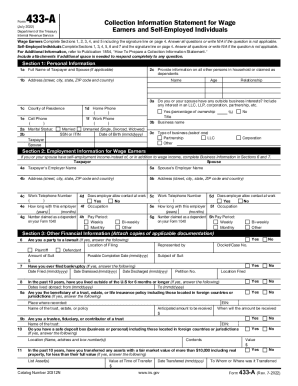

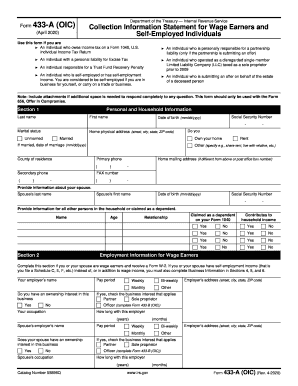

IRS 433-A 2020 free printable template

Instructions and Help about IRS 433-A

How to edit IRS 433-A

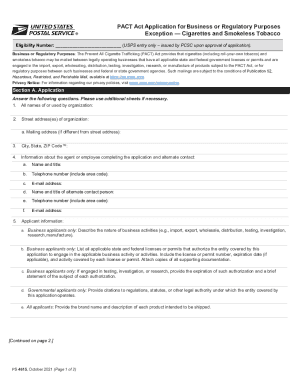

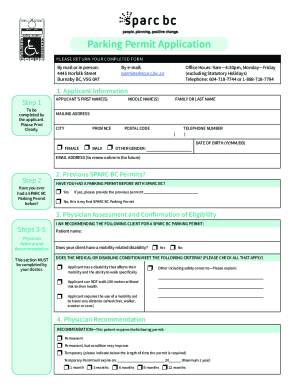

How to fill out IRS 433-A

About IRS 433-A 2020 previous version

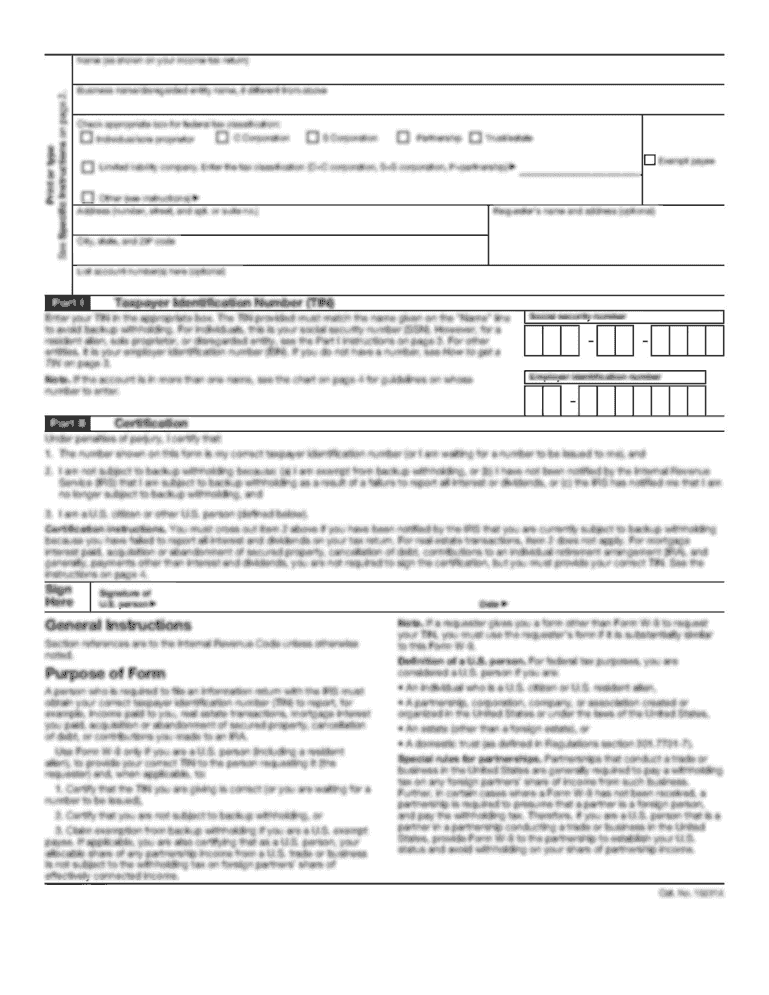

What is IRS 433-A?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 433-A

What should I do if I make a mistake on my IRS 433-A after filing?

If you realize you've made an error after submitting your IRS 433-A, you need to file an amended return. It's crucial to indicate the corrections clearly and include any supporting documentation. Ensure that your amended form is properly marked to avoid confusion during processing.

How can I verify the receipt of my IRS 433-A?

To check the status of your IRS 433-A, you can use the IRS online tracking tool available on their website. This tool will show you whether your form has been processed, any action required from you, and if your submission was accepted or rejected.

Are there specific errors I should avoid when submitting the IRS 433-A?

Common mistakes include omitting required fields, mismatched financial information, or incorrect signature. Carefully reviewing the form before submission can help you avoid these issues, ensuring a smoother processing of your IRS 433-A.

What should I do if my e-filed IRS 433-A gets rejected?

If your IRS 433-A submission is rejected, review the rejection code provided for specific instructions on how to rectify the issue. Often, it involves correcting errors on the form and resubmitting. Ensure that all presented information is accurate to prevent future rejections.

Can I e-sign the IRS 433-A and what are the requirements?

E-signatures are acceptable for the IRS 433-A, provided that the process used for e-signing meets IRS guidelines. It's essential to follow the specific steps for e-filing to ensure your signature is valid and that your submission complies with all electronic filing requirements.

See what our users say