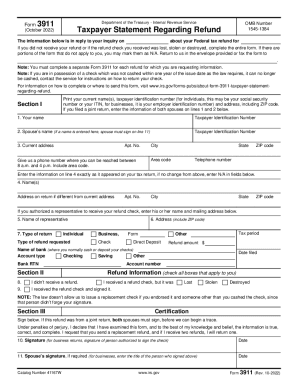

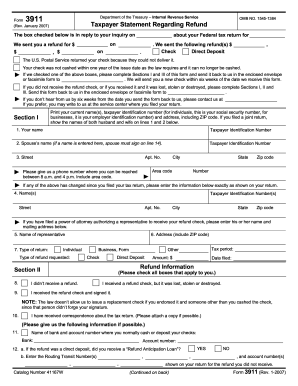

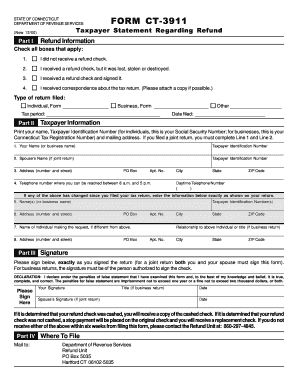

IRS 3911 2018 free printable template

Instructions and Help about IRS 3911

How to edit IRS 3911

How to fill out IRS 3911

About IRS 3 previous version

What is IRS 3911?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

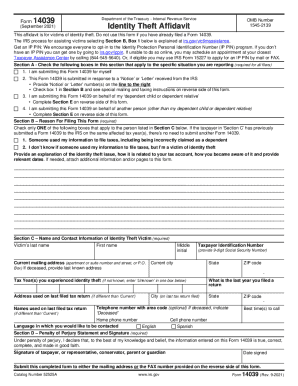

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 3911

What should I do if I realize I've made a mistake on my submitted IRS Form 3911?

If you've submitted an IRS Form 3911 and later discover an error, you need to correct it promptly. You can submit an amended form to address the mistake. Be sure to include a clear explanation of the corrections made to facilitate processing. Regularly check for updates on your form's status to ensure the amendment has been acknowledged.

How can I confirm if my IRS Form 3911 has been processed?

To verify the status of your IRS Form 3911, you can check the IRS's online tracking system or contact them directly via phone. It's essential to have relevant information such as your Social Security number and the details from your submitted form ready for reference. Keep an eye out for any communication from the IRS regarding your form's processing.

Are there specific privacy considerations to be aware of when filing IRS Form 3911?

When filing IRS Form 3911, it's crucial to consider privacy implications, as the form contains sensitive personal information. Ensure you are using secure methods to file, like e-filing through trusted IRS portals. Additionally, remember to retain copies of any submitted forms in a secure location to protect your data from unauthorized access.

What should I do if my IRS Form 3911 is rejected during e-filing?

If your IRS Form 3911 is rejected during e-filing, carefully review the rejection codes provided by the e-filing system. These codes will guide you on what issues need to be corrected. Address the errors and resubmit the form while ensuring that all information is accurate to avoid repeated rejections.

See what our users say