AU SA332a 2007 free printable template

Show details

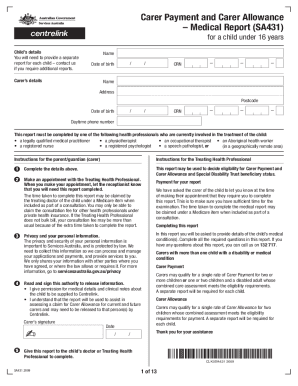

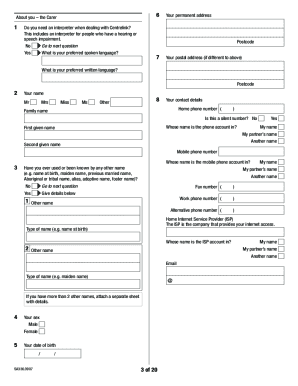

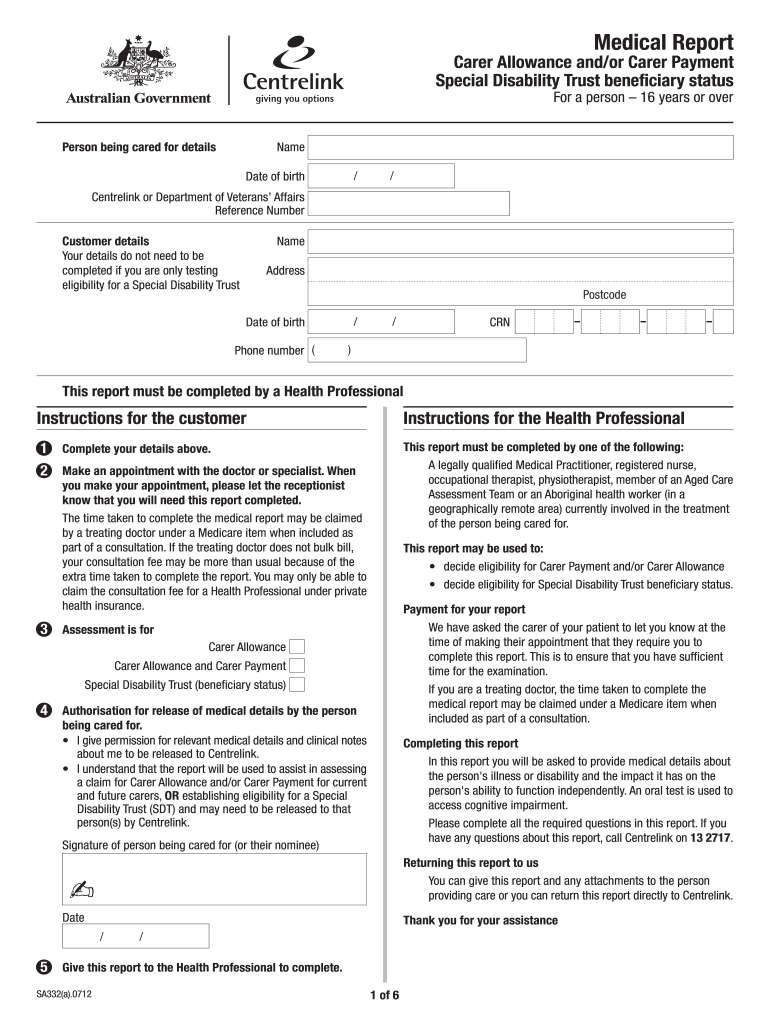

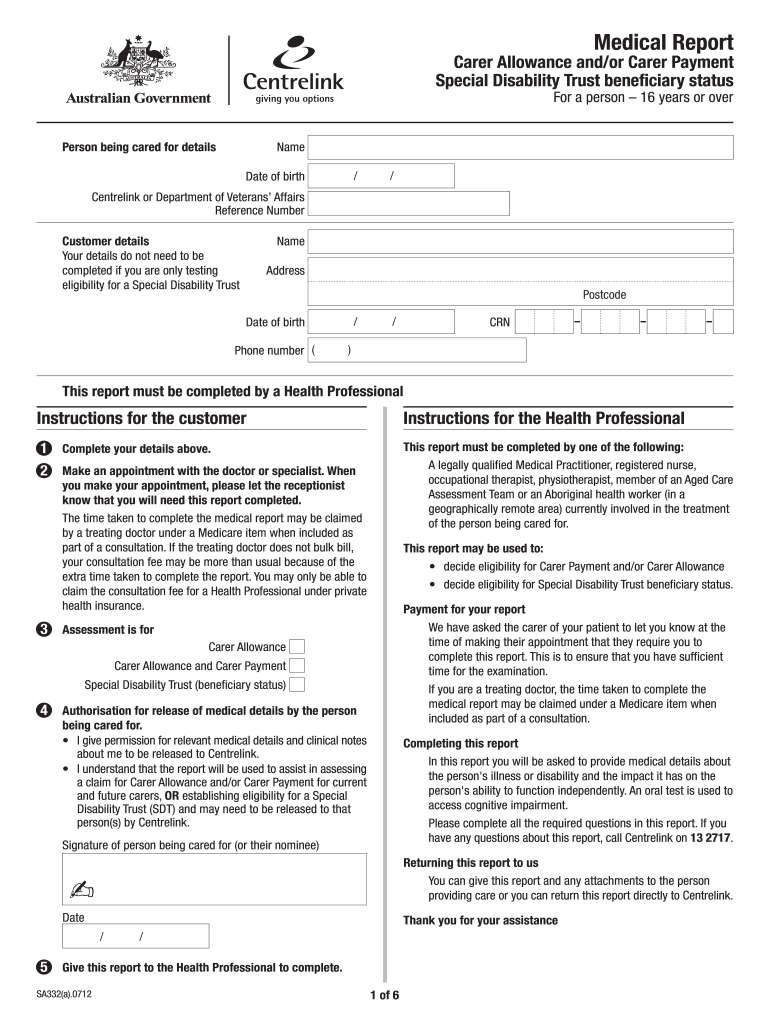

Medical Report Carer Allowance and/or Carer Payment Special Disability Trust beneficiary status For a person 16 years or over Person being cared for details Name / Date of birth / Centrelink or Department

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU SA332a

Edit your AU SA332a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU SA332a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU SA332a online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU SA332a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SA332a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU SA332a

How to fill out AU SA332a

01

Begin with your personal details including your name, address, and Social Security number.

02

Indicate the period for which you are filing the AU SA332a.

03

Provide information regarding your income sources and amounts during the specified period.

04

Fill out sections regarding any deductions or credits you are claiming.

05

Ensure to attach any required documentation that supports the information provided.

06

Review all entries for accuracy before signing the form.

07

Submit the form to the appropriate agency as instructed in the guidelines.

Who needs AU SA332a?

01

Individuals who are applying for certain types of assistance or benefits.

02

Anyone who needs to report income or changes in their financial situation.

03

Persons seeking to claim deductions or credits on their financial statements.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between carer Payment and carer Allowance?

Carer Payment, an income support payment if you give constant care to someone who has a disability, has a severe medical condition, or is an adult who is frail aged. Carer Allowance, a fortnightly supplement if you give additional daily care to someone who has a disability, has a medical condition, or is frail aged.

How long does carers Allowance take?

It usually takes between three and six weeks to receive your Carer's Allowance decision. But we're hearing from our community of carers that backlog of claims means it can take between 12 to 15 weeks. “Give them a call a few days after you have sent off your application!

What form do I need to claim carers allowance?

P45 if you've recently finished work. course details if you're studying. details of any expenses, for example pension contributions or the cost of caring for your children or the disabled person while you're at work.

Can I be a paid carer for a family member?

If you're undertaking caring responsibilities or providing support to your family member, you're a carer. To be considered for income support as a carer, you need to be providing more than 35 hours a week of full-time support or care for your loved one.

What documents do I need to send for carers allowance?

Before you apply make sure you have your: National Insurance number (if you have a partner you'll need theirs too) bank or building society details (unless you get your State Pension) employment details and latest payslip if you're working. P45 if you've recently finished work. course details if you're studying.

How do I claim 500 for carers?

Employee claim form If you wish to make a claim for a £500 payment you must have been employed in a qualifying role between 15 March 2020 and 31 May 2020. If you are eligible you should sign and return the declaration at the bottom of this form.

What is a SA332A form?

Carer Payment and/or Carer Allowance Medical Report for a person 16 years or over form (SA332A) Use this form as part of the assessment of eligibility for Carer Payment, Carer Allowance or Special Disability Trust beneficiary status.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AU SA332a?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific AU SA332a and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit AU SA332a on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign AU SA332a. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out AU SA332a on an Android device?

On Android, use the pdfFiller mobile app to finish your AU SA332a. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is AU SA332a?

AU SA332a is a specific form used for tax reporting and compliance purposes in Australia.

Who is required to file AU SA332a?

Entities that have reporting obligations under Australian tax laws are required to file AU SA332a.

How to fill out AU SA332a?

To fill out AU SA332a, individuals or entities must complete the relevant sections, including their identification information and any necessary financial details as per the instructions provided with the form.

What is the purpose of AU SA332a?

The purpose of AU SA332a is to ensure that entities fulfill their tax reporting responsibilities accurately and in a timely manner.

What information must be reported on AU SA332a?

The information that must be reported on AU SA332a includes financial transactions, entity identification details, and specific tax-related information as required by the Australian Taxation Office.

Fill out your AU SA332a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU sa332a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.