Get the free consumer loan application - JTNB

Show details

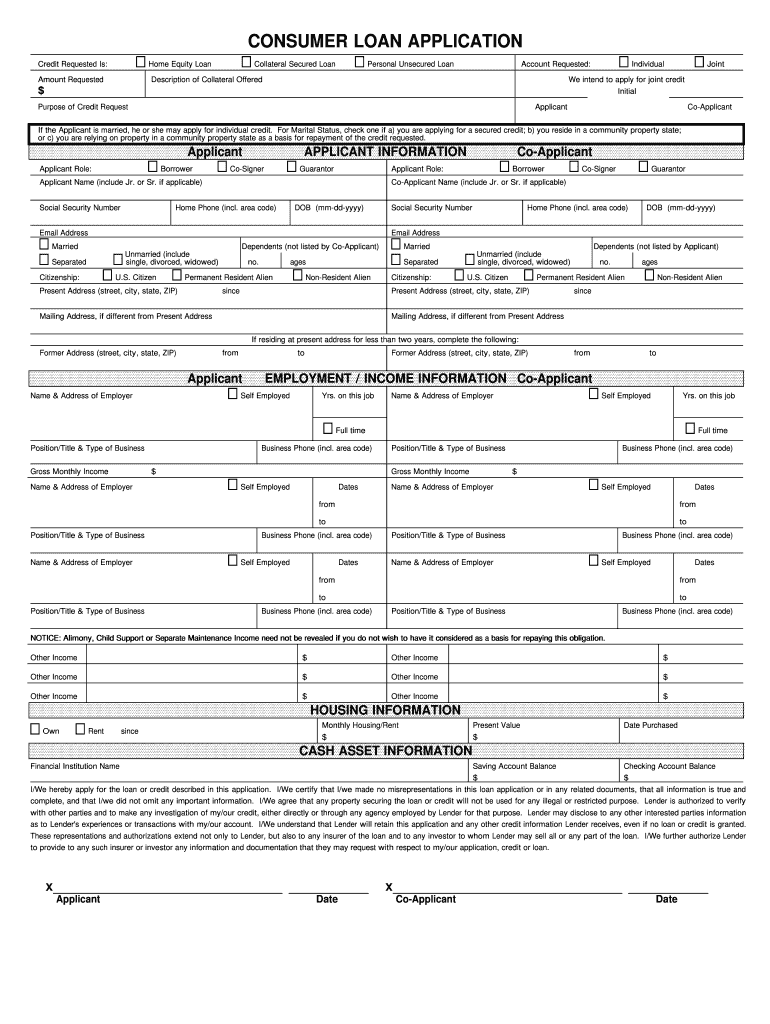

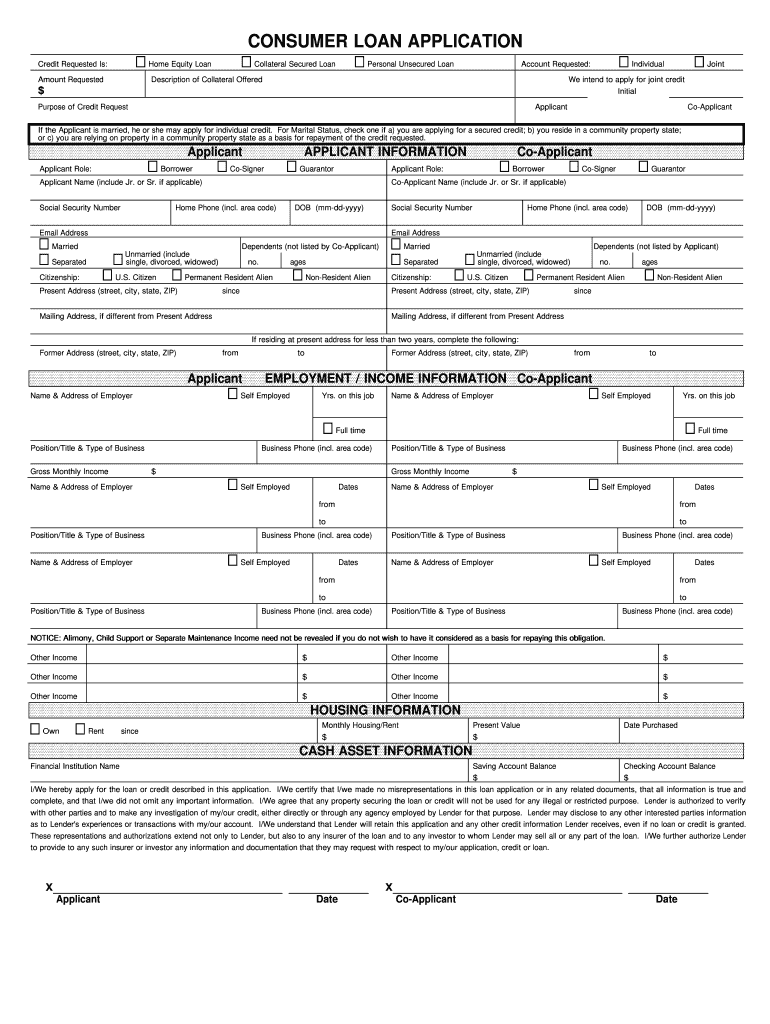

CONSUMER LOAN APPLICATION

Credit Requested Is:Home Equity Paramount RequestedCollateral Secured LoanPersonal Unsecured LoanAccount Requested:Description of Collateral OfferedIndividualJointWe intend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer loan application

Edit your consumer loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer loan application online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer loan application

How to fill out consumer loan application

01

Start by gathering all the necessary documents such as identification proof, income proof, and any other relevant financial information.

02

Research and compare different lenders to find the best loan options suited for your needs.

03

Visit the lender's website or branch office to get a consumer loan application form.

04

Read the instructions carefully and fill out the application form with accurate and complete information.

05

Provide personal details such as name, address, contact information, etc.

06

Provide information about your employment, including your current job position, salary, and duration of employment.

07

Fill in details about your income sources, including salary, bonuses, investments, or any other additional income.

08

Disclose your monthly expenses, including rent/mortgage, utilities, loan repayments, and other financial commitments.

09

Provide details about your existing debts, such as credit card balances, outstanding loans, or any pending payments.

10

Attach the required supporting documents, such as copies of identification proof, income documents, bank statements, etc.

11

Review the completed application form and attached documents to ensure accuracy and completeness.

12

Submit the application form and supporting documents to the lender through their designated channel, either online or in person.

13

Wait for the lender's response regarding your loan application, which may include further documentation or verification process.

14

Cooperate with the lender during the loan approval process and promptly provide any additional information or documents as requested.

15

Upon approval, carefully review the terms and conditions of the loan agreement and ensure you understand the repayment schedules, interest rates, and any applicable fees.

16

Sign the loan agreement if you are satisfied with the terms and conditions.

17

Receive the loan funds in your designated bank account or as per the disbursement method agreed upon.

18

Use the loan funds responsibly for your intended purposes, whether it be purchasing a car, funding education, or any other planned expenses.

19

Make timely loan repayments as per the agreed schedule to avoid any penalties or negative impact on your credit score.

20

Keep track of your loan account and regularly communicate with the lender regarding any concerns or changes in your financial situation.

Who needs consumer loan application?

01

Consumer loan application is needed by individuals or households who require financing for various purposes such as:

02

- Purchasing a house or property

03

- Buying a car or other vehicles

04

- Funding higher education or vocational courses

05

- Consolidating existing debts

06

- Covering medical expenses

07

- Renovating or making improvements to a property

08

- Starting or expanding a small business

09

- Planning a wedding or other special events

10

- Taking a dream vacation

11

- Handling unexpected or emergency expenses

12

- Any other personal or financial needs where borrowing money provides a viable solution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get consumer loan application?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific consumer loan application and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in consumer loan application?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your consumer loan application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out consumer loan application on an Android device?

Complete your consumer loan application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is consumer loan application?

Consumer loan application is a form that individuals complete to apply for a loan, typically for personal use such as buying a car or financing a home renovation.

Who is required to file consumer loan application?

Any individual seeking to borrow money from a financial institution or lender is required to file a consumer loan application.

How to fill out consumer loan application?

To fill out a consumer loan application, individuals must provide personal information, employment details, income verification, and details of the loan amount and purpose.

What is the purpose of consumer loan application?

The purpose of a consumer loan application is to provide lenders with essential information about the borrower's financial situation and creditworthiness to assess the risk of providing a loan.

What information must be reported on consumer loan application?

Information such as personal details, employment information, income verification, loan amount, purpose of the loan, and credit history must be reported on a consumer loan application.

Fill out your consumer loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.