Get the free 2012-13 Donation Form - Sierra Madre School - sierramadre pasadenausd

Show details

2012-13 Donation Form YES, I would like to support our children s education by making a gift to the Sierra Made School Annual Fund!!! Enclosed is my gift in the amount of: $$$1,000500250 ×100 Other:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-13 donation form

Edit your 2012-13 donation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-13 donation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012-13 donation form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2012-13 donation form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012-13 donation form

How to fill out a 2012-13 donation form:

01

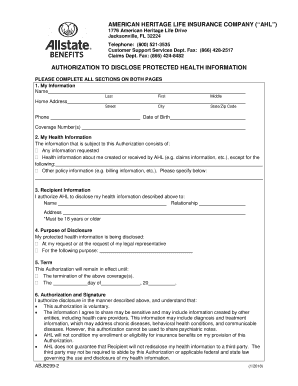

Start by gathering the necessary information. This includes your personal details such as your name, address, and contact information. Also, make sure to have the details of the organization you're donating to.

02

Determine the donation amount. Decide how much you want to contribute and make sure to enter the correct amount on the form. Include any additional information regarding the purpose of your donation if required.

03

If the donation form provides checkboxes or options, select the appropriate choice that best represents the nature of your donation. For example, if it's a one-time donation, check the box indicating so. If it's a recurring donation, provide the necessary details.

04

Review the form for accuracy. Double-check all the information you have provided, ensuring there are no mistakes or missing details. Any errors might delay the processing of your donation, so it's crucial to be thorough.

05

Once you verify the information, sign and date the form. Your signature serves as acknowledgment and consent for the donation. Make sure the date matches the day you fill out the form.

Who needs a 2012-13 donation form:

01

Individuals who want to make a charitable donation for the tax year of 2012-13 may require a 2012-13 donation form. This form helps in organizing and documenting their contribution for tax purposes.

02

Non-profit organizations that accept donations also utilize the 2012-13 donation form. By providing this form to donors, they can collect the necessary information required for their records and thank the donor appropriately.

03

Tax professionals or accountants may request their clients to fill out a 2012-13 donation form as part of their overall income tax-filing process. It helps them accurately report and claim any tax benefits associated with the charitable contribution.

Remember to consult with the relevant organization or tax professional for specific instructions on filling out the 2012-13 donation form, as requirements may vary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 13 donation form?

It is a form used to report donations made to tax exempt organizations.

Who is required to file 13 donation form?

Individuals and organizations who have made donations to tax-exempt organizations.

How to fill out 13 donation form?

You can fill out the form electronically or manually by providing information about the donation amount, recipient organization, and donor details.

What is the purpose of 13 donation form?

The purpose of the form is to report charitable donations made to tax-exempt organizations for tax purposes.

What information must be reported on 13 donation form?

Information such as the donation amount, recipient organization's details, and donor's information must be reported on the form.

How do I execute 2012-13 donation form online?

Easy online 2012-13 donation form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit 2012-13 donation form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 2012-13 donation form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit 2012-13 donation form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 2012-13 donation form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your 2012-13 donation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-13 Donation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.