Get the free INDIAN INCOME TAX RETURN Assessment Year ITR-4 FOR ...

Show details

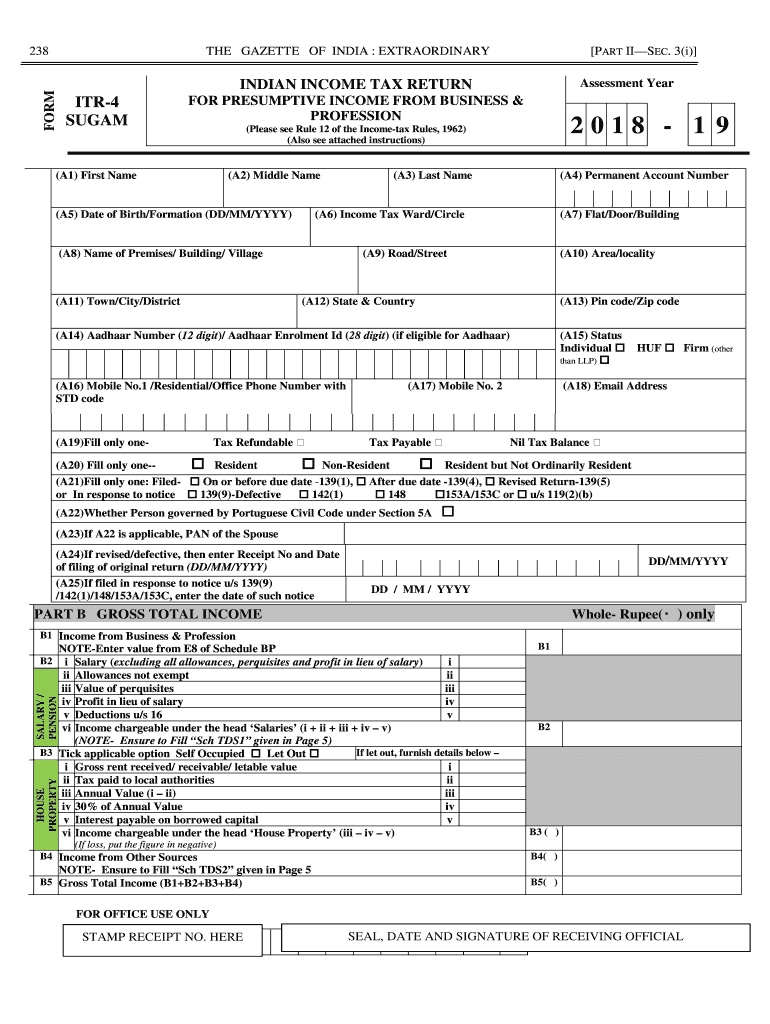

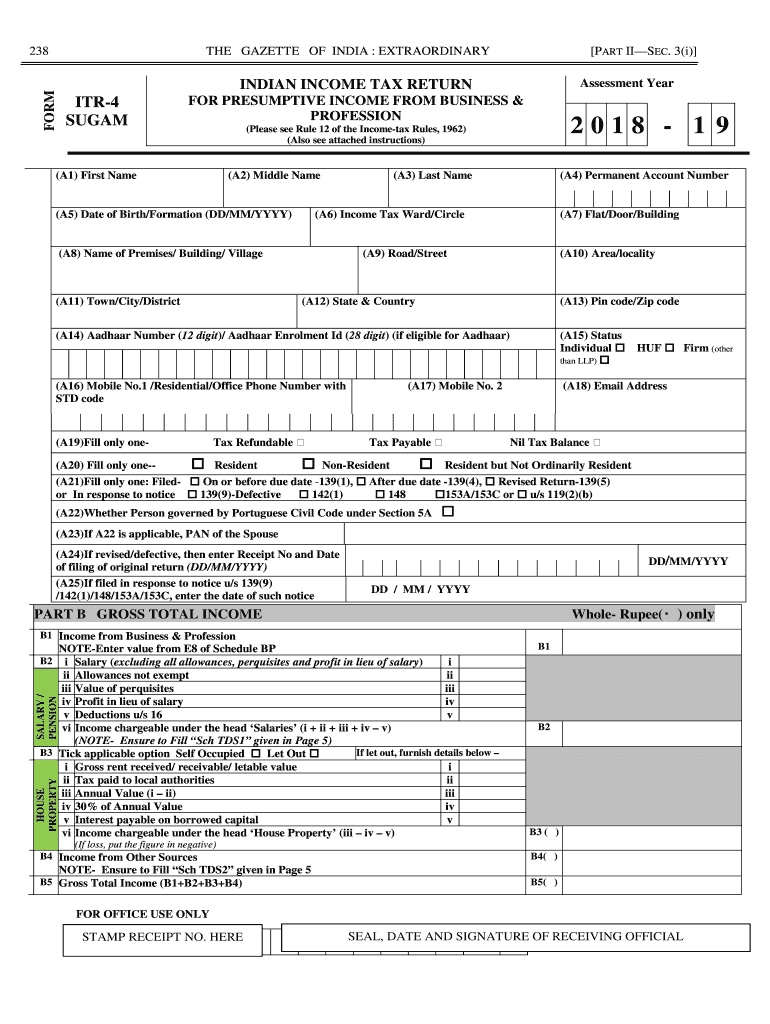

THE GAZETTE OF INDIA : EXTRAORDINARYFORM238 PART II SEC. 3(i) Assessment Amerindian INCOME TAX RETURNITR4 SUGAR PRESUMPTIVE INCOME FROM BUSINESS & PROFESSION2018 1 9(Please see Rule 12 of the Income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indian income tax return

Edit your indian income tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian income tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indian income tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit indian income tax return. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indian income tax return

How to fill out indian income tax return

01

Gather all the necessary documents such as Form-16, salary slips, bank statements, investment proofs, etc.

02

Determine which income tax form you need to fill out based on your income sources and residential status.

03

Fill out the personal information section accurately, including your name, address, PAN (Permanent Account Number), etc.

04

Provide details about your income from various sources such as salary, business or profession, capital gains, rental income, etc.

05

Declare your deductions and exemptions under various sections of the Income Tax Act, such as deductions for investments, insurance premiums, medical expenses, etc.

06

Calculate your total taxable income and determine the applicable tax slab.

07

Compute your income tax liability based on the tax rates provided by the government.

08

Pay any outstanding tax liability or claim a refund, as applicable.

09

Verify all the information provided and sign the income tax return form.

10

Submit the filled-out income tax return form online or offline, depending on the available options.

11

Keep a copy of your filed return and supporting documents for future reference or verification.

Who needs indian income tax return?

01

Any individual or entity that falls under the following criteria needs to file an Indian income tax return:

02

- Individuals with taxable income exceeding the basic exemption limit specified by the government.

03

- Resident individuals having assets or financial interests outside India.

04

- Individuals who have carried forward losses from previous years and want to set them off against current year's income.

05

- Individuals who want to claim a refund of excess taxes paid.

06

- Companies, firms, LLPs, and other entities registered under the Indian tax laws.

07

- Non-resident individuals earning income in India, unless specifically exempted.

08

- Individuals who are eligible for income tax treaty benefits or need to avail any other tax relief provisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my indian income tax return directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your indian income tax return and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find indian income tax return?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific indian income tax return and other forms. Find the template you need and change it using powerful tools.

How do I edit indian income tax return on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as indian income tax return. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is indian income tax return?

Indian income tax return is a form filed with the Indian government by taxpayers to declare their income, deductions, and taxes payable.

Who is required to file indian income tax return?

Individuals, Hindu Undivided Families (HUFs), companies, and other entities whose income exceeds the specified threshold are required to file Indian income tax returns.

How to fill out indian income tax return?

Indian income tax return can be filled out online on the Income Tax Department's website or through authorized intermediaries. Taxpayers need to provide details of their income, deductions, and taxes paid.

What is the purpose of indian income tax return?

The purpose of Indian income tax return is to calculate the tax liability of the taxpayer, reconcile any taxes paid, and determine if any refunds are due.

What information must be reported on indian income tax return?

Income tax return requires taxpayers to report their income from various sources, deductions claimed under different sections, taxes paid, and other financial details.

Fill out your indian income tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Income Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.