Get the free Form 8-K FIRST MERCHANTS CORP For: Jun 30

Show details

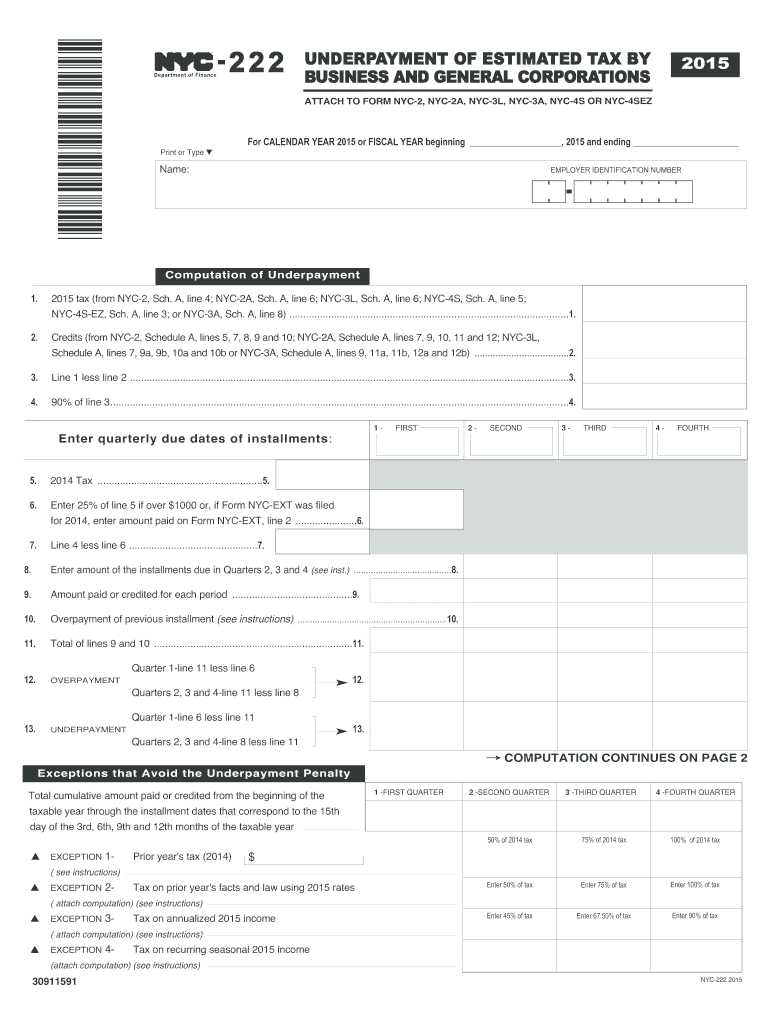

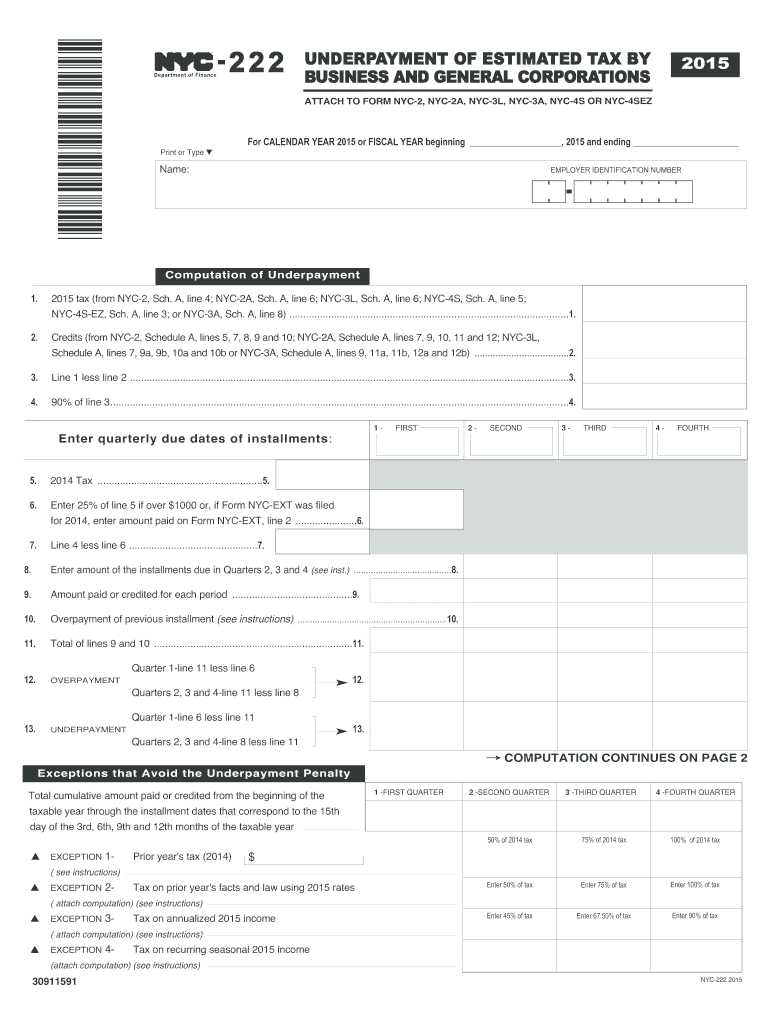

*30911591× 1. 2. 3.4. Department of Finance222Print or Type name:UNDERPAYMENT OF ESTIMATED TAX BY BUSINESS AND GENERAL CORPORATIONS2015ATTACH TO FORM NYC2, NYC2A, NYC3L, NYC3A, NYC4S OR NYC4SEZFor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8-k first merchants

Edit your form 8-k first merchants form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8-k first merchants form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8-k first merchants online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8-k first merchants. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8-k first merchants

How to fill out form 8-k first merchants

01

To fill out form 8-K First Merchants, follow these steps:

02

Obtain a copy of the form from the Securities and Exchange Commission (SEC) website or other reliable sources.

03

Read the instructions provided with the form to understand the requirements and reporting obligations.

04

Start by entering the company name and the Commission File Number in the appropriate fields.

05

Provide the date of the report and the fiscal year-end date.

06

Indicate the nature of the report (e.g., departure of directors or principal officers, amendments to articles of incorporation, etc.).

07

Fill in the contact information for the person to whom questions about the filing should be directed.

08

Provide a brief description of the subject matter of the report, including any relevant events or transactions.

09

Attach any required exhibits or additional information as specified in the instructions.

10

Review the completed form for accuracy and completeness before submitting it to the SEC.

11

Submit the filled-out form electronically through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system or other authorized electronic filing systems.

12

Retain a copy of the filed form for the company's records.

Who needs form 8-k first merchants?

01

Form 8-K First Merchants is required by publicly traded companies in the United States. It must be filed with the SEC to report significant events or transactions that could impact the company's financial position or governance. Typically, such events include but are not limited to changes in executive leadership, mergers or acquisitions, material agreements, bankruptcy filings, and changes in securities or trading markets. It is important for these companies to comply with SEC regulations and ensure transparency for stakeholders and investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8-k first merchants from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form 8-k first merchants into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute form 8-k first merchants online?

With pdfFiller, you may easily complete and sign form 8-k first merchants online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out form 8-k first merchants using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 8-k first merchants and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is form 8-k first merchants?

Form 8-K is a report filed by public companies with the Securities and Exchange Commission (SEC) to announce significant events that shareholders should know about. It includes information regarding financial results, mergers and acquisitions, changes in leadership, or other material events.

Who is required to file form 8-k first merchants?

Publicly traded companies listed on US stock exchanges are required to file form 8-K with the SEC.

How to fill out form 8-k first merchants?

Form 8-K can be filled out electronically through the SEC's EDGAR system. Companies must provide detailed information about the event being reported and ensure all required disclosures are included.

What is the purpose of form 8-k first merchants?

The purpose of form 8-K is to provide timely and transparent information to shareholders and the investing public about significant events that could impact the company's financial condition or stock price.

What information must be reported on form 8-k first merchants?

Form 8-K requires disclosure of material events such as acquisitions or dispositions of assets, changes in control of the company, departures or elections of directors, and non-reliance on previously issued financial statements.

Fill out your form 8-k first merchants online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8-K First Merchants is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.