Nationwide Acceptance C2 CAC 2020-2025 free printable template

Show details

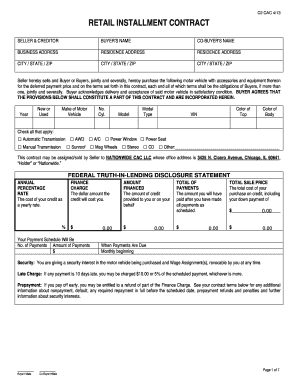

C2 CAC 2/2020RETAIL INSTALLMENT CONTRACT SELLER & CREDITORBUYERS NAMECOBUYERS NAMEBUSINESS ADDRESSRESIDENCE ADDRESSING / STATE / SimCity / STATE / SimCity / STATE / Seller hereby sells and Buyer or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign for form deferred payment

Edit your for form deferred payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for form deferred payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing for form deferred payment online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit for form deferred payment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Nationwide Acceptance C2 CAC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out for form deferred payment

How to fill out Nationwide Acceptance C2 CAC

01

Start by obtaining the Nationwide Acceptance C2 CAC form from the appropriate source.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill in your personal information in the designated sections, including name, address, and contact details.

04

Provide any necessary identification information, such as social security number or driver's license number.

05

Include details related to your financial information, if required, ensuring accuracy.

06

Review all sections of the form to ensure there are no errors or omissions.

07

Sign and date the form as required at the bottom of the page.

08

Submit the completed form according to the instructions provided, whether electronically or by mail.

Who needs Nationwide Acceptance C2 CAC?

01

Individuals seeking credit opportunities with Nationwide Acceptance.

02

Small business owners looking for financing options.

03

Consumers interested in purchasing products through financing plans.

04

Those looking to establish or improve their credit history with Nationwide Acceptance.

Fill

form

: Try Risk Free

People Also Ask about

What is a retail installment contracts?

A retail installment sale is a transaction between you and a dealer to purchase a vehicle where, you agree to pay the dealer over time, paying both the value of the vehicle plus interest. A dealer can sell the retail installment contract to a lender or other party.

What is a 553 form?

The LAW 553 acts as both a sale document and a financing document. The dealer sells the vehicle to the consumer and then immediately assigns the loan to a finance company, which is usually a subsidiary of the manufacturer.

What is an installment sales contract also called a sales contract or?

A contract for deed (sometimes called an installment purchase contract or installment sale agreement) is a real estate transaction in which the purchase of the property is financed by the seller rather than a third party such as a bank, credit union or other mortgage lender.

What is the difference between installment and loan?

The difference between an installment loan and a personal loan is that an installment loan can be any type of loan paid off in regular intervals over time, while a personal loan is just one example of an installment loan. All personal loans are installment loans, as are car loans, mortgages and home equity loans.

What is the difference between consumer credit transaction and retail installment contract?

The two key differences between installment and credits sales are the duration the credit is offered and the collateral used to back the credit. Credit sales are typically of shorter duration and installment sales spread payments out over longer periods of time.

What are examples of installment contracts?

Common Examples of Installment Contracts Vehicle sales. Sale of land plots. Technology or computer services, which need regular updating. Agricultural goods or produce sales, which are subject to seasonal cycles. Retail installment contracts, where wholesalers sell “in season” or “in-style” clothes to a seller.

What is the difference between a loan and a retail installment contract?

As you can see, a loan is wholly distinct from a retail installment sale contract/credit sale. In a credit sale, the creditor provides credit (not money) to the buyer. In a loan transaction, the lender provides/lends money (not credit) to the borrower.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the for form deferred payment electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your for form deferred payment and you'll be done in minutes.

How do I fill out the for form deferred payment form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign for form deferred payment and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit for form deferred payment on an Android device?

With the pdfFiller Android app, you can edit, sign, and share for form deferred payment on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Nationwide Acceptance C2 CAC?

Nationwide Acceptance C2 CAC is a specific form used for reporting credit and acceptance practices regarding consumer debts on a nationwide scale.

Who is required to file Nationwide Acceptance C2 CAC?

Entities involved in consumer credit transactions, including lenders, credit card companies, and financial institutions, are typically required to file the Nationwide Acceptance C2 CAC.

How to fill out Nationwide Acceptance C2 CAC?

To fill out the Nationwide Acceptance C2 CAC, follow the provided guidelines which include entering your organization details, reporting credit metrics, and disclosing acceptance procedures.

What is the purpose of Nationwide Acceptance C2 CAC?

The purpose of Nationwide Acceptance C2 CAC is to ensure transparency in consumer credit practices and to provide regulatory authorities with data for monitoring compliance and consumer protection.

What information must be reported on Nationwide Acceptance C2 CAC?

Information that must be reported includes consumer account details, credit limits, payment histories, interest rates, and any enforcement actions taken against consumers.

Fill out your for form deferred payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Form Deferred Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.