Equity Trust Company EI134 (Formerly CL105F) 2020-2025 free printable template

Show details

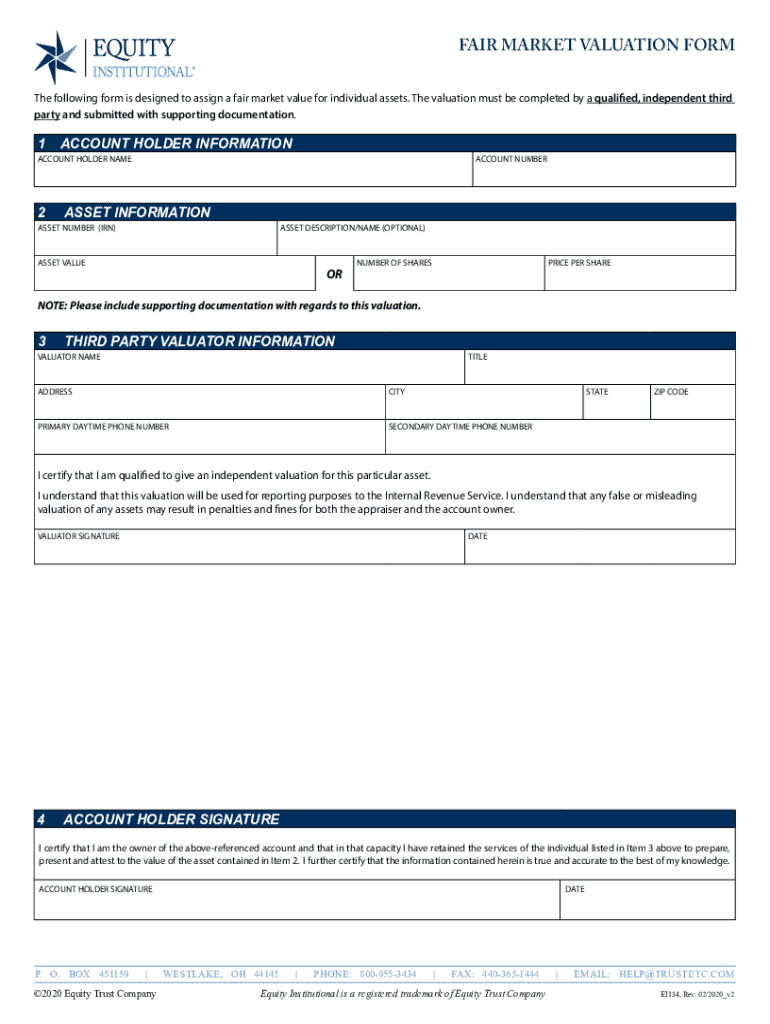

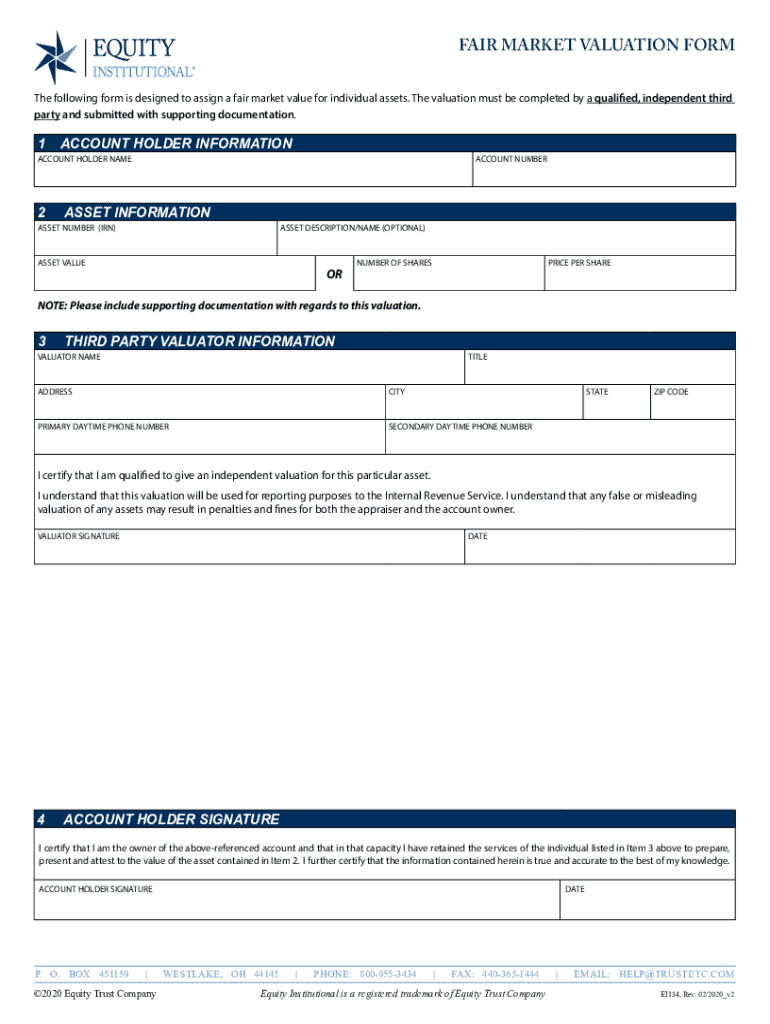

FAIR MARKET

VALUATION FORMER TO USE THIS FORM

A fair market valuation is used to assign or change the value of an

asset. Equity Trust Company requires that a fair market valuation

be submitted on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fair market valuation form

Edit your fair market valuation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair market valuation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fair market valuation form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fair market valuation form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Equity Trust Company EI134 (Formerly CL105F) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fair market valuation form

How to fill out fair market valuation form

01

Step 1: Start by entering your personal information such as name, address, and contact details.

02

Step 2: Provide details about the property or asset that you want to determine the fair market value for.

03

Step 3: Include any relevant attachments or supporting documents that can help in the valuation process.

04

Step 4: Review the form for accuracy and completeness before submitting it.

05

Step 5: Submit the filled-out fair market valuation form to the respective authority or organization.

Who needs fair market valuation form?

01

Individuals who are selling or buying a property and want to ensure a fair price.

02

Businesses involved in mergers, acquisitions, or partnerships to determine the value of assets.

03

Tax authorities for calculating accurate property or asset taxes.

04

Insurance companies for determining the value of insured assets.

05

Legal entities involved in disputes or settlements where fair market value is crucial.

Fill

form

: Try Risk Free

People Also Ask about

What is the fair market value of equity?

The fair market value is the price an asset would sell for on the open market when certain conditions are met. The conditions are: the parties involved are aware of all the facts, are acting in their own interest, are free of any pressure to buy or sell, and have ample time to make the decision.

How do you determine the fair market value of a company?

How to calculate fair market value How much your assets are worth. The present value of your future cash flows. How much common stock is worth at similar (comparable) companies. How much equity your company has in other similar businesses or industries.

What is an FMV form?

Fair Market Valuation Reporting & Guidelines A Fair Market Valuation (FMV) is part of the Internal Revenue Service (IRS) reporting requirements that provide the value of an asset annually. Your submission of a fair market valuation (FMV) is used to assign or change the value of an asset.

How much is a business worth with $1 million in sales?

The exact value of a business with $1 million in sales would depend on the profitability of the business and its assets. Generally, a business is worth anywhere from one to five times its annual sales. So, in this case, the business would be worth between $1 million and $5 million.

What is the best way to determine fair value?

To determine the fair value of a product or financial investment, an individual or business may look at actual market transactions for similar assets, estimate the expected earnings of the asset, and determine the cost to replace the asset.

What is the difference between FMV and valuation?

Fair value refers to the actual worth of an asset, which is derived fundamentally and is not determined by the factors of any market forces. Market value is solely determined by the factors of the demand and supply, and it is the value that is not determined by the fundamental of an asset.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fair market valuation form to be eSigned by others?

When your fair market valuation form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute fair market valuation form online?

Easy online fair market valuation form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit fair market valuation form in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing fair market valuation form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is fair market valuation form?

The fair market valuation form is a document used to determine the fair market value of an asset or property.

Who is required to file fair market valuation form?

Individuals or businesses who need to report the fair market value of an asset or property are required to file the fair market valuation form.

How to fill out fair market valuation form?

To fill out the fair market valuation form, one must provide detailed information about the asset or property being valued, including relevant financial information.

What is the purpose of fair market valuation form?

The purpose of the fair market valuation form is to accurately determine the value of an asset or property for tax or financial reporting purposes.

What information must be reported on fair market valuation form?

Information such as the description of the asset, the purpose of the valuation, the valuation method used, and the final estimated value must be reported on the fair market valuation form.

Fill out your fair market valuation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Market Valuation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.