Get the free LOPru Life UK - PRUlink application for withdrawal INDIVIDUAL03272018

Show details

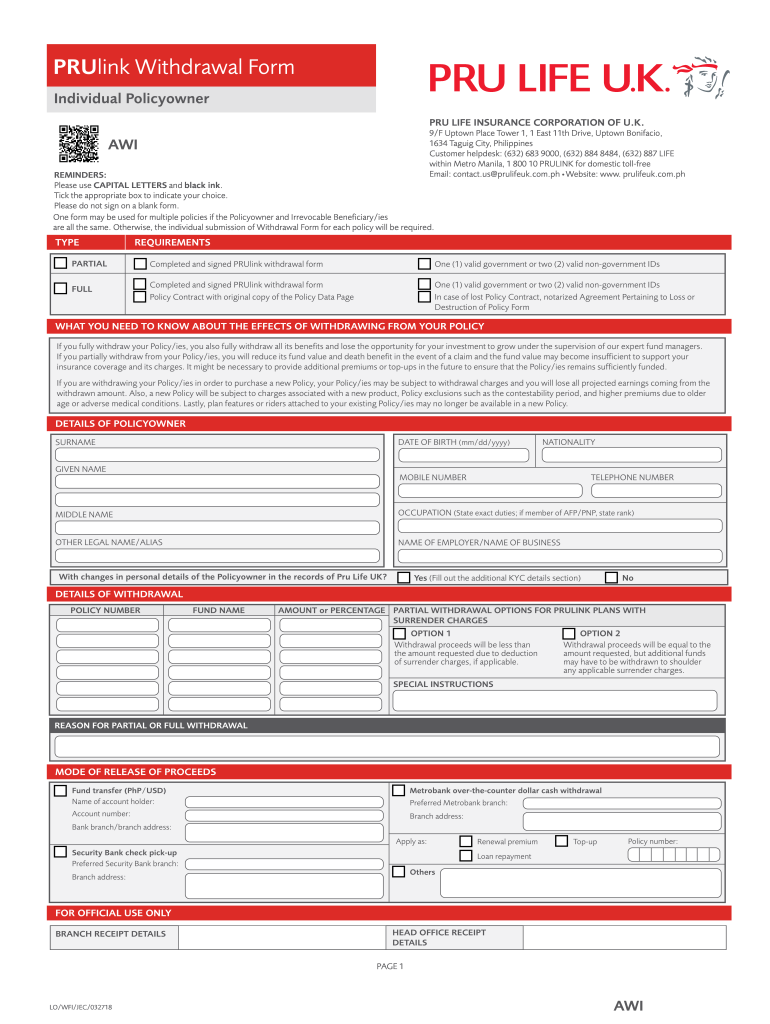

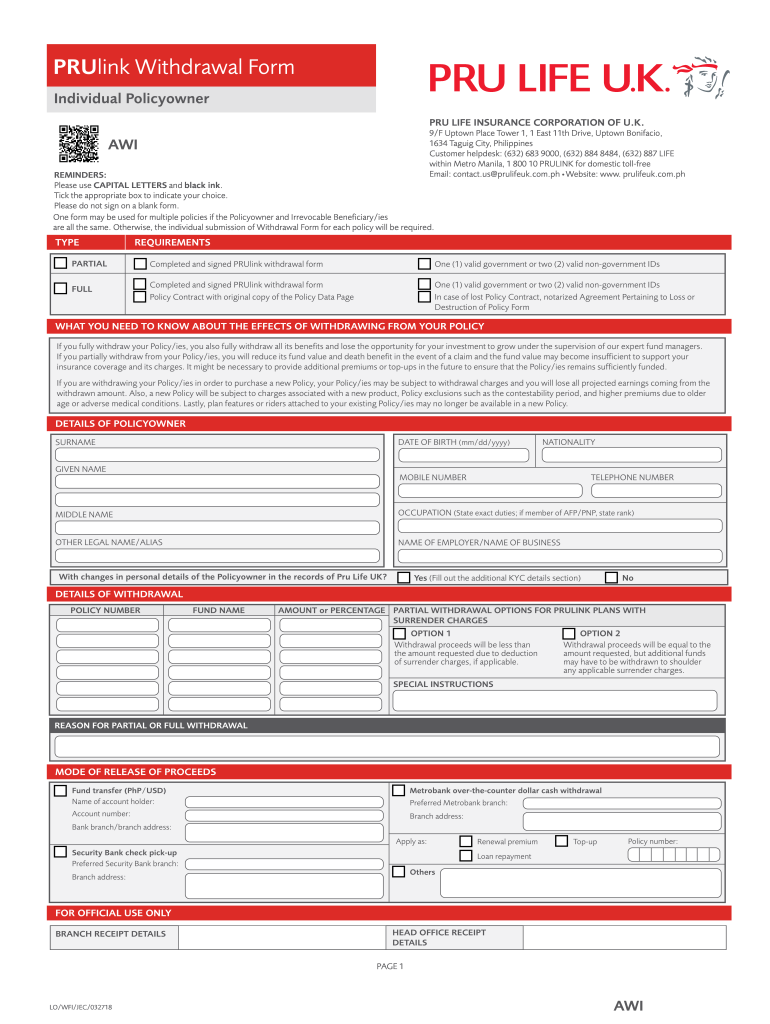

PRU link Withdrawal Form

Individual Policy owner

PRU LIFE INSURANCE CORPORATION OF U.K.9/F Uptown Place Tower 1, 1 East 11th Drive, Uptown Bonifacio,

1634 Lagoon City, Philippines

Customer help desk:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lopru life uk

Edit your lopru life uk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lopru life uk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lopru life uk online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lopru life uk. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lopru life uk

How to fill out lopru life uk

01

To fill out a Lopru Life UK form, follow these steps:

02

Start by gathering all the necessary information and documents, including your personal details, medical history, and any supporting documents required.

03

Carefully read through the form and understand each section before proceeding.

04

Begin by providing your personal information, such as your name, date of birth, and contact details.

05

Move on to the medical history section and answer all the questions accurately and truthfully. It is important to provide all relevant information to ensure proper assessment.

06

If there are any supporting documents required, make sure to attach them properly. This may include medical reports, identification documents, or any other relevant paperwork.

07

Once you have completed all sections of the form, review the entire document thoroughly to ensure accuracy and completeness.

08

Sign and date the form where indicated.

09

Make a copy of the filled-out form for your records before submitting it to the designated recipient. Follow any specific submission instructions provided, if applicable.

10

If you have any doubts or queries, it is advisable to seek professional assistance or contact the relevant authority for guidance.

11

Finally, submit the filled-out Lopru Life UK form as instructed and keep a record of the submission for future reference.

Who needs lopru life uk?

01

Lopru Life UK is designed for individuals who are seeking life insurance coverage in the UK.

02

Specifically, those who need Lopru Life UK may include:

03

- UK residents who want to protect their loved ones financially in the event of their death

04

- Individuals who have dependents and want to provide financial support for their future

05

- People who have financial responsibilities, such as mortgages or loans, and want to ensure those obligations are covered

06

- Individuals who want to leave a legacy or inheritance for their family or charitable causes

07

- Those who want to secure financial stability and peace of mind for their loved ones

08

- People who are looking for affordable and flexible life insurance options in the UK.

09

It is important to note that Lopru Life UK may have eligibility criteria and specific terms and conditions, so it is recommended to review the policy details and consult a financial advisor to determine if it suits individual needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit lopru life uk online?

With pdfFiller, the editing process is straightforward. Open your lopru life uk in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the lopru life uk form on my smartphone?

Use the pdfFiller mobile app to complete and sign lopru life uk on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete lopru life uk on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your lopru life uk. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is lopru life uk?

LOPRU Life UK is a form that must be filled out by individuals who have UK-based life insurance policies which are subject to the Loan-Out Provision Rule.

Who is required to file lopru life uk?

Individuals who have UK-based life insurance policies subject to the Loan-Out Provision Rule are required to file LOPRU Life UK.

How to fill out lopru life uk?

LOPRU Life UK can be filled out either electronically or through paper submission. It requires providing details about the UK-based life insurance policy and confirming compliance with the Loan-Out Provision Rule.

What is the purpose of lopru life uk?

The purpose of LOPRU Life UK is to ensure that individuals with UK-based life insurance policies subject to the Loan-Out Provision Rule are compliant with reporting requirements.

What information must be reported on lopru life uk?

Information such as details of the UK-based life insurance policy, premiums paid, policy benefits, and confirmation of compliance with the Loan-Out Provision Rule must be reported on LOPRU Life UK.

Fill out your lopru life uk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lopru Life Uk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.