NY DB-271S 2019 free printable template

Show details

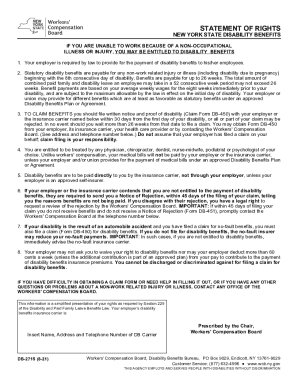

STATEMENT OF RIGHTS YORK STATE DISABILITY BENEFITS

ANDREW M. CUOMO, Governor IF YOU ARE UNABLE TO WORK BECAUSE OF A NONOCCUPATIONAL

ILLNESS OR INJURY, YOU MAY BE ENTITLED TO DISABILITY BENEFITS

1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DB-271S

Edit your NY DB-271S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DB-271S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DB-271S online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY DB-271S. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DB-271S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DB-271S

How to fill out NY DB-271S

01

Obtain the NY DB-271S form from the New York State Department of Labor website.

02

Fill out the identification section with your name, address, and Social Security number.

03

Provide details about your employment history, including the names of employers and dates of employment.

04

Complete the section regarding your disability claim, including the nature of your disability and any relevant medical information.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form as instructed on the form, either via mail or electronically if available.

Who needs NY DB-271S?

01

Individuals who are applying for disability benefits through the New York State Workers' Compensation Board.

02

Workers who have sustained a work-related injury or illness and are unable to work as a result.

Fill

form

: Try Risk Free

People Also Ask about

What are the rights of a person with disability?

Persons with disabilities have the right to the protection of the law against such interference or attacks. States Parties shall protect the privacy of personal, health and rehabilitation information of persons with disabilities on an equal basis with others.

What is the monthly payment for Social Security disability?

SSI amounts for 2023 The monthly maximum Federal amounts for 2023 are $914 for an eligible individual, $1,371 for an eligible individual with an eligible spouse, and $458 for an essential person.

What gets you denied for disability?

Here are some common leading reasons claims are often denied: Lack of medical evidence. Prior denials. Too much earnings.

How do I get around NYC with disability?

Door-to-door service is available for eligible individuals unable to use public bus or subway service. This service operates 24 hours a day, seven days a week. Please visit website or call (877) 337-201. Taxis are required to accept passengers with service animals and those in wheelchairs.

What is the most approved disability?

What Is the Most Approved Disability? Arthritis and other musculoskeletal system disabilities make up the most commonly approved conditions for social security disability benefits. This is because arthritis is so common. In the United States, over 58 million people suffer from arthritis.

How much money do you get on disability in New York?

Disability benefits are temporary cash benefits paid to an eligible employee, when they are disabled by an off-the-job injury or illness. Disability benefits are equal to 50 percent of the employee's average weekly wage for the last eight weeks worked, with a maximum benefit of $170 per week (WCL §204).

What are the rights of persons with disabilities in Philippines?

Consistent with the provisions of the Constitution, the State shall recognize the right of disabled persons to participate in processions, rallies, parades, demonstrations, public meetings, and assemblages or other forms of mass or concerted action held in public.

How much will my disability check be in 2022?

The monthly maximum SSI Federal Payments amounts for 2022: $841 for an eligible individual. $1,261 for an eligible individual with an eligible spouse. $421 for an essential person.

What are the rights of persons with disabilities in Jamaica?

The Disabilities Act 2014 identifies a number of key areas for the full inclusion of persons with disabilities such as the right to Education & Training; the right to Employment; the right to Adequate Healthcare and Accessible Facilities and the right to housing and to enter premises.

What conditions are considered a disability?

The law defines disability as the inability to engage in any substantial gainful activity (SGA) by reason of any medically determinable physical or mental impairment(s) which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.

How much does Social Security disability pay in 2022?

The 2022 SSI federal benefit rate ( FBR ) for an individual living in his or her own household and with no other countable income is $841 monthly; for a couple (with both husband and wife eligible), the SSI benefit rate is $1,261 monthly.

How much is disability in NY a month?

How much does disability pay in NY? For an individual, the federal monthly benefit amount is $771. For a couple, the benefit amount is $1,157 per month.

How do I file a complaint against HRA in NYC?

How can I make an inquiry or file a complaint? Send a message to the commissioner. Call the Office of Constituent Services at 212-331-4640 or Infoline at 718-557-1399.

How Much Does NY State pay for permanent disability?

The benefit payable to a totally disabled member is 66 2/3%* of Basic Earnings paid monthly.

How does permanent disability work in NY?

Permanent Total Disability Your wage-earning capacity is permanently and totally lost. There is no limit on the number of weeks payable. In certain instances, you may continue to engage in business or employment, if your wages, combined with the weekly benefit, do not exceed the maximums set by law.

How do I get around a disability in NYC?

The MTA currently has a fleet of 4300 buses equipped with lifts. In order to use the bus, just place yourself at the stop and wave to the driver. The bus will stop and right away you'll enter. In case the driver doesn't see you, ask someone to let the driver know you're here.

Do disabled people have equal rights?

The purpose of the law is to make sure that people with disabilities have the same rights and opportunities as everyone else. The ADA gives civil rights protections to individuals with disabilities similar to those provided to individuals on the basis of race, color, sex, national origin, age, and religion.

What qualifies for disability in NY?

Eligibility You cannot work due to a medical condition; You cannot do work that you did before; We decide that you cannot adjust to other work because of your medical condition(s); and. Your disability has lasted or is expected to last for at least one year or to result in death.

What is the average disability payment in New York State?

Disability Benefits Payments in New York Living SituationIndividualCoupleLiving in the Household of Another$23$46Family-type Home / Family Care Home$267* / $229$918* / $842Residential Facility$435* / $405$1,255* / $1,195Nonmedical Private Residential Facility$694$1,7732 more rows

Is NYC disability friendly?

New York City ranks second in the world for the most disability-friendly city, ing to a new study.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NY DB-271S without leaving Chrome?

NY DB-271S can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit NY DB-271S on an iOS device?

Create, edit, and share NY DB-271S from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete NY DB-271S on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your NY DB-271S from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is NY DB-271S?

NY DB-271S is a form used in New York State for reporting the details related to a business entity's employees and their payroll information to the Department of Labor.

Who is required to file NY DB-271S?

Employers who are subject to the state's wage reporting requirements and have employees are required to file the NY DB-271S.

How to fill out NY DB-271S?

To fill out NY DB-271S, employers must provide accurate payroll information, including employee names, Social Security numbers, wages paid, and any deductions, according to the guidelines provided by the New York State Department of Labor.

What is the purpose of NY DB-271S?

The purpose of NY DB-271S is to ensure compliance with state labor laws by collecting comprehensive payroll data for employees, which aids in the administration of unemployment insurance and compliance with wage laws.

What information must be reported on NY DB-271S?

The NY DB-271S requires reporting information such as the employer's identification details, employee names, Social Security numbers, total wages paid, and any deductions or withholdings applicable.

Fill out your NY DB-271S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DB-271s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.