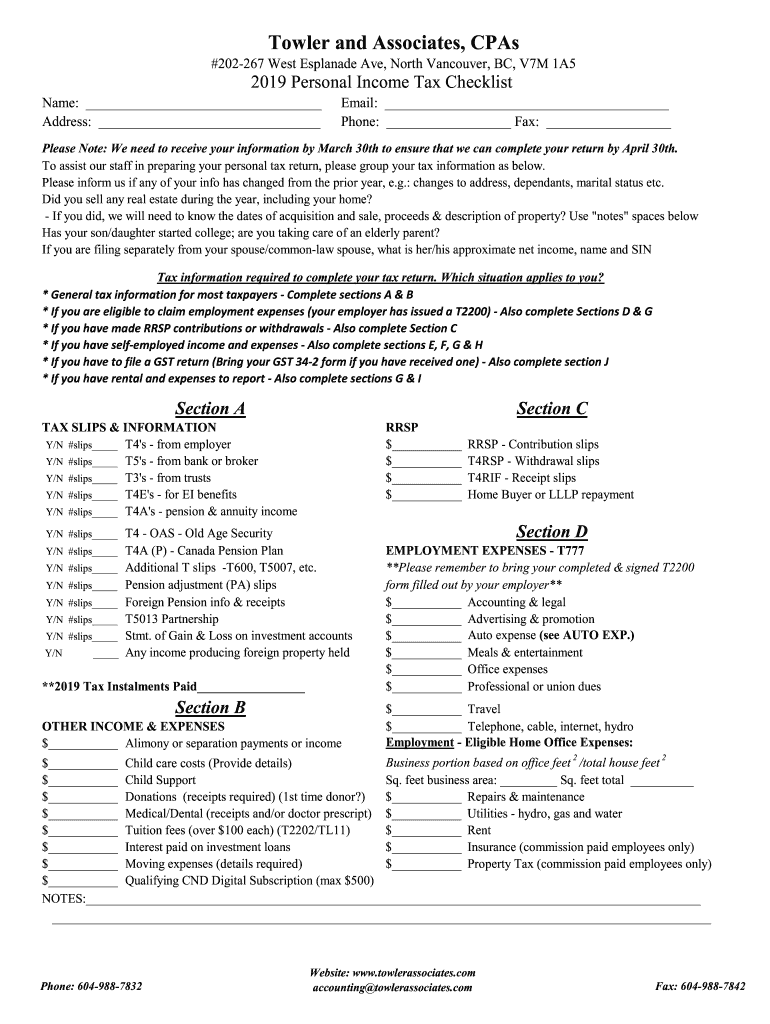

Tower and Associates, CPA's #202267 West Esplanade Ave, North Vancouver, BC, V7M 1A52019 Personal Income Tax Checklist Name: Address: Email: Phone: Fax: Please Note: We need to receive your information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cross border tax back

Edit your cross border tax back form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cross border tax back form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cross border tax back online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cross border tax back. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cross border tax back

How to fill out cross border tax back

01

Gather all the necessary documents such as your passport, purchase receipts, and travel itinerary.

02

Determine the eligible tax refund items, which usually include goods purchased for personal use and not for resale.

03

Research and find a reputable tax refund service or agency that offers cross-border tax back services.

04

Complete the tax refund application form provided by the tax refund service.

05

Attach all the required documents to the application form, ensuring they are readable and accurate.

06

Submit the completed application form and documents to the tax refund service either online or by mail.

07

Wait for the tax refund service to process your application and verify the provided information.

08

Once approved, the tax refund service will either send you the refund directly or provide instructions for collection.

09

Follow any additional instructions provided by the tax refund service to receive your cross-border tax back.

10

Keep a copy of all the submitted documents and records for future reference or potential audits.

Who needs cross border tax back?

01

Anyone who has made eligible purchases and paid taxes while traveling abroad can benefit from cross-border tax back.

02

Tourists, business travelers, and international shoppers can reclaim some of the value-added tax (VAT) they paid on goods purchased overseas.

03

Individuals who frequently travel across borders and make significant purchases can maximize their savings by utilizing cross-border tax back services.

04

Cross-border tax back is especially beneficial for those who travel to countries with high VAT rates or engage in tax-free shopping.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in cross border tax back?

The editing procedure is simple with pdfFiller. Open your cross border tax back in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out cross border tax back on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your cross border tax back by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete cross border tax back on an Android device?

On an Android device, use the pdfFiller mobile app to finish your cross border tax back. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is cross border tax back?

Cross border tax back refers to the process of reclaiming taxes paid on income or transactions in a foreign country.

Who is required to file cross border tax back?

Individuals or companies who have paid taxes in a foreign country and are eligible for a tax refund may be required to file cross border tax back.

How to fill out cross border tax back?

To fill out cross border tax back, you typically need to gather documentation of taxes paid in the foreign country, complete the necessary forms, and submit the application to the relevant tax authorities.

What is the purpose of cross border tax back?

The purpose of cross border tax back is to allow individuals or companies to reclaim taxes paid in a foreign country and prevent double taxation on the same income or transaction.

What information must be reported on cross border tax back?

Information such as details of taxes paid in the foreign country, proof of tax residency, and supporting documentation of income or transactions may need to be reported on cross border tax back.

Fill out your cross border tax back online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cross Border Tax Back is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.