Get the free 8,333 A

Show details

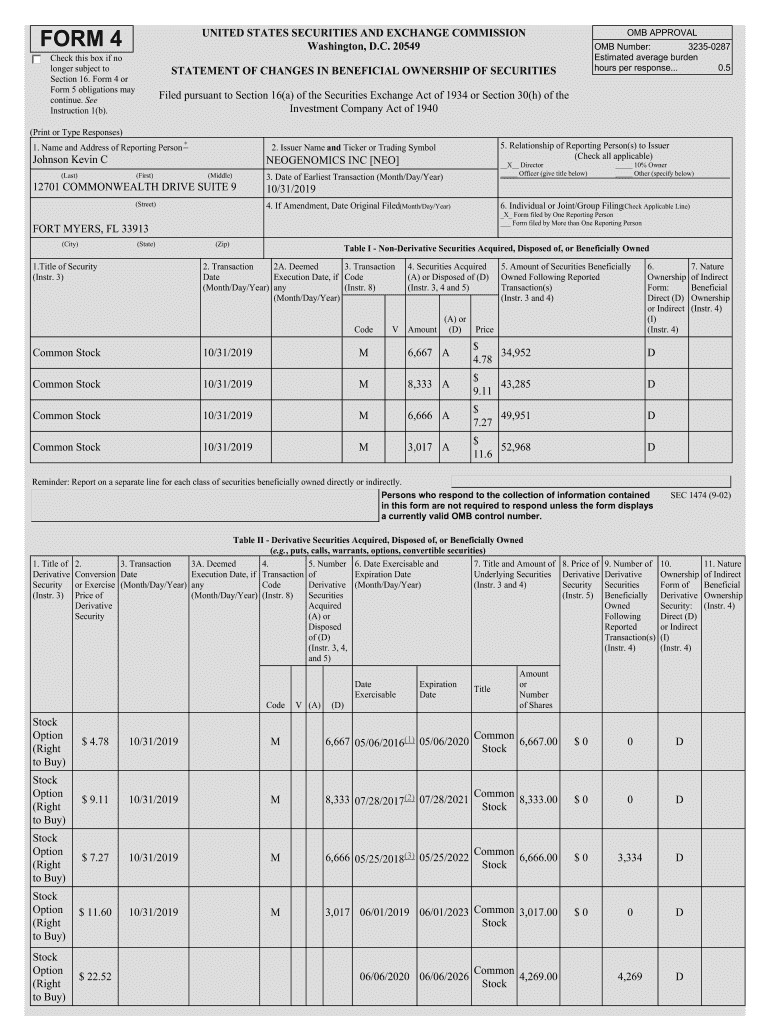

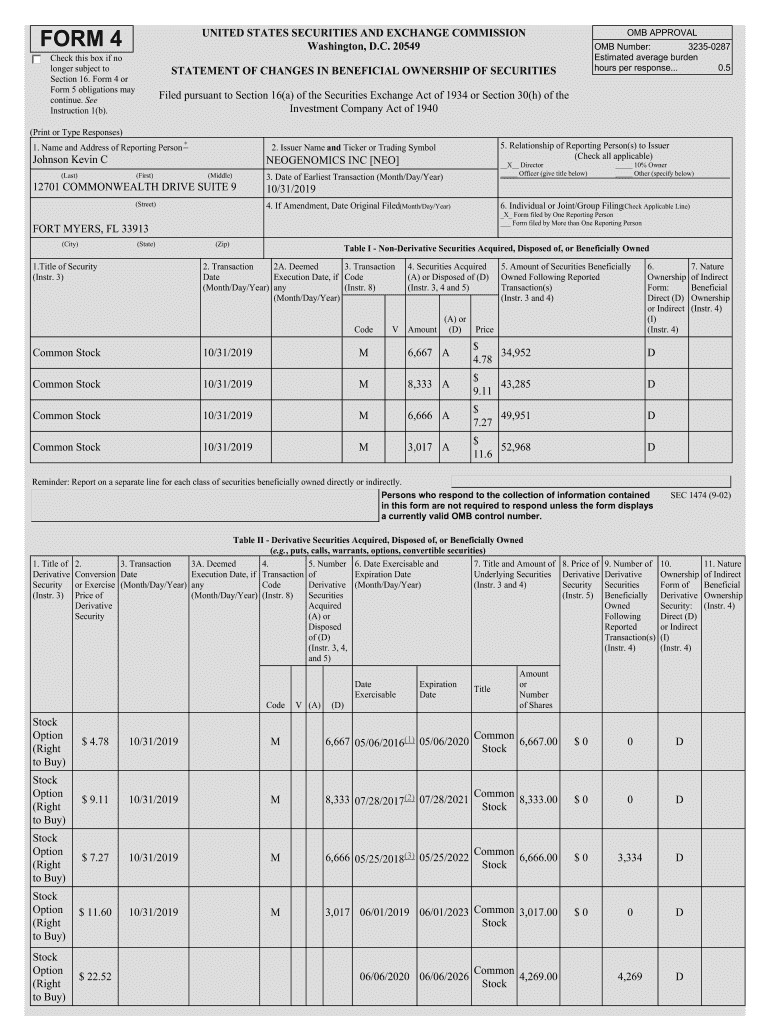

FORM 4UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549Check this box if no

longer subject to

Section 16. Form 4 or

Form 5 obligations may

continue. See

Instruction 1(b).OMB

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8333 a

Edit your 8333 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8333 a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 8333 a online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 8333 a. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 8333 a

How to fill out 8333 a

01

To fill out form 8333 a, follow these steps:

02

Start by entering your personal information, such as your name, address, and Social Security number.

03

Provide information about the type of income you received and the country it was received from.

04

Attach any supporting documents, such as copies of international tax forms or statements from the foreign payer.

05

Complete the certification section, where you sign and date the form.

06

File the completed form with the appropriate tax authority.

Who needs 8333 a?

01

Form 8333 a is typically required by individuals who have received income from foreign sources. This form is used to report and document income that is subject to international tax regulations. It is often necessary for individuals who have earned money from foreign employment, investments, or other types of international transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 8333 a without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 8333 a, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find 8333 a?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 8333 a in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the 8333 a in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 8333 a and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is 8333 a?

8333 a refers to the form used by individuals to claim an exemption from withholding on compensation for independent personal services.

Who is required to file 8333 a?

Individuals who are not U.S. citizens or resident aliens and who perform independent personal services in the U.S. are required to file Form 8333.

How to fill out 8333 a?

Form 8833 must be filled out completely and accurately, including providing all required information about the individual claiming the exemption.

What is the purpose of 8333 a?

The purpose of Form 8333 is to claim an exemption from withholding on compensation for independent personal services performed in the U.S.

What information must be reported on 8333 a?

Form 8333 must include information such as the individual's name, address, taxpayer identification number, description of services performed, and the treaty article that exempts the individual from withholding.

Fill out your 8333 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8333 A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.