Get the free 501 C-3

Show details

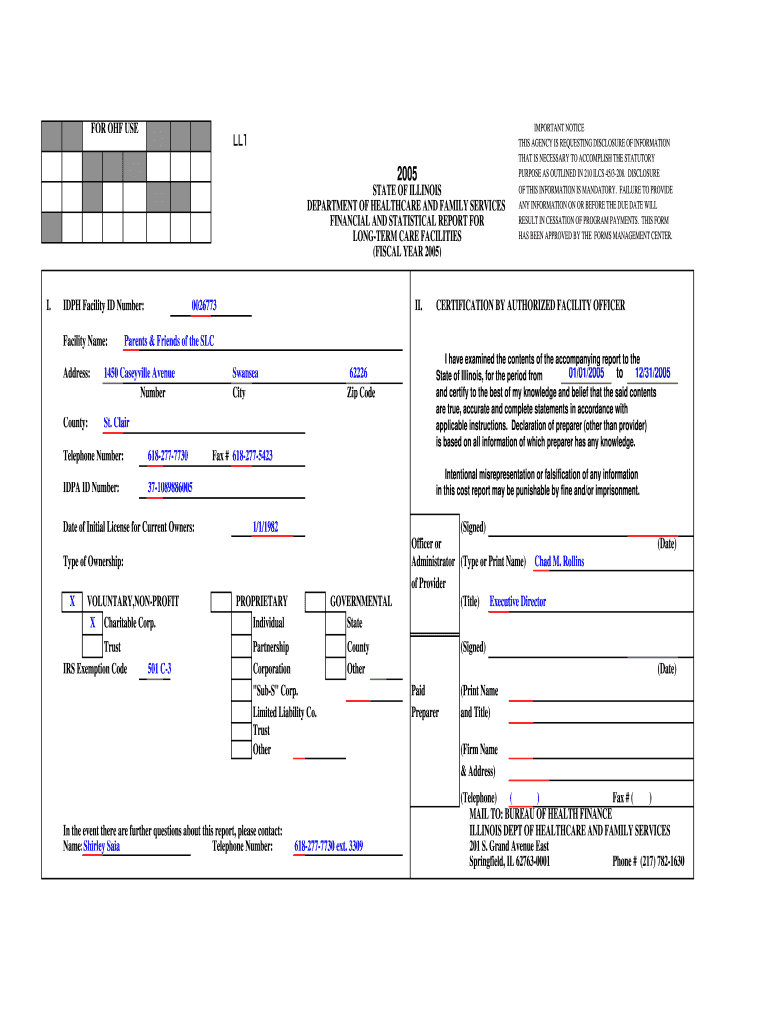

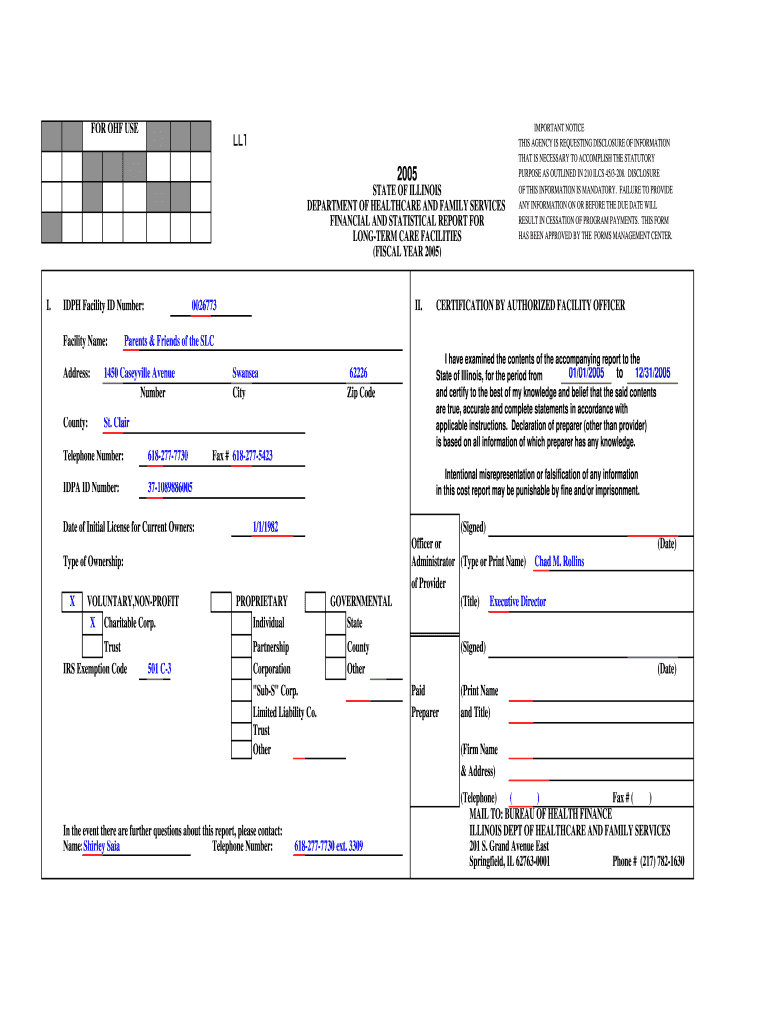

FOR OF USELL1 2005 STATE OF ILLINOIS DEPARTMENT OF HEALTHCARE AND FAMILY SERVICES FINANCIAL AND STATISTICAL REPORT FOR LONGER CARE FACILITIES (FISCAL YEAR 2005)I.DPH Facility ID Number: Facility Name:0026773II.CERTIFICATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 501 c-3

Edit your 501 c-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 501 c-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 501 c-3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 501 c-3. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 501 c-3

How to fill out 501 c-3

01

To fill out form 501 c-3, follow these steps:

02

Obtain the form: Visit the official website of the Internal Revenue Service (IRS) and download form 501 c-3.

03

Gather necessary information: Collect all the required information such as the name and address of your organization, purpose of the organization, details of the officers, financial information, etc.

04

Fill out the form: Carefully fill out the form, providing accurate information for each section.

05

Attach required documents: Include any necessary attachments, such as financial statements, bylaws, and articles of incorporation.

06

Review and double-check: Review the completed form and attachments to ensure everything is accurate and complete.

07

Submit the form: Mail the completed form to the appropriate IRS mailing address as mentioned in the instructions provided with the form.

08

Wait for response: The IRS will review your application and notify you of their decision. This process may take some time, so be patient.

09

Note: It is advisable to consult with a tax professional or legal advisor to ensure you understand and meet all the requirements while filling out form 501 c-3.

Who needs 501 c-3?

01

Various organizations may need to obtain a 501 c-3 status. These may include:

02

- Charitable organizations: Nonprofit organizations engaged in activities such as relief of poverty, advancement of education or religion, prevention of cruelty towards animals, etc.

03

- Educational institutions: Schools, colleges, or universities that are operated for educational purposes.

04

- Religious organizations: Churches, synagogues, temples, mosques, and other religious entities.

05

- Scientific or research organizations: Associations focusing on scientific research, testing, or experimentation.

06

- Literary or cultural organizations: Groups promoting literature, arts, culture, or preservation of historical sites.

07

- Public safety organizations: Organizations working to prevent or alleviate public safety issues, such as fire departments or disaster relief agencies.

08

- Amateur sports organizations: Nonprofit associations conducting amateur sports competitions.

09

- Certain government entities: Government agencies or subdivisions that meet specific requirements for 501 c-3 status.

10

These are just a few examples, and it is important to thoroughly understand the eligibility criteria and requirements set by the IRS to determine if an organization qualifies for 501 c-3 status.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 501 c-3 in Chrome?

Install the pdfFiller Google Chrome Extension to edit 501 c-3 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the 501 c-3 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 501 c-3 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit 501 c-3 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 501 c-3, you can start right away.

What is 501 c-3?

501 c-3 is a section of the Internal Revenue Code that defines the requirements for tax-exempt charitable organizations in the United States.

Who is required to file 501 c-3?

Non-profit organizations that want to be recognized as tax-exempt by the IRS are required to file for 501 c-3 status.

How to fill out 501 c-3?

To fill out 501 c-3, organizations need to complete Form 1023 or 1023-EZ and submit it to the IRS.

What is the purpose of 501 c-3?

The purpose of 501 c-3 is to provide a tax-exempt status to organizations that are formed for charitable, religious, educational, scientific, literary, or other specified purposes.

What information must be reported on 501 c-3?

Non-profit organizations must report their activities, finances, and governance structure on 501 c-3, including details about their mission, programs, and financials.

Fill out your 501 c-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

501 C-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.