Get the Small Business Administration Loan Application - PDF Free ...

Show details

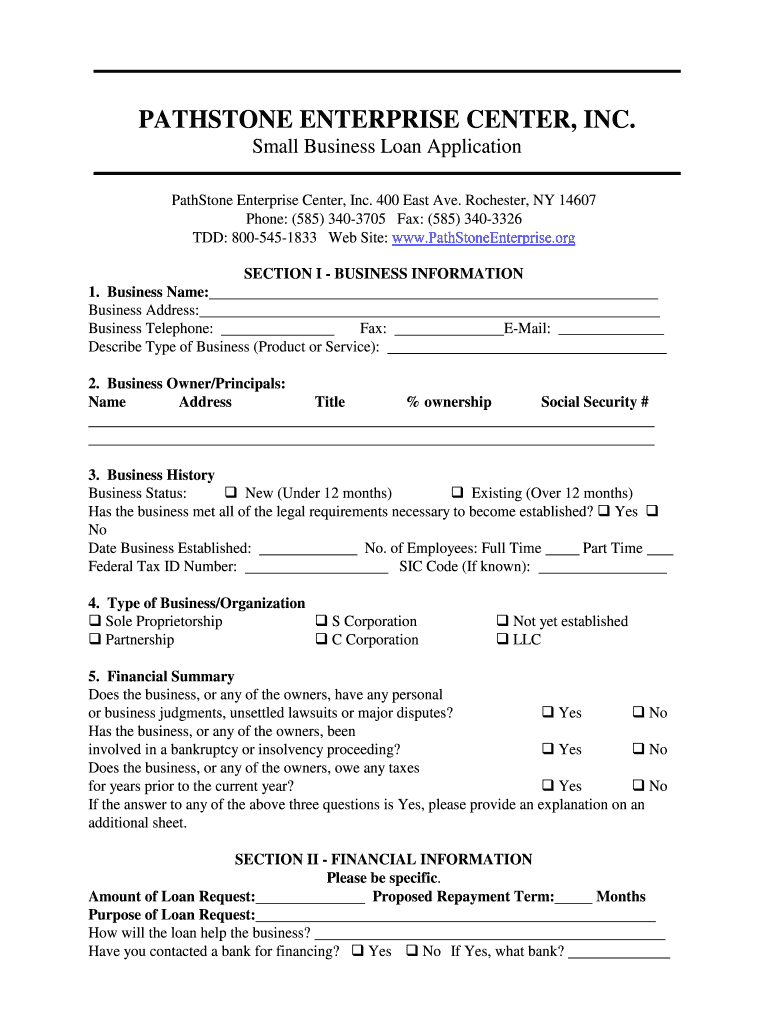

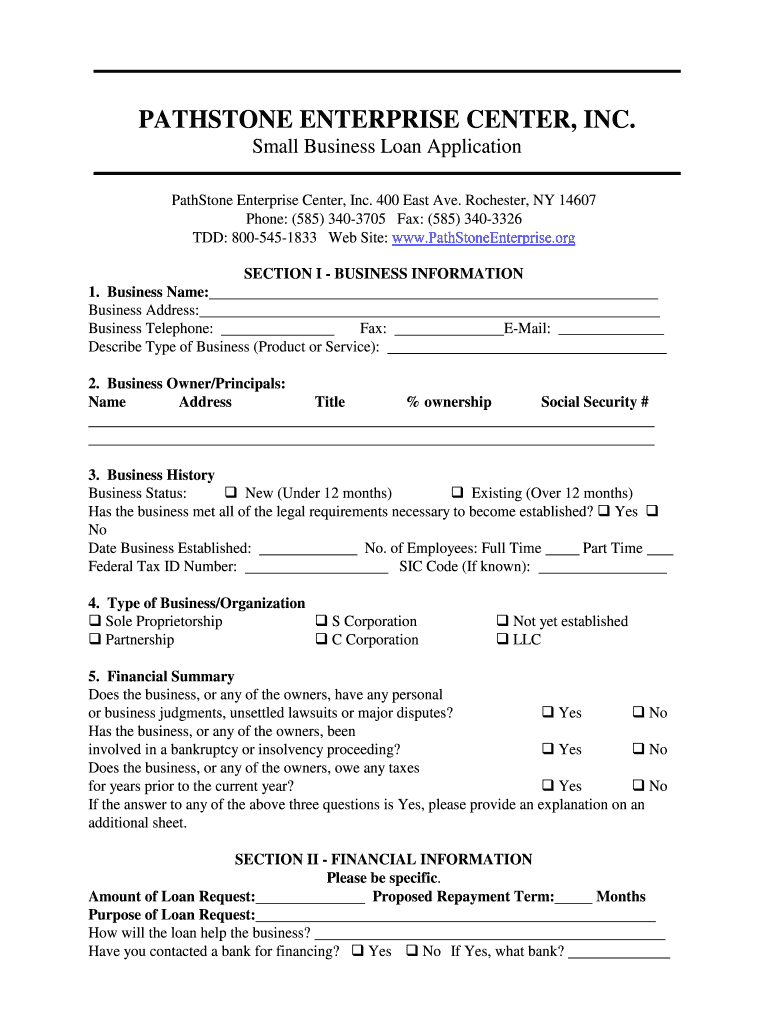

SANDSTONE ENTERPRISE CENTER, INC. Small Business Loan Application Path Stone Enterprise Center, Inc. 400 East Ave. Rochester, NY 14607 Phone: (585) 3403705 Fax: (585) 3403326 TDD: 8005451833 Website:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business administration loan

Edit your small business administration loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business administration loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

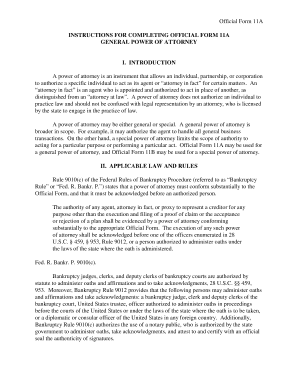

Editing small business administration loan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit small business administration loan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business administration loan

How to fill out small business administration loan

01

Step 1: Gather all necessary documentation and information, such as your business plan, financial statements, tax returns, and legal documents.

02

Step 2: Visit the Small Business Administration (SBA) website and locate the loan application form specific to your needs, such as the 7(a) Loan Application.

03

Step 3: Fill out the application form accurately and completely, providing all required information.

04

Step 4: Prepare a comprehensive business plan that includes a description of your business, market analysis, management team, and financial projections.

05

Step 5: Submit your completed loan application, supporting documents, and business plan to the SBA or an authorized lender.

06

Step 6: Wait for the SBA or lender to review and process your loan application. This may involve credit checks, collateral evaluations, and financial analysis.

07

Step 7: If approved, carefully review the terms and conditions of the loan offer. Consider consulting with a lawyer or financial advisor before accepting.

08

Step 8: Provide any additional information or documentation required by the SBA or lender.

09

Step 9: Once all requirements are fulfilled, sign the loan agreement and receive the funds.

10

Step 10: Use the loan funds responsibly for your small business needs and make timely repayments according to the agreed-upon terms.

Who needs small business administration loan?

01

Small business owners who require financial assistance to start, expand, or sustain their business operations.

02

Entrepreneurs who lack sufficient personal or business assets to secure a traditional commercial loan.

03

Businesses affected by natural disasters, economic downturns, or other unforeseen circumstances.

04

Minority-owned, women-owned, and veteran-owned businesses seeking equal opportunities in accessing capital.

05

Startups and new ventures looking for funding to launch their business idea.

06

Small businesses facing cash flow issues, which could be resolved by accessing affordable financing options.

07

Companies in industries that typically rely on loans, such as construction, manufacturing, retail, and professional services.

08

Business owners who want to take advantage of the favorable terms and guarantee provided by the Small Business Administration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete small business administration loan online?

With pdfFiller, you may easily complete and sign small business administration loan online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete small business administration loan on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your small business administration loan from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit small business administration loan on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as small business administration loan. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is small business administration loan?

A small business administration loan is a type of loan provided by the Small Business Administration (SBA) to help small businesses start up, expand, or recover from a financial loss.

Who is required to file small business administration loan?

Small business owners who meet the eligibility requirements set by the Small Business Administration are required to file for a small business administration loan.

How to fill out small business administration loan?

To fill out a small business administration loan, small business owners must complete the application form provided by the SBA, gather all necessary documents, and submit the application to an SBA-approved lender.

What is the purpose of small business administration loan?

The purpose of a small business administration loan is to provide financial assistance to small businesses to help them start, grow, or recover from economic hardships.

What information must be reported on small business administration loan?

Small business owners must report their business financials, personal financials, business plan, and other relevant information on the small business administration loan application.

Fill out your small business administration loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Administration Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.