Canada T1032 E 2013 free printable template

Show details

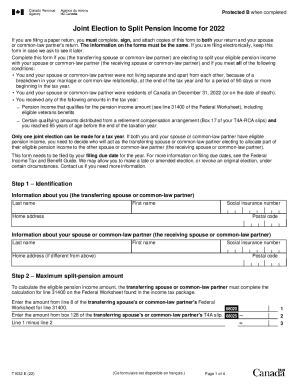

Clear Data Help Joint Election to Split Pension Income for 2013 Protected B when completed Complete this form if you (the pensioner) are electing to split your eligible pension income with your spouse

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada T1032 E

Edit your Canada T1032 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1032 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T1032 E online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T1032 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1032 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1032 E

How to fill out Canada T1032 E

01

Obtain the Canada T1032 E form from the official Canada Revenue Agency (CRA) website.

02

Fill in the identification section with your name, address, and Social Insurance Number (SIN).

03

Indicate the tax year for which you are submitting the form.

04

Provide details about your income and the tax situation relevant for the form.

05

Complete the sections regarding the federal tax credit you are applying for.

06

If applicable, include information about your spouse or common-law partner.

07

Review all entries for accuracy and completeness.

08

Sign and date the form to certify that the information provided is correct.

09

Submit the completed form as per the instructions provided by the CRA, either electronically or by mail.

Who needs Canada T1032 E?

01

Individuals who wish to transfer or allocate certain tax credits or amounts to their spouse or common-law partner.

02

Taxpayers looking to optimize their income tax situation by splitting income or claiming deductions.

03

Persons who have eligible amounts (like unused tuition fees or credits) to transfer.

Fill

form

: Try Risk Free

People Also Ask about

How do I report split income?

If you both have eligible income, you'll will first need to decide who transfers the money – usually, it's transferred from the higher-income spouse to the lower-income spouse. Then, you will need to fill out the Joint Election to Split Pension Income form when filing your personal tax returns.

Who is eligible for income splitting in Canada?

For the purpose of the joint election to split pension income, the transferring spouse or common-law partner is the individual who receives eligible pension income and elects to allocate part of that income to their spouse or common-law partner (the receiving spouse or common-law partner).

What is the income splitting rule?

What is Income Splitting? Income splitting is a tax strategy used in Canada to reduce a taxpayer's overall tax bill by allocating income to lower-income family members. The idea behind income splitting is to take advantage of Canada's progressive tax system, which imposes higher tax rates on higher income levels.

What is T1032?

The transferring spouse or common-law partner and the receiving spouse or common-law partner must make a joint election on Form T1032, Joint Election to Split Pension Income. This form must be completed, signed and attached to both spouse's or common-law partner's paper returns and filed by the filing due date.

How does pension splitting work?

What is pension splitting? Pension splitting allows a spouse to give up to 50% of their eligible pension income to their spouse for tax purposes only. There is no need to cut a cheque or give cash. Pension splitting is a paper transfer done via the tax returns.

What is the best way to file taxes when married but separated?

If you are separated, you are still legally married. While you may think you should file separately, your filing status should be either: Married filing jointly (MFJ) Married filing separately (MFS)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada T1032 E on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign Canada T1032 E right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit Canada T1032 E on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Canada T1032 E. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete Canada T1032 E on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Canada T1032 E. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Canada T1032 E?

Canada T1032 E is a form used by Canadian taxpayers to designate a spouse or common-law partner to receive income or losses from the taxpayer's business, property, or other sources. It is used mainly in the context of income splitting.

Who is required to file Canada T1032 E?

Individuals who wish to allocate their income or losses to a spouse or common-law partner for tax purposes must file Canada T1032 E. This is often applicable to couples in situations where one partner earns significantly more than the other.

How to fill out Canada T1032 E?

To fill out Canada T1032 E, taxpayers must provide their personal information, details about their spouse or common-law partner, and specify the income or losses they wish to allocate. It is essential to carefully follow the instructions on the form and ensure accuracy.

What is the purpose of Canada T1032 E?

The purpose of Canada T1032 E is to allow couples to split their income or losses for tax benefits, which can lead to reduced overall tax liability and better financial outcomes for both partners.

What information must be reported on Canada T1032 E?

The information that must be reported on Canada T1032 E includes the taxpayer's name, Social Insurance Number (SIN), details of the spouse or common-law partner, the amount of income or loss being allocated, and any relevant tax years.

Fill out your Canada T1032 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1032 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.