Get the free . Business Loan Application

Show details

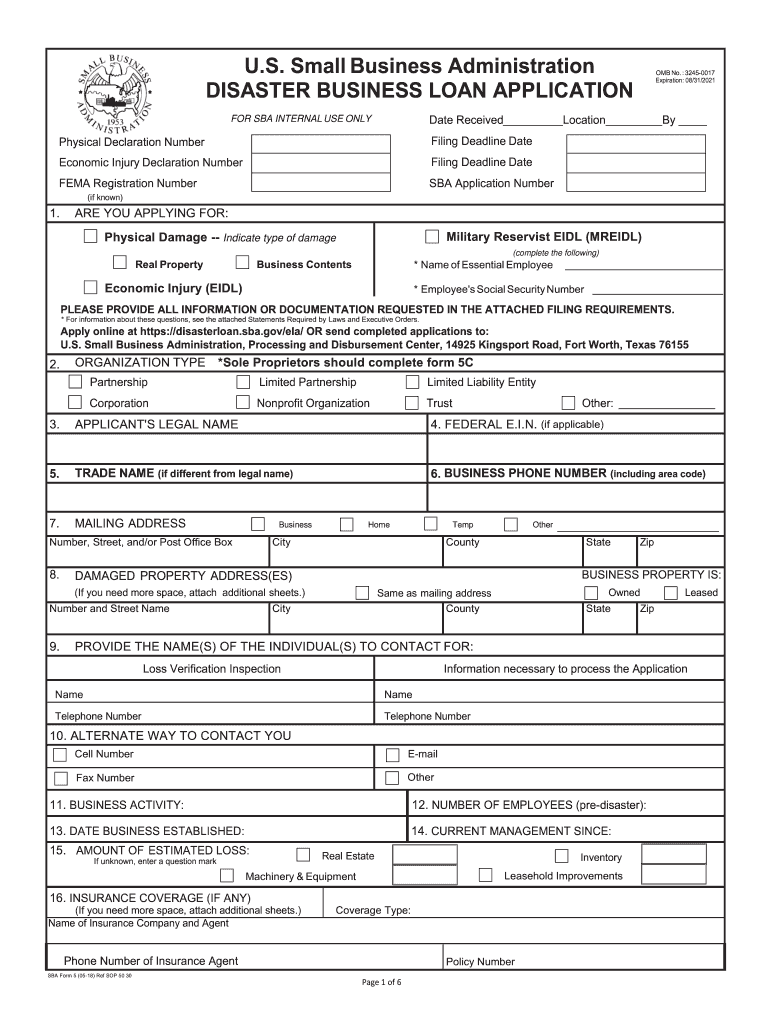

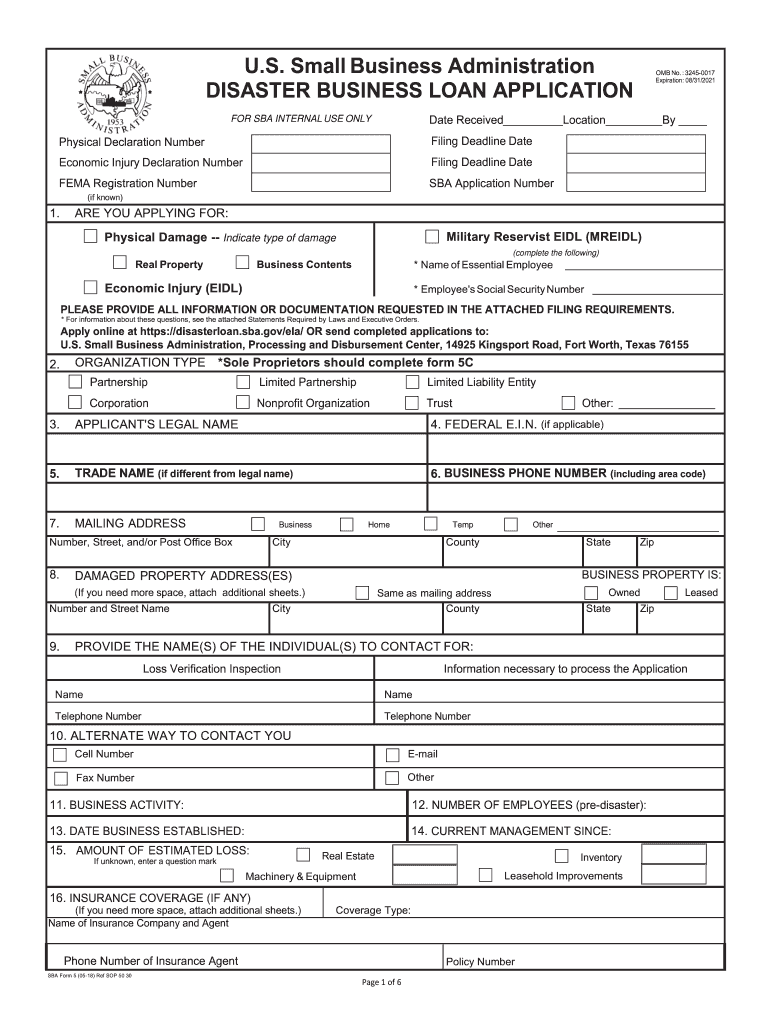

8S. Small Business Administration DISASTER BUSINESS LOAN APPLICATION Date Received SBA INTERNALUSEONLYOMB No. 32450017 Expiration: 08/31/2021LocationPhysical Declaration Numbering DeadlineDateEconomicInjury

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application

Edit your business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business loan application online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business loan application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan application

How to fill out business loan application

01

Step 1: Gather all necessary documents and information, such as financial statements, business plan, personal identification, and credit history.

02

Step 2: Research and choose a suitable lender or financial institution that offers business loans.

03

Step 3: Review the loan application form and understand the requirements and terms.

04

Step 4: Fill out the application form accurately and completely. Provide detailed information about your business, its structure, activities, and financial projections.

05

Step 5: Attach the required documents to support your application, such as financial statements, bank statements, tax returns, and collateral information.

06

Step 6: Double-check all the provided information and ensure its accuracy.

07

Step 7: Submit the completed application form and supporting documents to the lender according to their specified submission method, which can be online or in person.

08

Step 8: Wait for the lender's response and be prepared for additional documentation or inquiries if needed.

09

Step 9: Review and analyze the loan offers received from different lenders, considering factors like interest rates, repayment terms, and fees.

10

Step 10: Once you select a suitable loan offer, submit any required documents requested by the lender to proceed with the loan disbursement.

11

Step 11: Upon approval, carefully review the loan agreement and ensure you understand all terms and conditions before signing.

12

Step 12: Fulfill any additional requirements from the lender, such as providing insurance, additional collateral, or other necessary documentation.

13

Step 13: Receive the loan funds into your business account.

14

Step 14: Keep track of repayment dates and make timely payments on the loan according to the agreed terms.

15

Step 15: Monitor your business's financial health and seek professional advice if needed to ensure successful loan repayment.

Who needs business loan application?

01

Anyone who runs a business and requires financial assistance can benefit from a business loan application. This includes small business owners, entrepreneurs, startups, and even established companies.

02

Individuals who need funds to start a new venture, expand an existing business, purchase equipment or inventory, cover operational costs, or invest in business growth often rely on business loan applications.

03

Business owners facing temporary cash flow challenges or opportunities that require additional capital also need to fill out business loan applications.

04

Regardless of the industry or sector, as long as there is a need for funding to support business goals and objectives, a business loan application becomes essential.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business loan application directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your business loan application and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send business loan application for eSignature?

Once you are ready to share your business loan application, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in business loan application?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your business loan application and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is business loan application?

Business loan application is a formal request for financial assistance from a lending institution for business-related expenses.

Who is required to file business loan application?

Any individual or business entity seeking financial assistance for business purposes is required to file a business loan application.

How to fill out business loan application?

To fill out a business loan application, one must provide personal and business financial information, details about the business, and the purpose of the loan.

What is the purpose of business loan application?

The purpose of a business loan application is to request funding to support business operations, expansion, or other business-related needs.

What information must be reported on business loan application?

Information such as personal and business financial details, business plan, purpose of the loan, and collateral may need to be reported on a business loan application.

Fill out your business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.