ES Agencia Tributaria Modelo 030 2021-2025 free printable template

Show details

9 3Agencia TributariaRellenar Formulario4 :Pg. 1Declaracin census de Alta en El Censor DE obligates tributaries, cam bio DE domicile y/o de variation DE dates personals. Teflon: 901 33 55 33 www.agenciatributaria.esModelo030MINISTERIO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i 864 como llenar form

Edit your formulario de asilo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your como llenar el i 864 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit formulario permiso de trabajo online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mium i589 sample form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaracin obligados form

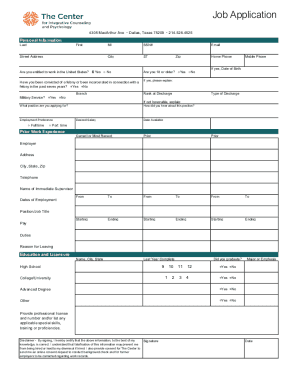

How to fill out ES Agencia Tributaria Modelo 030

01

Gather all necessary personal information, including your full name, address, and identification number (NIF).

02

Select the type of declaration you are submitting (for example, individual or business).

03

Fill in the relevant sections based on your situation, such as personal details, economic activity, and address.

04

Provide information on any previous models submitted, if applicable.

05

Sign and date the document where indicated.

06

Submit the completed form either online through the Agencia Tributaria website or in person at your local tax office.

Who needs ES Agencia Tributaria Modelo 030?

01

Individuals who start economic activities in Spain.

02

Self-employed persons registering for tax purposes.

03

Any person needing to declare changes in their personal or economic information.

04

Individuals who require a certificate of being a taxpayer.

Fill

i 589

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tributaria modelo 030 to be eSigned by others?

When you're ready to share your ds 3053 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the i 130 espanol in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your i 864 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit obligados cambio domicilio on an iOS device?

Create, edit, and share llenar formulario i 130 en linea from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is ES Agencia Tributaria Modelo 030?

ES Agencia Tributaria Modelo 030 is a form used in Spain for tax purposes, specifically for notifying or updating personal data to the Spanish tax authorities (Agencia Tributaria).

Who is required to file ES Agencia Tributaria Modelo 030?

Individuals who need to inform the Agencia Tributaria of changes in their personal tax information, such as modifications of residence, marital status, or any other relevant data, are required to file Modelo 030.

How to fill out ES Agencia Tributaria Modelo 030?

To fill out Modelo 030, individuals must provide their personal details, such as name, identification number (NIF), address, and the specific changes or updates they are reporting. The form can be filled out online or in paper format.

What is the purpose of ES Agencia Tributaria Modelo 030?

The purpose of Modelo 030 is to keep the tax authorities updated with accurate and current personal information of taxpayers, which is essential for proper tax assessment and compliance.

What information must be reported on ES Agencia Tributaria Modelo 030?

Information that must be reported on Modelo 030 includes personal identification details, address changes, marital status changes, and any other relevant personal circumstances affecting tax responsibilities.

Fill out your modelo 030 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Formulario 1 765 En Español is not the form you're looking for?Search for another form here.

Keywords relevant to planilla i 130 en español

Related to que es el formulario i 589

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.