Get the free dtf 803

Show details

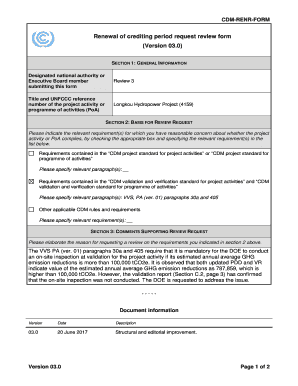

New York State Department of Taxation and Finance Claim for Sales and Use Tax Exemption Title/Registration DTF-803 (3/01) Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dtf 803

Edit your dtf 803 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dtf 803 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dtf 803 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dtf 803. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF DTF-803 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dtf 803

How to fill out dtf 803:

01

Start by obtaining a copy of the dtf 803 form from the relevant tax or finance department. It is usually available online or can be obtained in person.

02

Begin by filling out the top section of the form which includes personal information such as your name, address, and social security number.

03

Provide the necessary details of the tax year or period for which you are submitting the form. This includes the beginning and ending dates of the period.

04

Indicate the type of tax or fee being reported on the form. This could be sales tax, use tax, or any other applicable tax.

05

Proceed to provide accurate and complete information about the taxable sales, receipts, or purchases made during the specified period. This may involve listing the amounts, categories, and any relevant exemptions or exclusions.

06

Be sure to include any necessary supporting documentation such as invoices, receipts, or other evidence of transactions. Attach these documents where indicated on the form.

07

Review the completed form for accuracy and ensure that all required fields are filled out. Double-check calculations and make any necessary corrections before submitting the form.

Who needs dtf 803:

01

Businesses or individuals who are required to report and pay sales tax, use tax, or other applicable taxes may need to fill out the dtf 803 form. This includes retailers, vendors, and sellers who engage in taxable transactions.

02

Additionally, individuals or entities that have made significant purchases subject to sales tax, use tax, or other taxes may also need to complete this form. Examples include those who have made large out-of-state purchases or purchases from non-registered vendors.

03

It is important to note that the specific requirements for needing and filling out the dtf 803 form may vary based on the jurisdiction and tax laws applicable to the business or individual. It is advisable to consult the relevant tax authorities or seek professional advice to determine if this form is required.

Fill

form

: Try Risk Free

People Also Ask about

What items are exempt from sales tax in New York?

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

Do you pay sales tax on a used car in New York?

New York collects a 4% sales tax from all car sales, whether brand-new or used. However, depending on the city or county you're buying from, an additional up to 4.5% sales tax will be applied on top of the 4%. This means you're looking at a potential maximum sales tax of 8.5% when purchasing a car in the state.

What is NY State DMV Form DTF 804?

This form is to be used by a purchaser of a motor vehicle, all-terrain vehicle, trailer, vessel, or snowmobile (qualifying vehicle or vessel) to report the sales and use tax due on a purchase for which the purchaser wants to claim a credit for sales tax paid to another state.

What products do not get taxed?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with food stamps.

What sales are exempt from NYS sales tax?

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

What is the tax exempt form for NYS?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dtf 803 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your dtf 803 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit dtf 803 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share dtf 803 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete dtf 803 on an Android device?

Complete dtf 803 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your dtf 803 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dtf 803 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.