NY NYSLRS RS 6082 2018-2026 free printable template

Show details

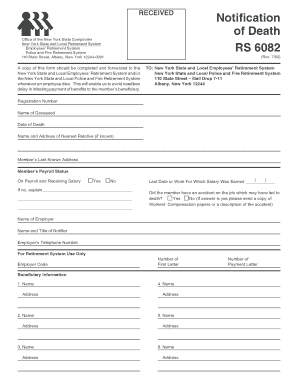

Notification of DeathReceived Daters 6082Please type or print clearly in blue or black deceased Social Security Number last 4 digits Deceased YEARS IDXXXXXRetirement System check one employee Retirement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYSLRS RS 6082

Edit your NY NYSLRS RS 6082 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYSLRS RS 6082 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYSLRS RS 6082 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY NYSLRS RS 6082. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYSLRS RS 6082 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYSLRS RS 6082

How to fill out NY NYSLRS RS 6082

01

Obtain the NY NYSLRS RS 6082 form from the official website or your local retirement system office.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information such as name, address, and retirement date in the designated sections.

04

Provide details about your employment history, including the names of employers and service dates.

05

Include any relevant information about your choice of retirement options if applicable.

06

Review all filled information for accuracy and completeness.

07

Sign and date the form in the required space.

08

Submit the completed form to the NYSLRS office either by mail or in person as directed.

Who needs NY NYSLRS RS 6082?

01

Employees who are members of the New York State and Local Retirement System (NYSLRS) and are applying for retirement benefits.

02

Individuals seeking to verify their retirement service credit or make updates to their retirement records.

Fill

form

: Try Risk Free

People Also Ask about

How do I notify NYS pension of death?

Survivors can report the death of a retiree by using our online death report form, or they can call 866-805-0990 and press 3 and then 1. We'll also need an original, certified death certificate. We'll mail information about death benefits, and any needed forms, to your beneficiaries.

Who is the beneficiary of the New York State retirement system?

When you became a member of the New York State and Local Retirement System (NYSLRS), you may have designated one or more beneficiaries. A beneficiary is a person, often a relative or loved one, whom you have chosen to be eligible to receive a benefit upon your death.

What forms are needed for NYS retirement?

Applications for Retirement. Application for Service Retirement (RS-6037) Beneficiaries. Eligibility of Retired Employee for Survivor's Benefit (RS-6355) Change of Address. Change of Address Form for Active Members (RS-5512) Health Benefits. Health Insurance Transaction Form (PS-404) M/C Life Insurance. Sign Up / Decline.

What is the Tier 1 death benefit in NY?

Ordinary Death Benefit This benefit is equal to 1/12th (8.33 percent) of your last year's earnings, multiplied by your years of service credit up to 36 years.

Who is the beneficiary of a pension after death?

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

Who is the beneficiary of a retirement benefit?

A beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an IRA after they die. The owner must designate the beneficiary under procedures established by the plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY NYSLRS RS 6082 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your NY NYSLRS RS 6082 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete NY NYSLRS RS 6082 online?

With pdfFiller, you may easily complete and sign NY NYSLRS RS 6082 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit NY NYSLRS RS 6082 on an iOS device?

Create, modify, and share NY NYSLRS RS 6082 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is NY NYSLRS RS 6082?

NY NYSLRS RS 6082 is a form used by the New York State and Local Retirement System to report specific data regarding retirement contributions and service.

Who is required to file NY NYSLRS RS 6082?

Employers who participate in the New York State and Local Retirement System are required to file NY NYSLRS RS 6082.

How to fill out NY NYSLRS RS 6082?

To fill out NY NYSLRS RS 6082, employers need to provide accurate information regarding employee contributions, service credit, and any other required details as specified in the instructions accompanying the form.

What is the purpose of NY NYSLRS RS 6082?

The purpose of NY NYSLRS RS 6082 is to gather necessary information about retirement contributions from employers, ensuring compliance with retirement system regulations and helping to maintain accurate records.

What information must be reported on NY NYSLRS RS 6082?

The information that must be reported on NY NYSLRS RS 6082 includes details about employee contributions, service credit, identifying employee information, and any adjustments or corrections related to retirement records.

Fill out your NY NYSLRS RS 6082 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYSLRS RS 6082 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.