Get the free Form 1023 and 1023-EZ: Amount of User FeeInternal Revenue ...

Show details

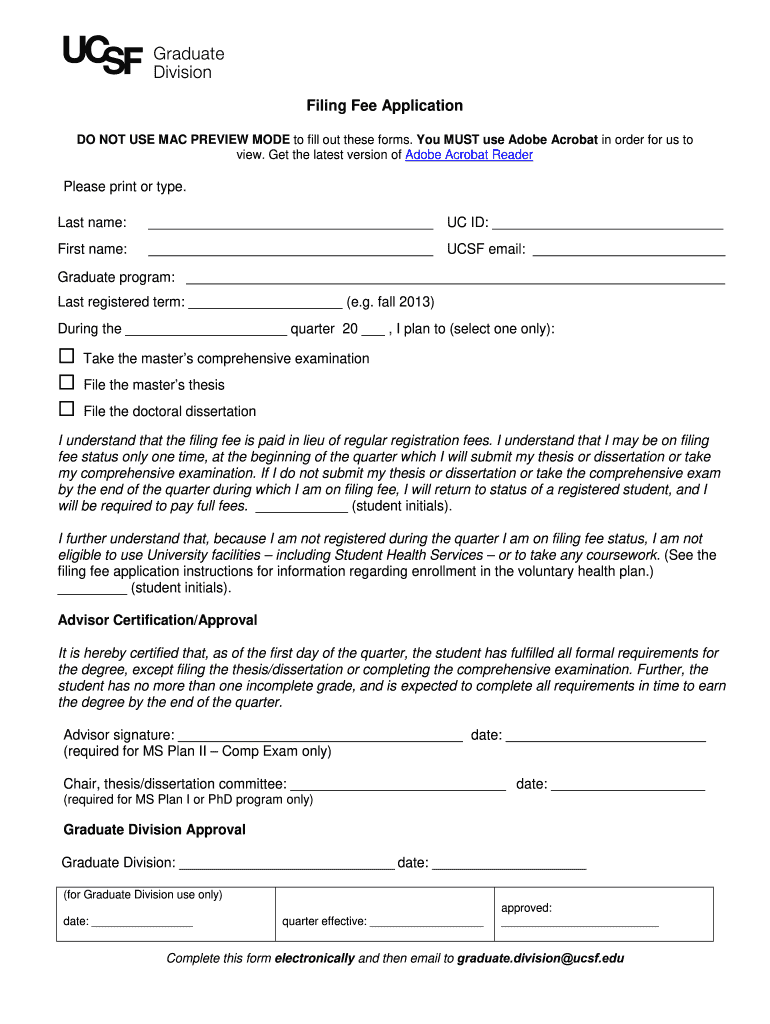

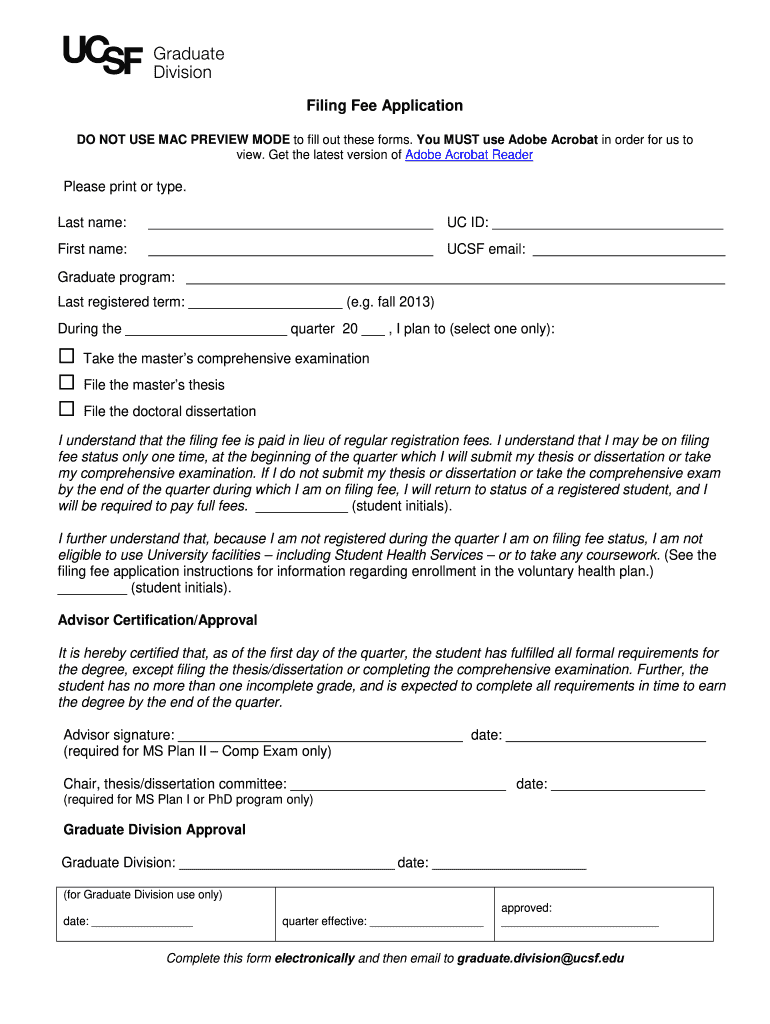

Filing Fee Application Instructions Filing Fee is an optional method of registration for the quarter in which a student plans to graduate. Filing fee is a onetime only option. Students must return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1023 and 1023-ez

Edit your form 1023 and 1023-ez form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1023 and 1023-ez form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1023 and 1023-ez online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 1023 and 1023-ez. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1023 and 1023-ez

How to fill out form 1023 and 1023-ez

01

To fill out form 1023 and 1023-ez, follow these steps:

02

Review the instructions: Read the instructions for form 1023 and 1023-ez carefully to understand the eligibility criteria, requirements, and filing process.

03

Gather required information: Collect all the necessary information, such as the organization's legal name, address, purpose, activities, financial details, and relevant documentation.

04

Complete the form: Fill out the form accurately and provide all the required details. Ensure that the information is consistent with the organization's governing documents and supporting materials.

05

Attach supporting documents: Include any necessary attachments, such as financial statements, articles of incorporation, bylaws, and exemption ruling letters.

06

Check for errors: Double-check the form for any errors or omissions. Ensure that all sections are completed correctly and legibly.

07

Sign and date: Sign and date the form, indicating your authorization and agreement with the submitted information.

08

Review and submit: Review the completed form and all supporting materials to ensure everything is accurate and complete. Submit the form as directed by the IRS, either electronically or by mail.

09

Pay applicable fees: If required, include the necessary payment for the processing fees. Check the form instructions for the current fee amounts and acceptable payment methods.

10

Keep copies: Make copies of the completed form, supporting documents, and any payment receipts for your records.

11

Follow-up: If you do not receive a response within the specified time frame, follow up with the IRS to ensure your application is being processed.

12

Note: Form 1023-ez is a streamlined version of form 1023 and is available to certain eligible organizations. Review the eligibility criteria in the form instructions to determine if you qualify for form 1023-ez.

Who needs form 1023 and 1023-ez?

01

Form 1023 and 1023-ez are required for organizations that want to apply for recognition of exemption under section 501(c)(3) of the Internal Revenue Code.

02

The following types of organizations may need to file form 1023 or 1023-ez:

03

- Charitable, educational, religious, scientific, literary, testing for public safety, or fostering national or international amateur sports organizations.

04

- Organizations providing prevention of cruelty to children or animals.

05

- Certain types of social clubs, employee associations, and labor organizations.

06

- Certain types of veteran organizations.

07

However, certain organizations are not eligible to use form 1023-ez and must file form 1023 instead. These include:

08

- Organizations with projected annual gross receipts exceeding $50,000 in any of the next three years.

09

- Organizations involved in supporting or conducting private foundations.

10

It is recommended to review the form instructions or consult with a tax professional to determine if form 1023 or 1023-ez is required for your specific organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 1023 and 1023-ez online?

Completing and signing form 1023 and 1023-ez online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out form 1023 and 1023-ez using my mobile device?

Use the pdfFiller mobile app to fill out and sign form 1023 and 1023-ez. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit form 1023 and 1023-ez on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign form 1023 and 1023-ez on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your form 1023 and 1023-ez online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1023 And 1023-Ez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.