Get the free ANNUAL AUDITED REiORT

Show details

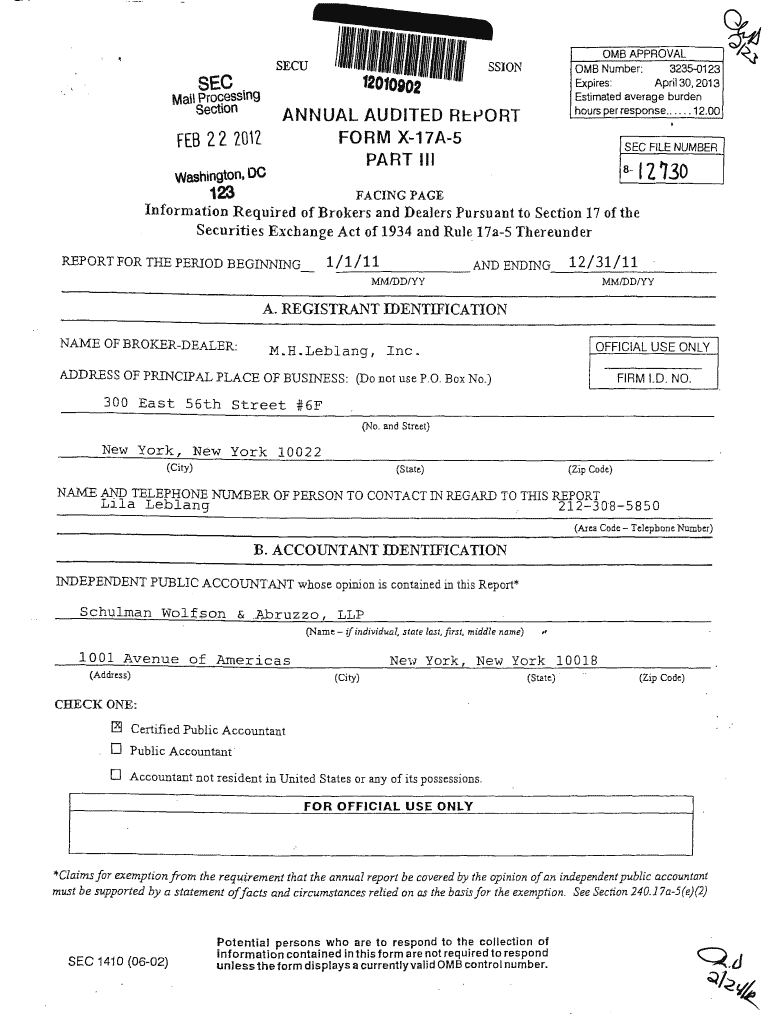

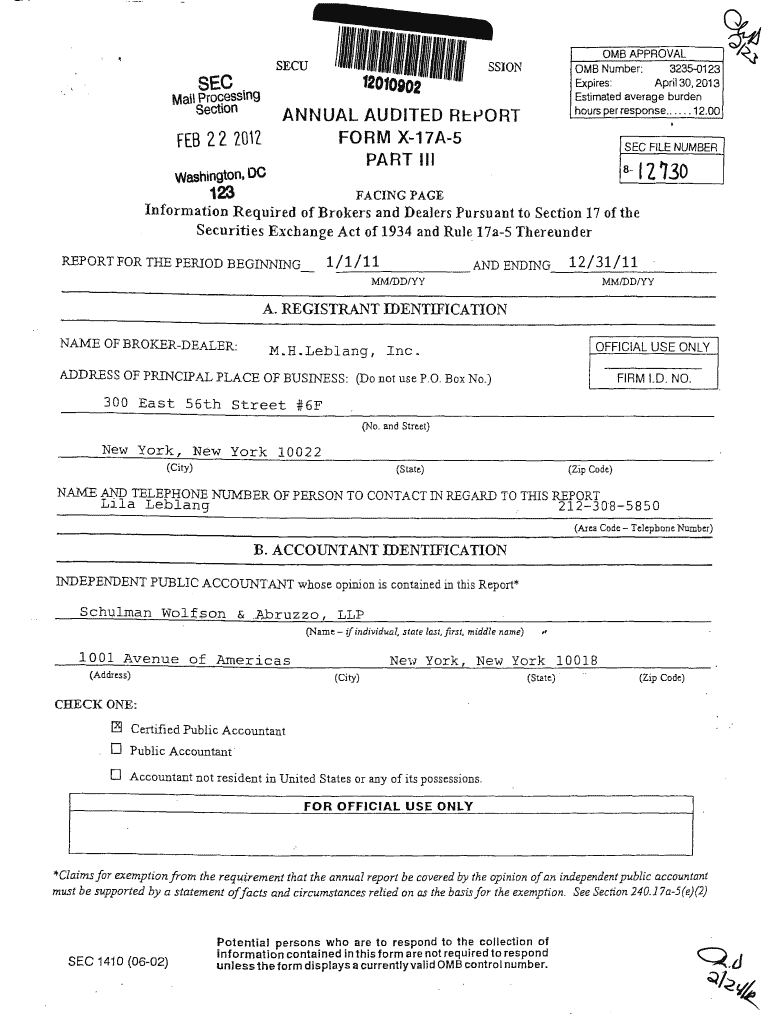

SECU0MB APPROVAL

0 MB Number

32350123SSIONSEC

MaUExpiresProceSSlfl9ANNUAL AUDITED Report

FORM X17A5Section22FEB7WPART

shingt0fl DC

123REPORT FOR THE PERIOD BEGINNINGActof 1934SECtoSection17OF BROKERDEALER12/31/11AND

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual audited reiort

Edit your annual audited reiort form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited reiort form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual audited reiort online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual audited reiort. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited reiort

How to fill out annual audited reiort

01

Start by gathering all the necessary financial documents, including income statements, balance sheets, and cash flow statements. Ensure that all the information is accurate and up to date.

02

Review the financial statements and organize them in a logical order. This will make it easier to fill out the annual audited report.

03

Pay attention to any specific guidelines or requirements set by your jurisdiction or industry. This may include specific disclosures or accounting standards that need to be followed.

04

Prepare the management's discussion and analysis (MD&A) section, which provides an overview of the company's financial performance and highlights any significant events or trends.

05

Include any necessary footnotes or supplementary information to explain any unusual or complex transactions or events that may impact the financial statements.

06

Have your financial statements audited by a qualified and independent auditor. This ensures that your financial statements are free from material misstatements and comply with applicable accounting standards.

07

Review the auditor's report and include it in the annual audited report. The auditor's report provides an opinion on the fairness and reliability of the financial statements.

08

Proofread and review the entire annual audited report for accuracy, clarity, and compliance with any regulatory requirements.

09

Once you are satisfied with the report, distribute it to relevant stakeholders, such as shareholders, investors, and regulatory authorities.

10

Keep a copy of the annual audited report for your records and ensure that it is easily accessible for future reference.

Who needs annual audited reiort?

01

Annual audited reports are typically required by publicly traded companies. These reports are important for shareholders, investors, and regulatory authorities to assess the financial health and performance of the company.

02

In addition to publicly traded companies, other entities that may need annual audited reports include government agencies, nonprofit organizations, and privately held companies seeking external financing or partnerships.

03

Having an annual audited report can provide credibility and transparency to the financial information presented by an entity, which can enhance trust and confidence among stakeholders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my annual audited reiort in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your annual audited reiort and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send annual audited reiort to be eSigned by others?

Once your annual audited reiort is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit annual audited reiort on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute annual audited reiort from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is annual audited report?

Annual audited report is a financial document that provides an overview of a company's financial performance and activities during the fiscal year. It is prepared by independent auditors.

Who is required to file annual audited report?

Publicly traded companies, large private companies, non-profit organizations, and government entities are usually required to file annual audited report.

How to fill out annual audited report?

Annual audited report is typically filled out by the company's finance or accounting team based on the guidelines of accounting standards and regulations applicable to the organization.

What is the purpose of annual audited report?

The purpose of annual audited report is to provide stakeholders with a transparent and accurate view of a company's financial health and performance.

What information must be reported on annual audited report?

Annual audited report typically includes financial statements, management discussion and analysis, auditor's report, and notes to the financial statements.

Fill out your annual audited reiort online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Reiort is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.