Get the free GIFT OF EQUITY LETTER

Show details

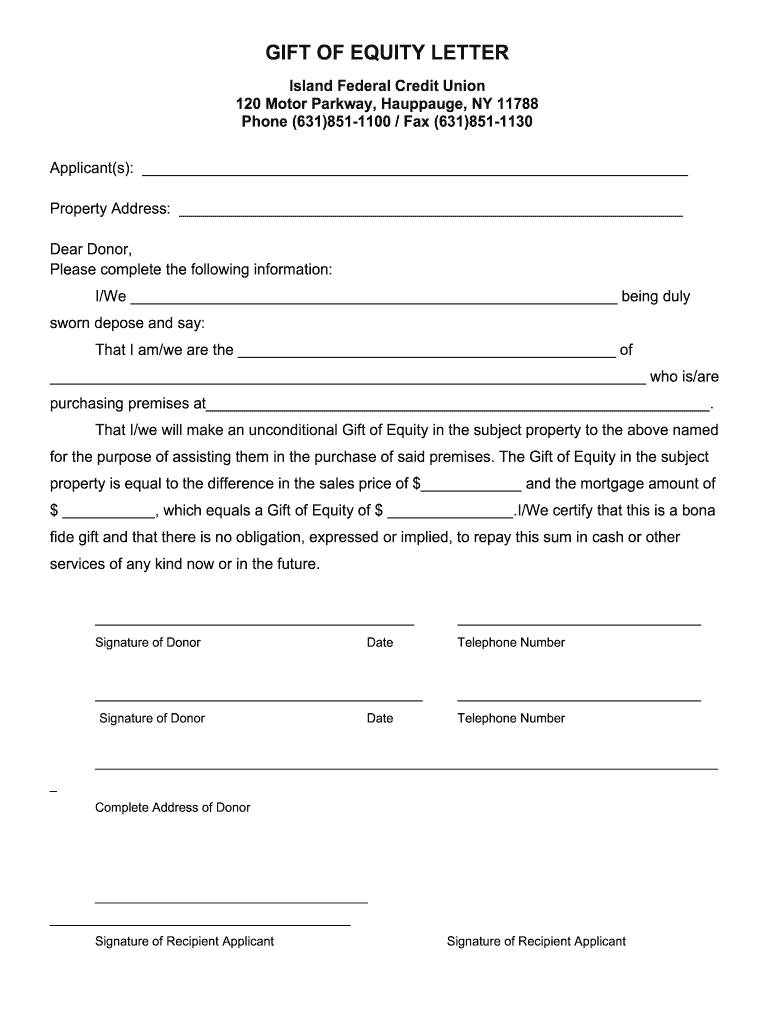

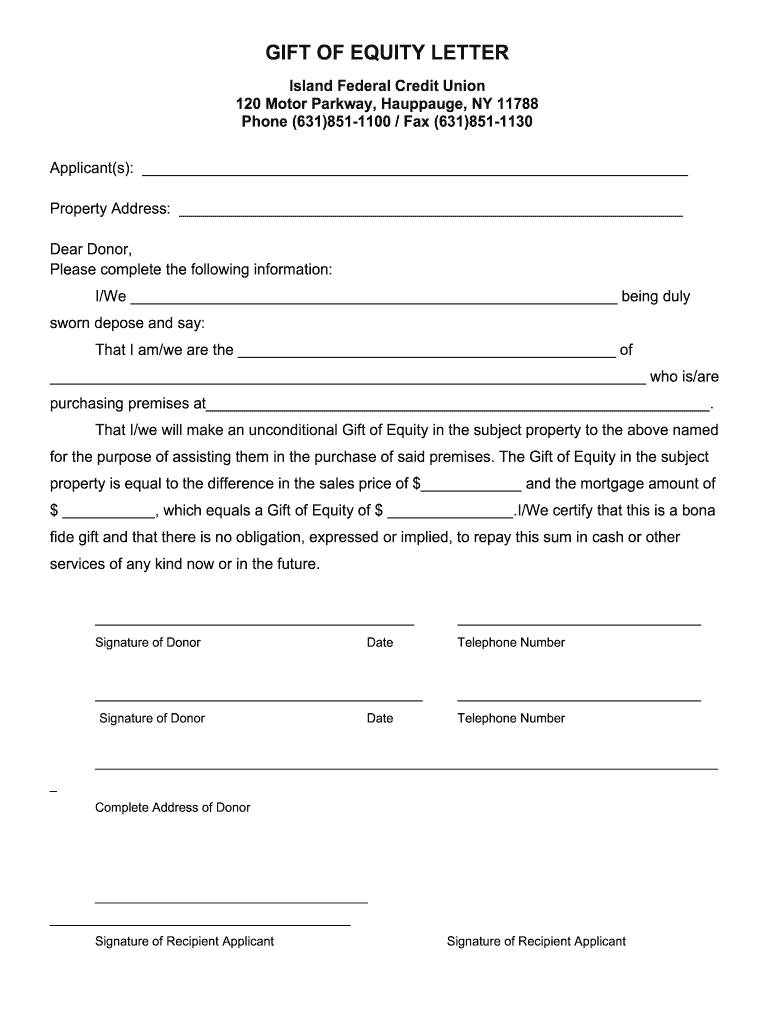

GIFT OF EQUITY LETTER Island Federal Credit Union 120 Motor Parkway, Haulage, NY 11788 Phone (631)8511100 / Fax (631)8511130 Applicant(s): Property Address: Dear Donor, Please complete the following

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift of equity letter

Edit your gift of equity letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift of equity letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift of equity letter online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gift of equity letter. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift of equity letter

How to fill out gift of equity letter

01

To fill out a gift of equity letter, follow these steps:

02

Start by addressing the letter: Begin by typing the date at the top left corner of the page. Below the date, type the name of the person or entity giving the gift of equity, followed by their address.

03

Include recipient information: On the next line, type the name of the person or entity receiving the gift of equity, along with their address.

04

Write the salutation: Begin the letter with a formal salutation, such as 'Dear [Recipient's Name],' or 'To Whom It May Concern,.'

05

State the purpose: In the opening paragraph, clearly state that the letter is intended to document the gift of equity for a particular property.

06

Provide property details: Include information about the property, such as the address and any relevant legal descriptions.

07

Explain the gift: Outline the details of the gift of equity, including the value of the gift and any conditions or expectations attached to it.

08

Acknowledge legal implications: Address any legal considerations or requirements, such as tax implications or potential impact on the recipient's eligibility for certain loans.

09

Express gratitude: Conclude the letter with a gracious closing, expressing appreciation for the opportunity to provide the gift of equity.

10

Sign and date: At the end of the letter, leave space for the giver's signature and date. It is also recommended to include printed names and contact information below the signature.

11

Notarize if necessary: Depending on local regulations or the preference of the involved parties, the gift of equity letter may need to be notarized. Check with legal professionals or relevant authorities to determine if notarization is required.

12

Remember to save a copy of the completed gift of equity letter for your records, and provide a copy to all relevant parties involved.

Who needs gift of equity letter?

01

A gift of equity letter is typically needed in real estate transactions where the buyer is receiving a gift of equity from a family member, friend, or another party. This letter serves as documentation and proof of the gift, ensuring transparency and clarity.

02

The recipient of the gift of equity, usually the buyer, may need the letter to provide to mortgage lenders, insurance companies, or other relevant entities to support their financial claims and eligibility for loans or financial assistance.

03

The person or entity giving the gift may also need the gift of equity letter to satisfy legal and financial requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gift of equity letter without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including gift of equity letter, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit gift of equity letter in Chrome?

Install the pdfFiller Google Chrome Extension to edit gift of equity letter and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit gift of equity letter on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign gift of equity letter on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is gift of equity letter?

A gift of equity letter is a document that indicates the transfer of ownership of a property for less than its fair market value, usually as a gift from a family member.

Who is required to file gift of equity letter?

The parties involved in the gift of equity transaction, such as the donor and the recipient, are generally required to file the gift of equity letter.

How to fill out gift of equity letter?

The gift of equity letter should include details about the property, the transfer of ownership, the relationship between the parties, and any conditions or restrictions associated with the gift.

What is the purpose of gift of equity letter?

The purpose of the gift of equity letter is to document the transfer of ownership of a property for less than its fair market value, often for tax or estate planning purposes.

What information must be reported on gift of equity letter?

The gift of equity letter should include information about the property, the parties involved, the relationship between the parties, the fair market value of the property, and any conditions or restrictions associated with the gift.

Fill out your gift of equity letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Of Equity Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.