UK P11D WS2 2020 free printable template

Show details

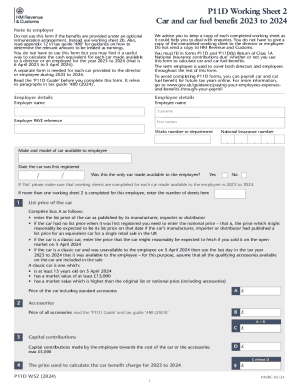

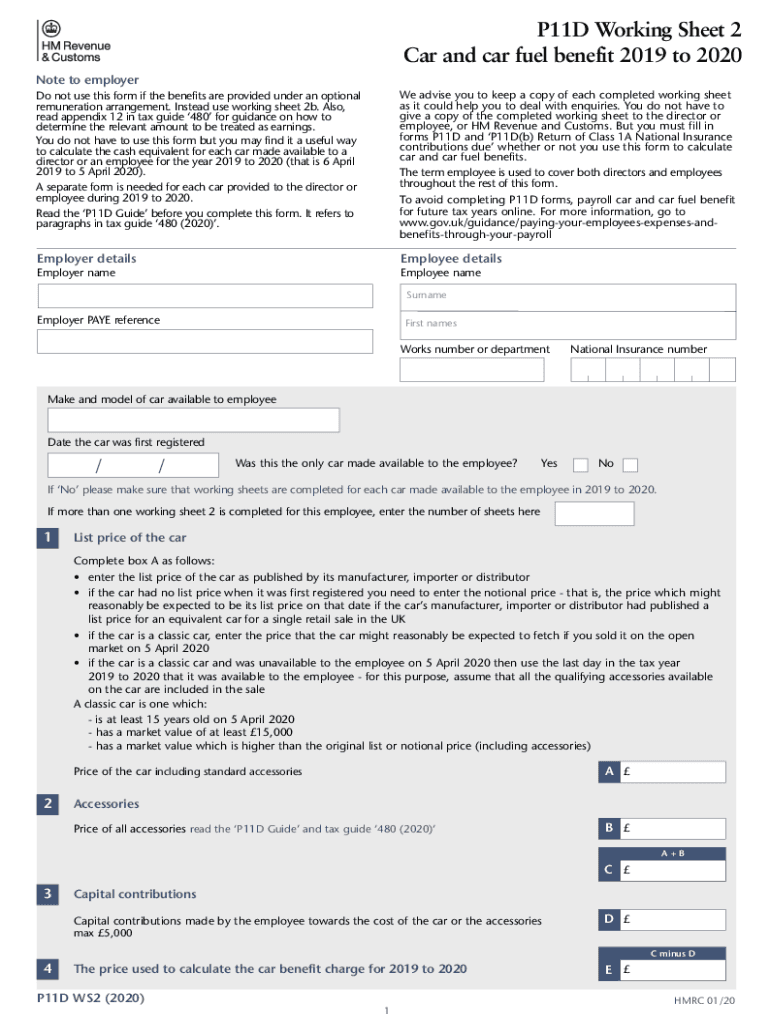

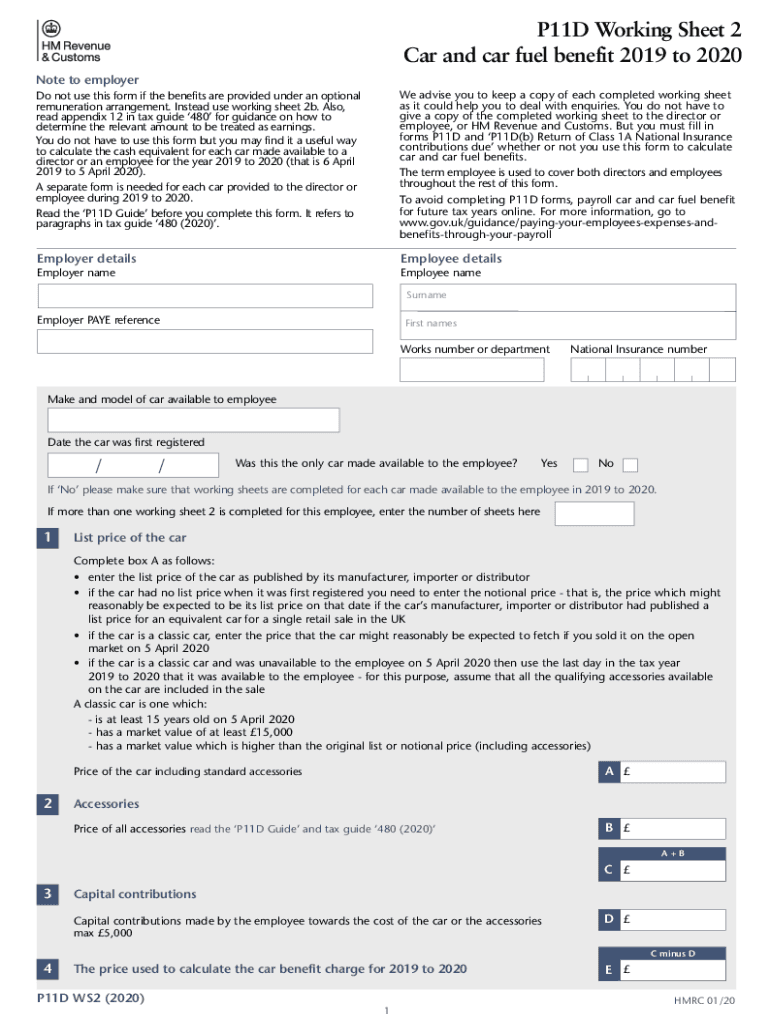

P11D Working Sheet 2

Car and car fuel benefit 2019 to 2020

Note to employer

Do not use this form if the benefits are provided under an optional

remuneration arrangement. Instead, use working sheet

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK P11D WS2

Edit your UK P11D WS2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK P11D WS2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK P11D WS2 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK P11D WS2. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK P11D WS2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK P11D WS2

How to fill out UK P11D WS2

01

Gather all necessary information including employee details and benefits provided.

02

Access the UK P11D WS2 form from the official HMRC website.

03

Fill in the employee's name, address, and National Insurance number at the top of the form.

04

List all benefits and expenses provided to the employee in the corresponding sections.

05

Calculate the cash equivalent of each benefit and enter the amount in the provided fields.

06

Ensure all calculations are accurate and double-check entries for any errors.

07

Sign and date the completed form, certifying that the information is correct.

08

Submit the form to HMRC by the specified deadline, either online or via post.

Who needs UK P11D WS2?

01

Employers in the UK who provide benefits or expenses to their employees need to complete the UK P11D WS2.

02

This includes companies, organizations, and non-profit entities that offer taxable benefits to staff.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit UK P11D WS2 online?

With pdfFiller, the editing process is straightforward. Open your UK P11D WS2 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit UK P11D WS2 in Chrome?

Install the pdfFiller Google Chrome Extension to edit UK P11D WS2 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete UK P11D WS2 on an Android device?

Complete your UK P11D WS2 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is UK P11D WS2?

UK P11D WS2 is a form used by employers in the United Kingdom to report expenses and benefits provided to employees that are not included in their salary.

Who is required to file UK P11D WS2?

Employers who provide taxable benefits or expenses to their employees must file UK P11D WS2.

How to fill out UK P11D WS2?

To fill out UK P11D WS2, employers need to provide details of the benefits and expenses, including their values, and submit the completed form to HM Revenue and Customs (HMRC).

What is the purpose of UK P11D WS2?

The purpose of UK P11D WS2 is to ensure that employers report all non-salary benefits and expenses provided to employees for tax purposes, helping HMRC assess the tax liability.

What information must be reported on UK P11D WS2?

Information that must be reported on UK P11D WS2 includes details of the employee, type of benefit or expense, its value, and any amounts reimbursed by the employee.

Fill out your UK P11D WS2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK p11d ws2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.