Get the free Terminal Illness Rider Instruction Sheet

Get, Create, Make and Sign terminal illness rider instruction

Editing terminal illness rider instruction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out terminal illness rider instruction

How to fill out terminal illness rider instruction

Who needs terminal illness rider instruction?

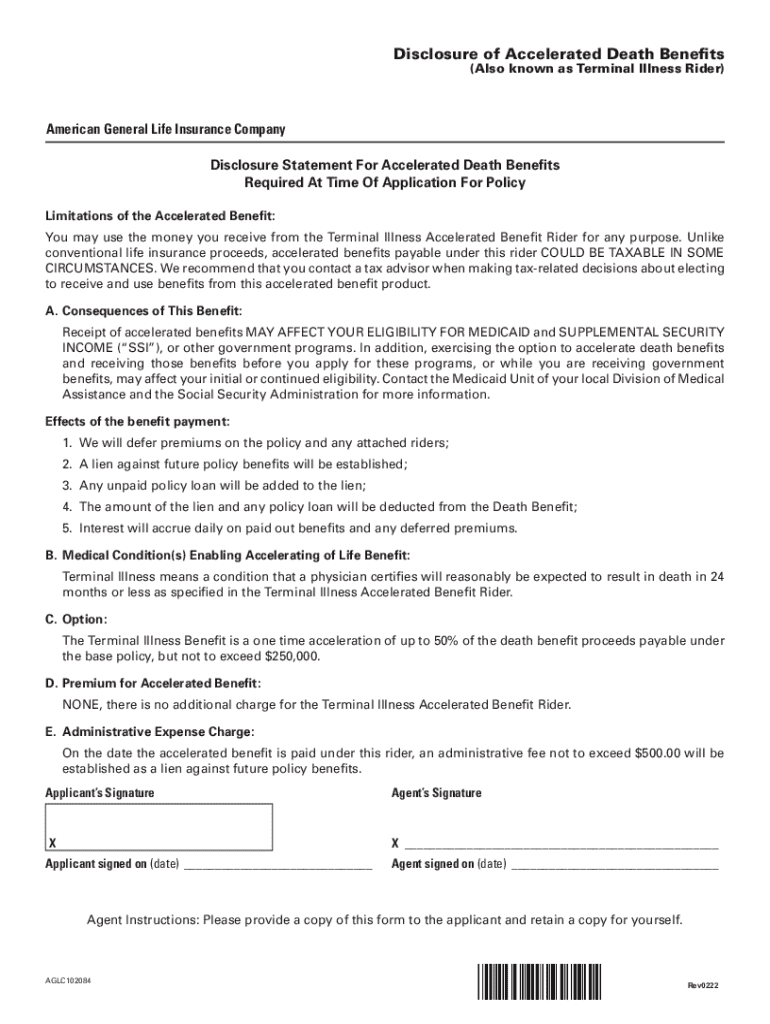

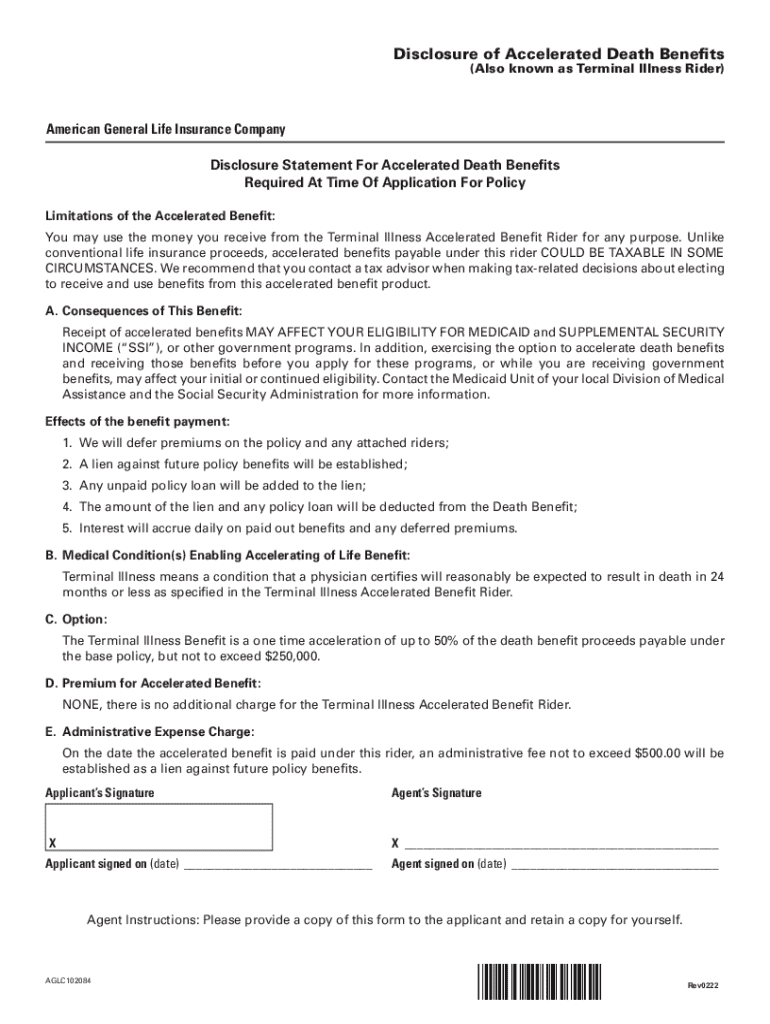

Comprehensive Guide to the Terminal Illness Rider Instruction Form

Understanding the terminal illness rider

A terminal illness rider is an important addition to life insurance policies, allowing policyholders to access a portion of the death benefit while still alive, upon receiving a terminal diagnosis. Its primary purpose is to provide financial security during challenging times, allowing individuals to address medical expenses, pay off debts, and make memories with loved ones. Unlike standard life insurance payouts, which disburse funds posthumously, the terminal illness rider facilitates immediate access when it's needed most.

Having a terminal illness rider attached to a life insurance policy offers numerous benefits. It serves as a financial buffer, enabling families to cope with the economic burdens of late-stage medical care without having to leverage other assets. This security can ease the stress of financial woes, ensuring that loved ones are mostly unaffected financially during such taxing periods. Moreover, it allows the policyholder to make thoughtful decisions regarding their care and arrangements, providing peace of mind as they navigate this challenging journey.

Despite its advantages, many misconceptions surround terminal illness riders. Some individuals confuse them with critical illness riders, which pay out upon diagnosis of specific critical illnesses but do not require a terminal diagnosis. Others mistakenly believe that these riders automatically apply to all policies without reviewing terms and conditions, which is not the case. Understanding these nuances is crucial to choosing the right coverage for personal circumstances.

Key terminology related to terminal illness riders

Navigating the world of life insurance requires familiarity with certain key terms. First and foremost, a 'terminal illness' is typically defined as a condition certified by a medical professional that is likely to result in death within a specific timeframe, often one to two years. The 'accelerated death benefit' refers to the portion of the death benefit that the policyholder can access prior to passing, a fundamental aspect of the terminal illness rider.

Additionally, it’s vital to comprehend exclusions and limitations outlined in your insurance policy. These may include specific illnesses or conditions that are not covered by the rider, presenting potential challenges during claims processing. Being conversant with common insurance phrases can aid policyholders in interpreting legal jargon and ensuring they fully understand their rights and benefits.

The importance of filling out the instruction form correctly

Completing the terminal illness rider instruction form with precision is critical for a smooth claims process. Any inaccuracies or incomplete information can lead to significant delays, leaving families in financial limbo during an already stressful period. To avoid complications, it's essential to ensure that each detail is correct, from personal information to medical history.

Common errors often arise from misunderstanding the required supporting documents. For instance, submitting an incomplete medical record or failing to include the necessary signature can halt the processing of your claim. Policyholders should familiarize themselves with the requirements ahead of time, helping to reduce errors and expedite the approval process.

Step-by-step guide to completing the terminal illness rider instruction form

Before diving into the form's specifics, it’s essential to gather all necessary documents, such as medical records verifying the diagnosis and the life insurance policy number. Understanding eligibility criteria is also crucial. Ensure that you meet all requirements related to your condition to avoid any future complications when processing your claim.

Here's a detailed breakdown of the various sections of the terminal illness rider instruction form:

Utilizing interactive tools for form management

pdfFiller provides a seamless digital experience for managing the terminal illness rider instruction form. By accessing the form online, users can take advantage of editing tools, e-signing features, and collaboration options that enhance the overall experience. The ability to edit the document ensures that all information is accurate, while e-signatures expedite the submission process, eliminating the need for printing and mailing.

The platform also offers real-time collaboration features, allowing users to engage with family members or professional advisors when necessary. Step-by-step guidance through the filling process helps demystify complicated legal language, ensuring users feel empowered and informed.

Submitting the terminal illness rider instruction form

Upon completing the terminal illness rider instruction form, users have multiple submission options. The most common methods include submitting via the insurance company’s website, sending the document through email, or opting for postal mail. It's essential to follow specific submission guidelines outlined by the insurer to ensure your claim is processed promptly.

After submission, it’s important to know what to expect. Typically, insurance companies will process claims within a defined timeframe, often ranging from a few weeks to a couple of months, depending on the complexity of the case. Ensure you receive a confirmation of receipt to keep track of your application status.

Managing your terminal illness rider after submission

Once you have submitted the terminal illness rider instruction form, managing your application is crucial. Keeping a record of all correspondence with the insurance company, including submission confirmations and supporting documents, can help track your claim status effectively. It’s advisable to follow up with the insurance provider after a couple of weeks to inquire about the progress.

Post-approval, it’s essential to understand how the rider impacts your overall life insurance policy. The funds accessed through the rider will reduce the death benefit available for beneficiaries, so it’s important to assess any modifications needed for coverage or beneficiary designations to maintain financial security for your loved ones.

Frequently asked questions

Many policyholders have questions regarding the terminal illness rider. One common query is what conditions qualify as terminal. Typically, this includes conditions like advanced cancer, HIV/AIDS, or degenerative diseases diagnosed by a physician. Another frequent concern is whether the rider can be added after the policy purchase, and this often depends on the insurance provider's specific policies on riders.

Privacy and confidentiality regarding medical information are also significant concerns for many policyholders. Insurance companies are typically required to adhere to strict privacy regulations, ensuring that your information is securely managed. Additionally, any changes in health status during the claims process may affect eligibility, underscoring the importance of maintaining open communication with the insurer.

Final thoughts on the terminal illness rider

Incorporating a terminal illness rider into your life insurance policy can be a profound aspect of future planning. It empowers policyholders by providing crucial financial resources during a challenging time, enabling them to make informed decisions about their healthcare and legacy. The flexibility and accessibility afforded by a terminal illness rider represent not only financial security but also peace of mind for individuals and their families during some of life's most challenging moments.

Support and resources available through pdfFiller

For those navigating the terminal illness rider instruction form, pdfFiller offers robust customer service and assistance. Users can easily reach out for help with the form or explore additional resources that provide further education about terminal illness riders and their implications. The platform’s commitment to empowering users means that help is readily available, ensuring that individuals can manage their documents with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in terminal illness rider instruction?

How do I fill out the terminal illness rider instruction form on my smartphone?

How do I fill out terminal illness rider instruction on an Android device?

What is terminal illness rider instruction?

Who is required to file terminal illness rider instruction?

How to fill out terminal illness rider instruction?

What is the purpose of terminal illness rider instruction?

What information must be reported on terminal illness rider instruction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.