OH Fixed Asset Transfer Form - Franklin County 2013-2025 free printable template

Show details

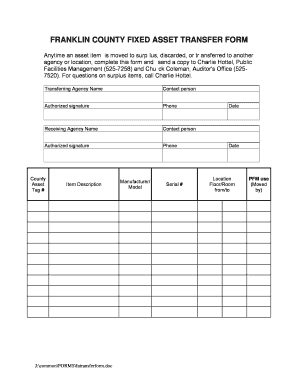

FRANKLIN COUNTY FIXED ASSET TRANSFER FORM

Anytime an asset item is moved to surplus, discarded, or transferred to another

agency or location, complete this form and send a copy to Charlie Hotel, Public

Facilities

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign franklin county fixed asset

Edit your franklin county fixed asset form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your franklin county fixed asset form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit franklin county fixed asset online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit franklin county fixed asset. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH Fixed Asset Transfer Form - Franklin County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out franklin county fixed asset

How to fill out OH Fixed Asset Transfer Form - Franklin

01

Obtain the OH Fixed Asset Transfer Form - Franklin from the appropriate department or website.

02

Fill in the date of the transfer at the top of the form.

03

Provide the name of the department transferring the asset.

04

List the description of the asset being transferred, including serial numbers if applicable.

05

Indicate the value of the asset at the time of transfer.

06

Fill in the name of the department receiving the asset.

07

Sign and date the form to acknowledge the transfer.

08

Submit the completed form to the designated office for processing.

Who needs OH Fixed Asset Transfer Form - Franklin?

01

Departments or employees who are transferring fixed assets within the organization.

02

Individuals responsible for asset management and record-keeping.

03

Finance or auditing teams that require documentation of asset transfers.

Fill

form

: Try Risk Free

People Also Ask about

Why is asset transfer form important?

Importance of an Asset Transfer Form An asset transfer form provides entire shipment details about the type of items and destination, thereby making everything transparent. The importance of an AST form in secure transport is to: Preserve business relationships. Prevent the risks of data breaches.

How do you transfer fixed assets between companies?

The transfer process itself can take the form of a contract for transfer/purchase of business assets. In the case of money transfers, these can be done as a loan or by purchasing shares in the other company, or through dividend payments if shares in the transferor company are owned by the recipient company.

What is asset transfer in finance?

An asset transfer is a movement of an item of plant and equipment from one fund/department to another using the Asset Cost Adjust/Transfers function of the ESP Assets Management System (ESP). The business unit that is receiving the asset is responsible for processing the transfer in ESP.

How do you transfer fixed assets?

This task guide will transfer the financial information for a fixed asset book from one financial dimension set to a new financial dimension set. Go to Fixed assets > Fixed assets > Fixed assets. In the list, find and select the fixed asset to transfer. On the Action Pane, click Fixed asset. Click Transfer fixed assets.

What is transfer of ownership of an asset?

What is an Asset Transfer Agreement? An asset transfer agreement is a legal document between a seller and a purchaser that outlines the terms under which the ownership of property will be transferred. Assets aren't considered legally transferred until it is written in a legal agreement and signed by both parties.

What are the steps in asset transfer?

This is a two step process: first complete, to “Final” status, a monetary transfer (transfer of funds) for the purchase of the asset, then complete a transfer of the asset.

What is the asset transfer policy?

Asset Transfer is the term used to describe the process of the transfer of the ownership (or leasehold) of property or land from one party to another.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send franklin county fixed asset for eSignature?

When you're ready to share your franklin county fixed asset, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my franklin county fixed asset in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your franklin county fixed asset and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit franklin county fixed asset on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing franklin county fixed asset.

What is OH Fixed Asset Transfer Form - Franklin?

The OH Fixed Asset Transfer Form - Franklin is a document used to officially record the transfer of fixed assets within the Franklin organization, ensuring that asset records are updated and accurate.

Who is required to file OH Fixed Asset Transfer Form - Franklin?

Employees or departments within the Franklin organization that are involved in the transfer of fixed assets must file the OH Fixed Asset Transfer Form - Franklin.

How to fill out OH Fixed Asset Transfer Form - Franklin?

To fill out the OH Fixed Asset Transfer Form - Franklin, you need to provide details such as the asset description, the current owner department, the new owner department, transfer date, and the reason for transfer, along with any necessary signatures.

What is the purpose of OH Fixed Asset Transfer Form - Franklin?

The purpose of the OH Fixed Asset Transfer Form - Franklin is to document and authorize the transfer of fixed assets, which helps maintain accurate asset tracking and accountability within the organization.

What information must be reported on OH Fixed Asset Transfer Form - Franklin?

The information that must be reported on the OH Fixed Asset Transfer Form - Franklin includes the asset identification number, description, original cost, transferor and transferee details, transfer date, and any relevant approvals.

Fill out your franklin county fixed asset online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Franklin County Fixed Asset is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.